The association representing super funds, ASFA, has released research that a home owning couple needs just $690,000 in super, as a minimum, to have a 'comfortable' retirement.

A single retiring homeowner needs $595,000.

Also, ASFA suggests that annual retirement income, to be deemed comfortable, needs to be just $74,000 per annum (p.a.) for a couple and $52,000 p.a. for a single - both representing between 50% to 70% of average wages (tax affected).

By drawing the mandatory 4% p.a. from their super (as a pension), the difference is made up from the full entitlement (or drawing) of the ‘means tested’ Commonwealth pension. Commonwealth Health card benefits would be essential for these low-income retirees.

Clearly a couple or an individual with less in super than ASFA’s minimum at retirement will have an extremely uncomfortable retirement. People who also rent and have less in super are also destined for a difficult and problematic retirement. The extent of the discomfort will be determined by access to non-super assets. There are still over 20% of Australians who retire without a super account.

ASFA provides information on what expenditure that is covered by this income, but it’s arguably flawed as it quotes averages and doesn’t differentiate by age or health. AFSA makes no mention of retirees who rent.

In any case, it should not be a surprise, though it should be disturbing, that a majority of today’s retirees, men or women, enter retirement with less than what is required to meet ASFA's comfortable level. After 33 years of compulsory super, this is a sobering observation.

But there is good news, according to ASFA, who suggest that the average 30-year-old who today has $30,000 in super, and will earn the average wage, will reach the equivalent of today's $595,000 by age 67. I will consider what this means later, but I do acknowledge that the compulsory 12% p.a. contribution rate helps the future look better than both the past and the present.

