It’s no surprise then that the ever-innovating ETF industry is now making ‘active’ outcomes more accessible via the use of factors. This is a subset of smart beta ETFs, and investors are flocking in droves.

Factor-based investing involves identifying the dynamics of an investment that drive its return. It has become more common in recent times, often involving the ‘quant’ factors that active fund managers have been using for decades to sort the wheat from the chaff.

Factor-based investing has long been a part of institutional investors’ portfolios, and academics have backed its investment benefits through numerous studies. These studies have identified certain detectable and constant influences that propel the investment performance of an asset over the long run. They describe these influences as factors, and institutions have long adopted factor-based investing to construct portfolios to achieve targeted outcomes.

Factors defined

Portfolio factors are identifiable, persistent drivers of risk and return. In his 1949 seminal work ‘The Intelligent Investor’[i], Benjamin Graham identified that, among other features, return on equity (ROE), low debt and consistent earnings could isolate investments that would outperform over the long run. These identifiable, persistent drivers of risk and return became the precursor for the ‘quality’ factor.

Many investors rely on active fund managers to achieve their investment objectives. Active fund managers have often utilised ‘factors’ as a key part of their investment process to identify companies worthy of investment.

More recently, investors have been questioning their reliance on active managers and seeking passive alternatives. Apart from active management being more expensive than passive investing, it also introduces other risks, such as key-man risk and investment process risk.

There is an alternative for investors to achieve targeted outcomes while retaining the low costs of passive investing and avoiding key man and investment process risks. Enter ETFs.

Making it easy for factor-based investing

Factor-based ETFs, a subset of smart beta, combine the best aspects of active and passive management by tracking indices with defined rules that are designed to deliver a targeted investment outcome, while retaining transparency, liquidity and ease of trading for investors.

Most traditional index providers have had the foresight to create factor-based indices in anticipation of increasing demand for low-cost passive investing alternatives. MSCI, for example, has created a range of factor-based indices that aim to isolate factors, including the MSCI Quality Index series, based on Graham’s ‘quality’ factor noted above.

ETFs that track these indices are available for investors on exchanges around the world and are opening up factor investing beyond institutions and active managers to all types of investors.

These low-cost ‘beta’ strategies are increasingly replacing traditional active allocations - and for good reason.

Seven equity style factors

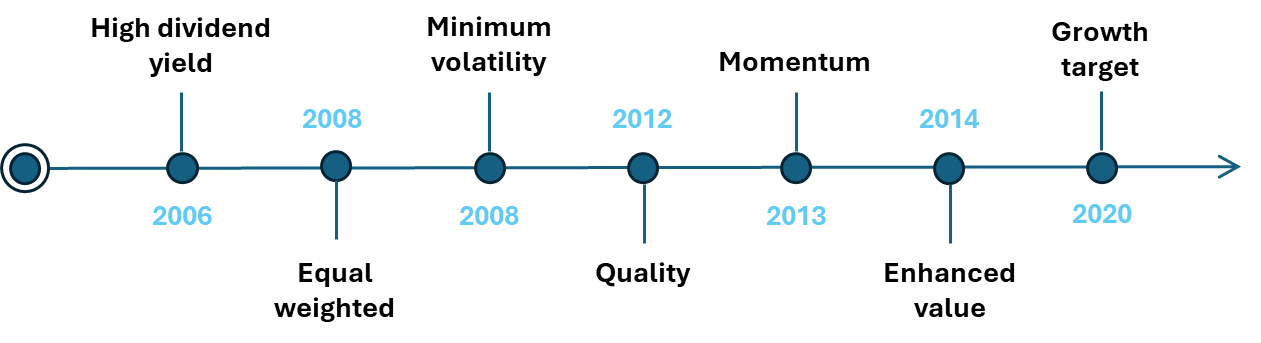

There are seven main equity style factors that MSCI have created indices for: quality, size (growth), value, momentum, dividend yield, volatility and growth.

Chart 1: Evolution of MSCI single factor indices

Source: MSCI, Factor Indexing Through the Decades, July 2025

Investment strategies may target a particular individual factor or a combination of the factors, outlined below:

- Quality – ‘Quality’ stocks, with stronger balance sheets, tend to have positive long-term returns and are better placed to withstand economic downturns, according to MSCI. Quality characteristics may include high ROE, stable earnings per share (EPS), growth in profit margins and low debt levels. Research supporting ‘quality’ includes Benjamin Graham and David Dodd in the 1930s[ii]. Subsequent empirical studies show that quality growth stocks have historically outperformed the market with relatively low volatility over long time periods (Novy-Marx 2014[iii]) and a portfolio of quality stocks produces better Sharp ratios (risk-adjusted returns) than the market (Asness, Frazzini, and Pedersen 2013[iv]).

- Size (Equal weighted) - Smaller companies, which are riskier investments, tend to outperform larger companies over a long-horizon. A company’s size, as a proxy for growth, is supported by well documented evidence in equity markets such as Canada (Berges, McConnell and Schlarbaum 1984[v]), Germany (Stehle 1992[vi]) and the United Kingdom (Strong and Xu 1997[vii]).

- Value - As the name suggests, investments in relatively cheaper stocks tend to earn a return above investments in relatively expensive stocks. There are a number of relative ‘value’ measures, including price to book, forward price to earnings and enterprise value to free cash flow. The ‘value’ factor is also grounded on the work of Benjamin Graham and David Dodd in the 1930s and academic research by Basu (1977) [viii] and Fama and French (1992) [ix].

