Infrastructure assets exhibit unique characteristics which have become increasingly relevant in the current economic environment. They provide essential goods or services to society that have a low level of sensitivity to the economic cycle, using contracted or regulated price structures which can provide an inflation hedge.

Myth 1: Listed infrastructure is highly correlated to equities

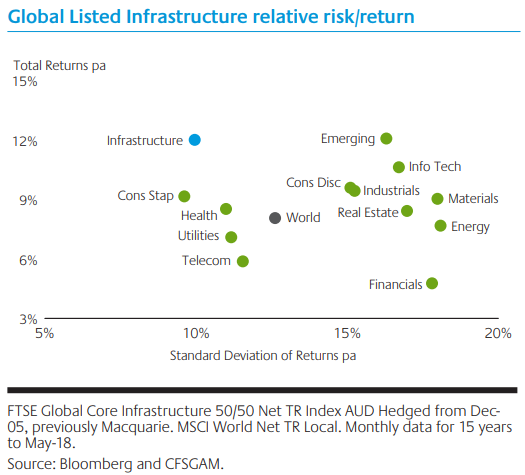

Global listed infrastructure assets tend to complement other typical constituents of an investment portfolio, meaning that allocating listed infrastructure assets to an investment portfolio can improve its risk/return profile. Global listed infrastructure has delivered higher returns with lower risk than general equities over the past 15 years, as illustrated in the chart below.

The sector has also proven to be defensive during periods of market volatility. In the past 15 years, the sector has provided over 80% of the upside in rising global equity markets but under 60% of the downside in falling markets. It may also suit investors who are concerned about the impact of inflation and aim to ensure that their investments maintain and grow in real terms.

Myth 2: Infrastructure assets are low growth and are left behind in rising markets

Infrastructure companies often generate growth from structural rather than cyclical drivers. Long-term trends like urban congestion, globalisation of trade, security of energy supplies, and mobility of communications have placed enormous strain on infrastructure networks and will require investment over many decades. Backed by the right business model, this investment has the potential to deliver strong capital growth for investors.

A number of infrastructure sectors are currently delivering double-digit growth due to structural change. For example, mobile towers have been a beneficiary of the exponential growth in smart phone usage and the resulting pressures on mobile carriers to improve network quality.

American Tower has been increasing rental charges, co-locating new tenants on existing sites and building or acquiring new sites. Strict planning restrictions and community opposition to new tower sites represent effective barriers to entry.

Among listed port and freight rail companies, Union Pacific is the largest North American Class I freight rail company. It owns and operates a 32,000-mile network of railroads covering the western two thirds of the United States. The company has been a beneficiary of volume recovery as the US economy has improved.

Myth 3: Exposure to listed infrastructure is available through traditional equity managers

Many global equity managers hold 2% or less of their portfolio in infrastructure assets, and this exposure could be concentrated amongst a small number of large, well-known utility names. However, much of the alpha generated in this sector comes from mid-cap stocks, which are under-researched by global equity managers, such as toll roads, oil storage, mobile towers and water utilities.

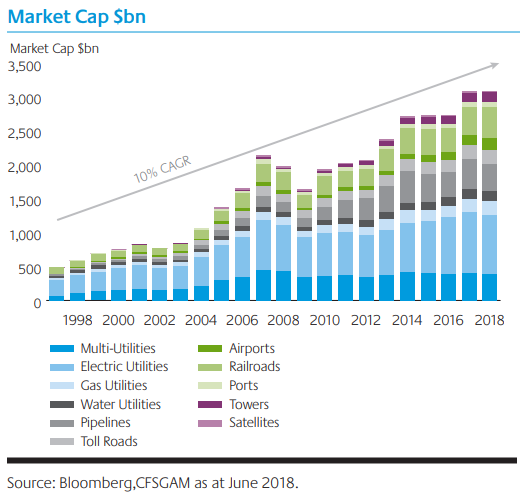

It is important to view investments in listed infrastructure from a global perspective. The global listed universe is capitalised at over US$2 trillion, allowing investors to diversify across various infrastructure sectors and geographies and to actively manage key risks.

A good example is the airport sector. Sydney Airport is one of the world’s leading airports in terms of profitability by passenger, but this is widely recognised and already fully reflected in the stock price – it trades at a 19x EV/EBITDA multiple. Alternatively, our fund can buy shares in Spanish airport operator AENA, which is currently trading at 11x EV/EBITDA. At these levels we believe that AENA represents a better investment for our clients’ money.