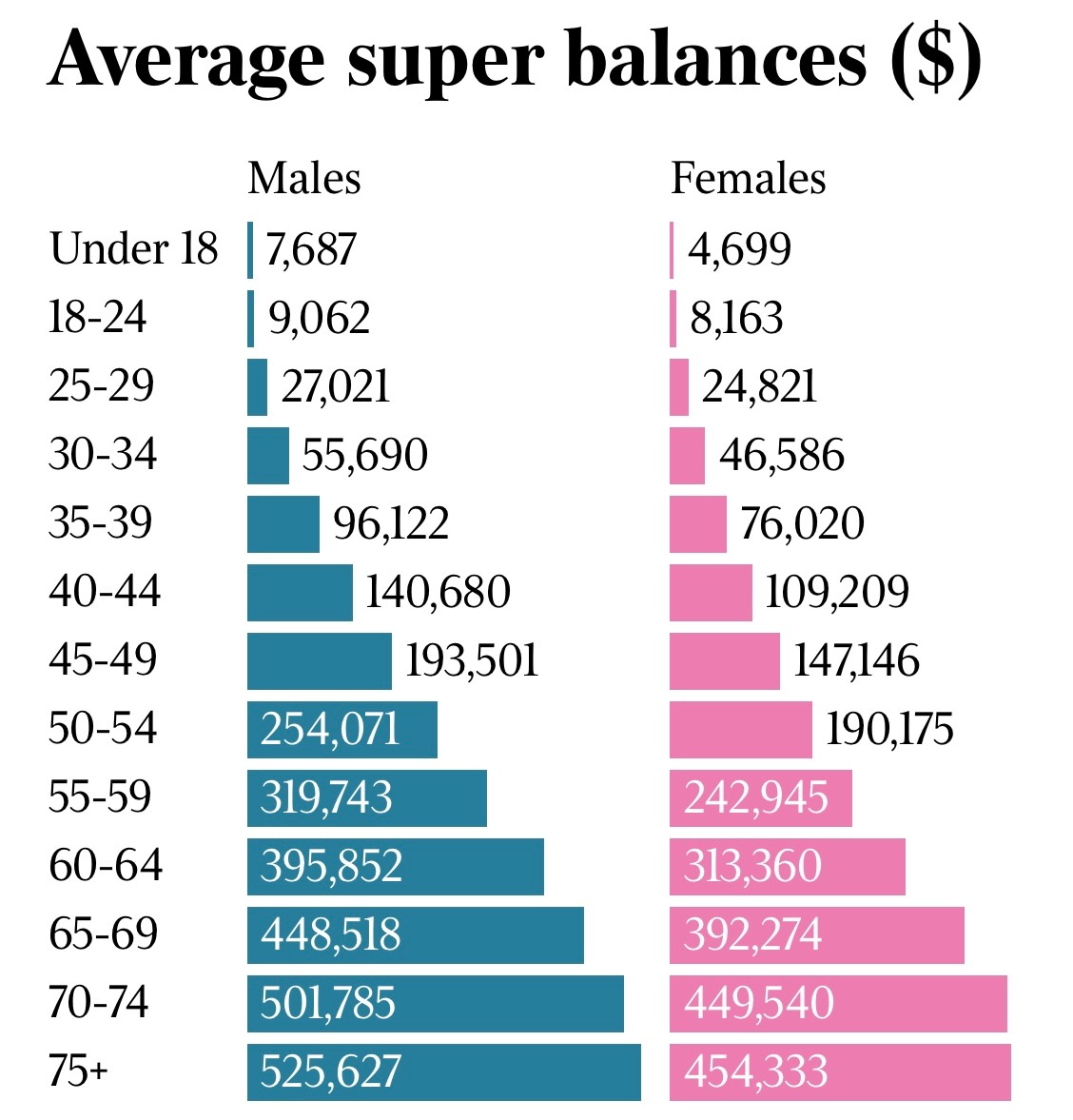

Today’s average super balances

The ABS has produced the following table, as of 2024, detailing the average super balances for each age cohort. It suggests that the average ‘single’ retiree (65 to 69) will retire with less than enough to achieve a comfortable retirement. Average married couples (male and female) in general will have enough.

However, retiring low-income earners need to navigate the ‘assets test’ for the full entitlement to a Commonwealth pension. Having just enough may be better than having slightly too much as the Commonwealth pension is adjusted downward accordingly. This is where the much-maligned financial advisor comes into their element in strategic advice.

Superannuation in future

ASFA references how the 30-year-old of today will retire at 67 in 2062, and that opens up some questions:

- How will today’s $595,000 - the minimum needed by a single, retiring homeowner, according to ASFA - be measured in 2062 dollars?

- What will an annual pension payment require to equal today’s $52,000 for a single?

- What affect does inflation and the compounding of the cost of living and average wages mean for a future comfortable retirement?

Assuming a moderate 4% growth in annual ‘average wages’ (pretax to match inflation plus 1%), and the same ratio of drawings from super and the Commonwealth pension, the requirements in 2062 dollars for an individual retiree are:

- $2.5 million in the individual's retirement fund; and

- An income of $220,000 p.a. of which $100,000 is drawn pension, with about $120,000 p.a. coming from the Commonwealth pension.

Quite simply stated, even multimillion-dollar retirement accounts will not be enough to enter a ‘comfortable retirement’ in 2062. Compounding inflation fairly covered by average wage rises create this consequence.

Clearly the proposed non indexed unrealised capital gains tax targeting $3 million super accounts will hit millions of retirees over time - and many of these retirees will be average workers on average retirement benefits.

Even in 2062, some 70 years after the introduction of mandatory super, it is likely that more than 50% of retirees will still need to draw a full or part Commonwealth pension even if they retire with over $2 million in their super account.

Concluding thoughts

My points are simple:

- Australia's account-based superannuation system is flawed - it is well past time to acknowledge this.

- It would have been much better, and there still may be time, for the creation of a national mandatory contributory pension scheme that targets a 60% of average wage pension to all retirees. A 'reasonable asset tested' savings pension account (with a reduced earnings tax) could be an adjunct to the national pension scheme and thus most current super accounts would already comply.

- The government should junk the unrealised capital gains tax proposal as it is an intellectually limited tax policy inside a flawed super system.

- Indexing of taxation bands, both inside and outside super (i.e. wages), should be mandatory for both tax regulation and fiscal integrity.

- The defined benefit pensions inside Commonwealth and State schemes need to be much more transparent. They need to be both funded and taxed, consistent with a sustainable and fair national retirement scheme developed for all Australians; and

- The persistent adding to inflation, through the indexing of government charges, needs curtailing. Government indexed charges make the ambition of a ‘comfortable retirement’ simply unattainable for many.

John Abernethy is Founder and Chairman of Clime Investment Management Limited, a sponsor of Firstlinks. The information contained in this article is of a general nature only. The author has not taken into account the goals, objectives, or personal circumstances of any person (and is current as at the date of publishing).

For more articles and papers from Clime, click here.