- Momentum - Stock prices tend to exhibit certain trends such as upwards movements in price or earnings over certain time horizons. So, winners continue to win, and losers continue to lose. Momentum is identifiable by price changes over three, six or 12 months. Momentum, as a factor, is supported by academic research by Jegadeesh and Titman (1993)[x] which was reinforced by Carhart (1997)[xi] and Rowenhorst (1998)[xii].

- Dividend yield – Many investors have long believed that investment in stocks delivering relatively high dividend yields will return more than those not paying dividends. In particular, high and stable yields are associated with positive long-term performance. Litzenberger and Ramaswamy (1979) [xiii] confirmed this and Blume (1980)[xiv] later reinforced there is a positive relationship between stock returns and expected dividend yields. This was further supported by Fama and Frech (1988)[xv] who found the dividend yield has more explanatory power for longer term returns.

- Volatility - A negative correlation between volatility and returns has historically led to outperformance in weak economic environments. As a result, a defensive strategy focusing on companies that have had low share price volatility has produced a premium over the market and delivered portfolio protection in turbulent environments. Minimum volatility is supported by research by Haugen and Baker’s (1991)[xvi] Clarke, Silva and Thorley (2006)[xvii] and Neilson and Subramanian (2008)[xviii] to name a few.

- Growth - Growth investing focuses on identifying companies poised for rapid revenue and earnings expansion, often driven by innovation, market disruption or evolving consumer preferences. According to a recent MSCI paper, "The roots of growth investing can be traced back to early 20th century investors who focused on companies with strong earnings potential and reinvestment prospects."[xix]

Using ETFs for factor investing

Australian investors can now access entire portfolios of Australian and international securities selected on the basis of individual or multiple factors via a range of ETFs on ASX. These factor-based ETFs are attractive compared to active funds due to their:

- lower costs;

- ease of trading;

- explicit rules-based methodology;

- transparency of holdings; and

- reduction of risks, including liquidity, key man risk and investment process risk.

ETFs are ideal building blocks for an investment portfolio because they offer liquid, diversified and cost-effective exposure to many different asset classes and markets via simple trades on ASX.

With the ability to adapt and innovate quickly to meet investor demands for targeted investment solutions, it’s no surprise that ETF issuers are now providing investors with opportunities to invest in a range of smart beta ETFs employing different factor-based methodologies, and no surprise that investor uptake is growing rapidly.

Sources:

i. Graham, B., (1949) “The Intelligent Investor”, New York; Harper & Brothers.

ii. Graham, B., and Dodd, D. (1934). Security Analysis. New York: McGraw Hill.

iii. Novy-Marx, R. (2014). "Quality Investing." Rochester: Rochester University.

iv. Asness, C. S., Franzzini, A. and Pederson, L. H. (2013). "Quality minus Junk," working paper, AQR Capital Management.

v. Berges, A. and J. McConnell and G Schlarbaum, (1984). “The Turn-of-the-Year in Canada,” The Journal of Finance, 39(1) 185-192.

vi. Stehle, R. (1992). “The Size Effect in the German Stock Market,” Unpublished Manuscript, University of Augsburg.

vii. Strong, N. and X. Xu (1997). “Explaining the Cross-Section of UK Expected Stock Returns” The British Accounting Review, 29 (1): 1-23.

viii. Basu, S. (1977). “Investment Performance of Common Stocks in Relation to Their Price-Earnings Ratios: A Test of the Efficient Market Hypothesis.” Journal of Finance. 12:3, 129-56

ix. Fama, E. F. and K. R. French (1992), “The Cross-Section of Expected Stock Returns,” Journal of Finance 47, 427-465.

x. Jegadeesh, N. and S. Titman (1993), “Returns to Buying Winners and Selling Losers: Implications for Market Efficiency,” Journal of Finance 48(1), 65-91.

xi. Carhart, M. (1997), “On Persistence in Mutual Fund Performance,” the Journal of Finance 52(1), 57-82

xii. Rouwenhorst, K. G. (1998), “International Momentum Strategies,” The Journal of Finance 53(1), 267-284.

xiii. Litzenberger, R., and K. Ramaswamy (1979), “The Effects of Personal Taxes and Dividends on Capital Asset Prices: Theory and Empirical Evidence,” Journal of Financial Economics 7(2), 163-195

xiv. Blume, M. E. (1980), “Stock Returns and Dividend Yields: Some More Evidence,” The Review of Economics and Statistics, Vol. 62, No. 4 (Nov., 1980), pp. 567-577.

xv. Fama, E. F. and K. R. French (1988), “Dividend yields and expected stock returns,” Journal of Financial Economics, 22: 3-25

xvi. Haugen, R, and N. Baker (1991), “The Efficient Market Inefficiency of Capitalization-Weighted Stock Portfolios”, Journal of Portfolio Management.

xvii. Clarke, R. H. De Silva and S Thornley (2006). “Minimum-Variance Portfolios in the US Equity Market,” The Journal of Portfolio Management, 33, 10-24

xviii. Nielsen, F. and R. A. Subramanian (2008), “Far From the Madding Crowd – Volatility Efficient indexes,” MSCI Research Insights, April 2008.

xix. Gupta, A. and Doole, S (2025), “ Factor Indexing Through the Decades,” MSCI Research Insights, July 2025.

Russel Chesler is Head of Investments and Capital Markets at VanEck, a sponsor of Firstlinks. Russel oversees VanEck's investment operations, leveraging his expertise in ETFs, equities, and global markets. This is general information only and does not take into account any person’s financial objectives, situation or needs. Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

For more articles and papers from VanEck, please click here.