Most people would love to choose when they retire, preferably before they are too old to enjoy it. At the same time, because people are living longer, they need to be realistic about how long they are likely to be in retirement and how much money they will need. Superannuation is a great long-term investment vehicle, with significant tax advantages for most Australians, but recent changes and a lack of flexibility mean super isn’t necessarily the only long-term option.

Investors who want greater flexibility of access to their super, or who are facing limits to their super contributions, should consider alternative ways to save in order to have enough money to retire at a time of their choosing.

Most individuals do not have enough super

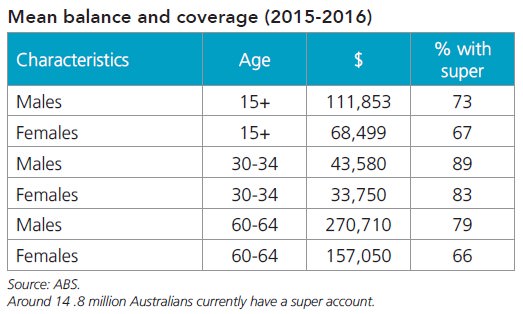

Despite recent improvements in super balances and gender imbalances, the table below reveals that individual super amounts are frequently insufficient to fund retirement at the usual desired age of 60-64, let alone allowing the option of early retirement. Super balances at retirement age (60-64) stand at $270,710 for men and $157,050 for women.

Putting aside the problem of the large gap between men and women, these balances are a far cry from the $545,000 that ASFA estimates a single person needs for a comfortable retirement. Furthermore, there are restrictions on when most people can access their super, such as the age of 60 if born after 1960.

Superannuation by gender and age (from ASFA superannuation statistics)

For most people, making additional super contributions will be the most tax-effective way to build retirement funds. However, recent changes mean that some Australians will be unable to contribute more to super in a tax-effective way. Here’s a brief reminder of the recent changes:

- Concessional (pre-tax) contributions are limited to $25,000 per annum. If a person’s adjusted taxable income exceeds $250,000 a year, concessional super contributions are taxed at 30% instead of the usual 15%.

- Once a threshold of $1.6 million in super is reached, no additional non-concessional (post-tax) contributions are permitted.

- Balances in tax-free pension phase accounts are limited to $1.6 million. Once this is reached, the excess must be transferred back into an accumulation phase account, or out of super.

- Non-concessional (after-tax) contributions to super are limited to $100,000 per annum (or nil if more than $1.6 million is already held in super).

What are the alternatives to super?

Alternative savings strategies such as investing in property, contributing to a managed fund, building a share portfolio or perhaps using term deposits or bonds are all valid investments that will not lock money away in the same way as superannuation, but they have few reliable tax advantages. Negative gearing on property relies on making a loss to be used to offset other income. On other investments, most people will pay their marginal tax rate on returns from investments outside of super.

Creating a company structure to hold investments is one way to reduce tax. Most companies pay a corporate tax rate of 30% rather than the investor’s personal tax rate, which could be as high as 49% including the Medicare levy.

There are two downsides to this strategy. The first is that setting up and maintaining a company (including preparing financial statements every year as well as on-going legal compliance requirements) can be expensive. In addition, the tax advantage is only a way of deferring tax. As soon as dividends are paid from the company to an individual, the individual will pay the difference between the company tax rate and the personal marginal rate.

An investment bond can mean you pay less tax

In operation, investment bonds seem like tax-paid managed funds, whereas in structure, they are in fact insurance policies, each with a life insured and a beneficiary. Like managed funds, they offer investors a range of underlying investment portfolios, from defensive assets like cash and fixed interest, to higher-growth options such as share portfolios, as well as portfolios with a mixture of both.

There is no upper limit to how much can be placed in an investment bond, and it is possible to continue to contribute each year up to 125% of the previous year’s contribution.

The tax advantage works like this: returns from the underlying investment portfolio are taxed at the company rate of 30%, and are then reinvested. The investor does not receive a distribution, and therefore does not need to declare returns on their personal income tax return.