Infrastructure is a separate asset class for many pension funds, endowment funds, sovereign wealth funds, private banks and multi-managers from around the world. Early movers are typically allocating between 5% and 10% to this asset class.

Myth 4: Infrastructure assets are too highly leveraged and therefore less defensive

Extreme levels of debt can change the characteristics of equity. A handful of infrastructure stocks, notably in Australia and Spain, created inappropriate capital structures (70-90% leverage) in the mid 2000’s when debt was cheap and plentiful. But these companies represented less than 5% of the global investment universe. The vast majority of infrastructure stocks are traditional companies, sensibly leveraged (30-50%) and run for shareholders. In recent years, they have strengthened balance sheets by reducing costs and repaying debt. We have also seen widespread refinancing of existing debt, to lock in reduced rates and diversify funding sources. The wave of share buybacks and bolt-on acquisitions suggest that many management teams now feel they are under leveraged.

Some poorly aligned companies took a back-to-basics approach. Australian toll road operator Transurban is a great example. Following changes in the Board and senior management earlier this decade, the company raised equity to repay debt, cut the dividend to sustainable levels, halved corporate costs and refocused on its core assets. Having undertaken these measures, Transurban became a key portfolio holding and delivered a total return of over 18% pa in the period from September 2011 to May 2018.

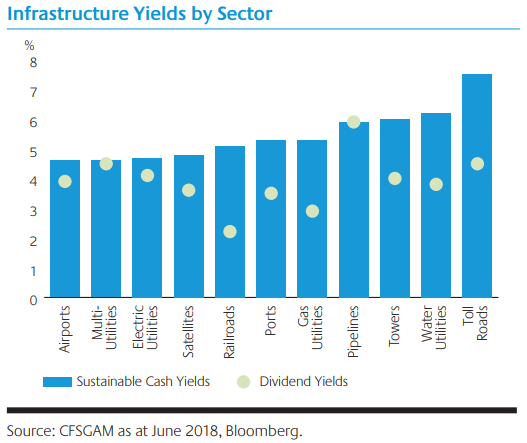

The cash yields of infrastructure sectors are higher than dividend yields, implying scope for payout ratios to be raised. This is especially the case for railroads and toll roads.

Myth 5: Infrastructure is reliant on government funding, which is in short supply

Following years of underinvestment, a significant amount of infrastructure investment is now needed globally. Rough estimates from the OECD suggest that annual investment requirements for road, rail, electricity (transmission and distribution), telecommunications and water are likely to total around an average of 2.5% of world GDP (roughly US$53 trillion to 2030) . Economic growth for a number of nations has been hindered in by critical infrastructure bottlenecks, particularly in the transport sector.

However, while scarce government funding is problematic for societies in need of infrastructure upgrades, it is less of an issue for listed infrastructure companies.

The listed infrastructure investment universe consists of mature, established businesses. These companies provide essential services and generate predictable cash flows underpinned by regulated or contracted business models. Regulatory frameworks often encourage infrastructure companies to invest to maintain or improve their existing assets and allow them to earn a return on money spent in this way. Under this model, infrastructure companies are incentivised to provide better and more efficient services; with no reliance on government help.

Financially-distressed governments have felt the need to divest assets, including valuable infrastructure, to help maintain financial stability. A good example of this theme is AENA, the world’s largest airport operator. The company handles approximately 200 million passengers per year, primarily at 46 Spanish airports including hubs at Madrid and Barcelona. Previously wholly owned by the Spanish government, a 49% stake was IPO’d in early 2015. Since then the stock has risen strongly as robust passenger growth, limited capital expenditure requirements and improving commercial earnings have propelled its share price higher.

Looking ahead, many infrastructure assets remain in state government hands. The partial sale of WestConnex to a consortium led by Transurban offers a roadmap to the recycling of these assets. Brazil is also in the midst of a major privatisation program of toll roads, ports, railroads, airports and utilities.

The listed infrastructure investment universe is benefitting from a wave of corporate restructurings. Many infrastructure assets reside within large, vertically integrated corporations and conglomerates. Companies are increasingly looking to streamline and optimise their capital structures. This has often led to the divestment of infrastructure assets - highly valuable in their own right but deemed peripheral by a larger entity.

Combined, these themes of government privatisation and corporate restructuring have resulted in significant expansion, as well as improvements in quality and diversification, for the listed infrastructure asset class in recent years.

Peter Meany is Head of Global Listed Infrastructure at Colonial First State Global Asset Management, a sponsor of Cuffelinks. This article is general information and does not consider the circumstances of any investor.

For more articles and papers from CFSGAM, please click here.