Global gold demand stays strong, supporting record-high prices

Australians resist buying into the gold rally

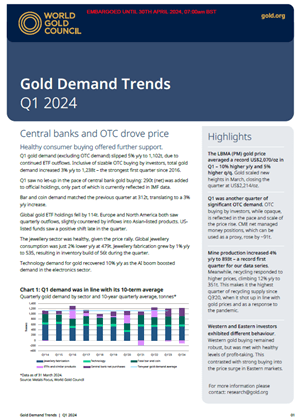

The World Gold Council’s Q1 2024 Gold Demand Trends report reveals that total global gold demand (inclusive of OTC purchases) was up 3% year-on-year to 1,238t, marking the strongest first quarter since 2016. Demand excluding OTC fell 5% to 1,102t in Q1 compared to the same period in 2023.

Healthy investment from the OTC market*, persistent central bank buying, and higher demand from Asian buyers, helped drive the gold price to a record quarterly average of US$2,070/oz—10% higher year-on-year and 5% higher quarter-on-quarter.

Central banks continued to buy gold apace, adding 290t to official global holdings during the quarter. Consistent and substantial purchases by the official sector highlight gold's importance in international reserve portfolios amidst market volatility and increased risk.

Turning to investment demand, bar and coin investment increased 3% year-on-year, remaining steady at the same levels from Q4 2023 at 312t.

Australia was an outlier in the Asia region, recording its lowest quarter on record for gold consumption, which at 4.3 tonnes was down 37% from Q1 2023. This includes a halving in demand for bar and coins and a 15% drop in jewellery consumption over that time.

*Over-the-counter (OTC) transactions (also referred to as ‘off exchange’ trading) take place directly between two parties, unlike exchange trading which is conducted via an exchange.

Download the full paper