Over the next five years, more than 670,000 Australians intend to retire, taking the total to almost five million retirees, according to the Australian Bureau of Statistics (ABS). A check of how often the word ‘retirement’ is searched for on Google over the past 10 years has shown a recent and sustained spike.

We hear a lot about how to build money for your retirement and how much you will need, but there is nowhere near as much discussion about how to manage your retirement.

What will you do on your first day? In the second week? At the end of the first quarter? The end of the first year? These are all milestones that can bring great joy – or despair. I hear many stories of people retiring and becoming bored, so bored. Others say they are busier than ever before, with fitness, family, travel and more.

However, some 20% of retirees feel unfulfilled and 20% say they have no purpose, according to research by Henry Jones last year. What will you do? What are you going to focus on next? And how will you prepare for it? And this is not about playing more golf to improve your handicap.

The first thing about preparing for retirement is to have a discussion with your family, the people you will live with. As that person or those people will soon have you around the house more than they ever have before, will they welcome that change or will you disrupt their own routine?

Where will you find your new value? The importance of self-worth

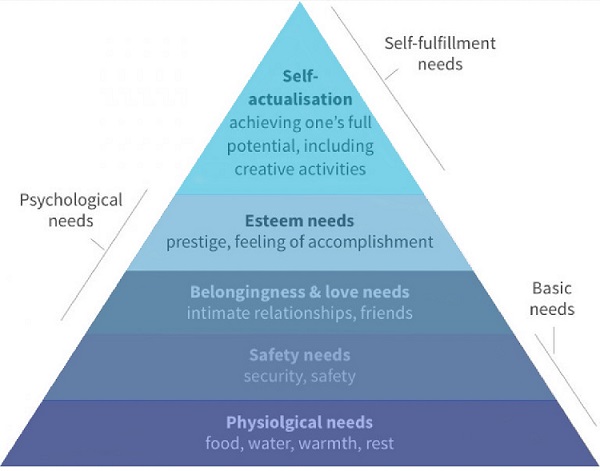

Another key aspect of retiring is recognising that your work, your contribution, your colleagues, have (generally overall) provided you with a sense of self-esteem, or self-worth, for decades. Self-esteem is a major human need, according to US psychologist Abraham Maslow’s famous Hierarchy of Needs. It follows others of safety and security, and community and connection, which can also suffer if you retire alone.

Many retirees tell me that once they retired, they lost their sense of self-worth that they achieved from the work that they did. “All of a sudden that was gone,” said one. No one even asked them for advice any more, never mind giving them something important to do. This loss of identify and failure to craft a new one can be a big shock for many retirees, especially male retirees. It even has a name: ‘Relevance Deprivation Syndrome’.

Giving back

One way to generate new self-worth is to determine ways to contribute your talents, skills, knowledge or unique gifts to others. It doesn’t matter if it is one person or millions. Giving back and helping people can provide a renewed sense of purpose.

Think beyond the traditional forms of giving back, such as volunteering or donating. It can be surprising how fulfilling it is to impact someone else’s life in a unique way, but ensure it will also stimulate you enough.

According to research, there are many benefits to living a purposeful life, including longevity and lower risk for diseases. Full-time work typically takes up to 40 or more hours per week. What are you going to do with that time when you retire? This time cannot be replaced by golf, boating, fishing. Minding grandchildren can help the family – and yourself – if you have them, while travel can provide a good distraction.

Having at least a rough outline of how you will spend your time is another key, non-financial consideration when preparing for retirement. Retirement can be a time to explore new interests, new passions, and a new purpose, even set new goals. But this can be scary, even overwhelming if this personal transformation is not your strength. Combating loneliness is a big deal and having people around you, outside of work, to do things with is also important, such as friends, family or people in your community.

One of the best ways to prepare for retirement is routine creation. A retirement coach can help with these challenges.

The five best ways to prepare for your retirement

Structure helps your retirement plans, following these hints:

#1 Create a reliable retirement routine

#2 Find clarity around your retirement purpose

#3 Focus on both your physical and mental health

#4 Understand your unique retirement needs

#5 Consider a retirement coach

May you smoothly transition into the best next chapters of your life.

The adage of 'You have worked hard and saved diligently for your golden years. It is now finally time to take it slow and enjoy your life’ is of little comfort if you are not mentally ready for it.

Jon Glass is former chief investment officer at Media Super, and has worked at AMP and BT and today runs 64Plus, a company coaching people nearing retirement on what to expect and how to prepare, beyond the financial.