In addition, if the underlying portfolio in the bond contains equities with franking credits, the effective tax-rate paid may be less than 30%.

If the investor holds the bond for 10 years, all accumulated returns and principal are distributed free from further taxes.

Investment bonds are flexible as it is possible to access funds before the 10-year period is up. However, depending on timing, some of the tax advantage may be lost.

An investment bond can also be an effective estate planning tool. Investment bonds do not form part of an investor’s estate and can be left to a nominated beneficiary who will receive all proceeds tax-free on the death of the life insured, regardless of when that occurs.

Case study

For example, Anthony has contributed as much as he is legally able to super, both in terms of his concessional (pre-tax) and non-concessional (post-tax) contributions.

At the same time, he has recently sold a property investment, making a profit of $200,000, and he wants to invest the proceeds as tax-effectively as possible rather than pay 49% tax on any returns. He earns a good income and does not need investment distributions to live on, and would prefer returns re-invested to benefit from compounding over the longer term. He is also not ready to lock up savings in superannuation in case he needs money before he retires.

Anthony first considers a portfolio of Australian and international shares via a managed fund, but he knows that any distributions will be taxed at the highest rate.

Instead, Anthony invests in an investment bond, with an underlying portfolio of equities, which means he receives a tax advantage at two levels:

- Returns from the portfolio of an investment bond are taxed at the company rate of 30%, and are re-invested in the bond. Anthony does not need to declare returns in personal tax.

- Some of the equities in his portfolio pay fully-franked dividends, and the actual rate of tax paid in the bond is less than 30%.

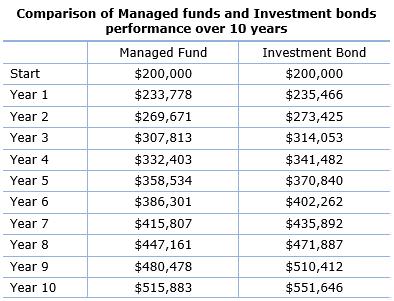

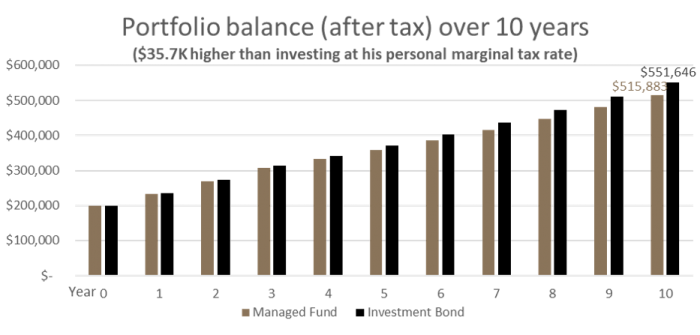

In addition, because Anthony is unable to contribute more to his super fund, he contributes $20,000 per annum to his investment bond instead. And after three years, he reduces his annual contribution to his bond to $5,000. After 10 years from the start of his bond, Anthony redeems his bond to pay off his home loan. Assuming total returns of 8.5% pa (4.5% pa income (80% franked), 4% pa capital growth, 100% annual turnover of the portfolio, 50% CGT discount applies for managed funds), the proceeds are around $551,646 and, because he has held the bond for 10 years, they are tax-free in the investment bond. If Anthony had invested in a managed fund with the same portfolio and rate of return, he would have $35,763 less, due to the tax paid on returns.

Source: Centuria, based on assumptions outlined in the article.

Flexibility and choosing the date of retirement

Anthony now has more flexibility about choosing when he will retire, because he no longer has a home loan and he followed a disciplined saving regime. Even if he had already paid off his loan, he would have a significant boost to his retirement savings while retaining access flexibility over the previous 10 years.

Superannuation is often the best retirement option, but for Australians looking to build financial freedom with more choices – including when and how they retire – other tax-effective options such as investment bonds are worth considering.

Neil Rogan is Head of Investment Bonds for Centuria. Centuria is a sponsor of Cuffelinks. Suitability of an investment bond will depend on a person’s circumstances, financial objectives and needs, none of which have been taken into consideration in preparing this article.