What business would you like to own? For some, the dream might be McDonalds, Subway or even the local Laundromat, all potentially good businesses. But some new companies have more compelling operating models. Uber owns no cars, Facebook doesn’t pay for its media content and Alibaba, the world’s largest e-commerce site, has no stock to store. They’re all great businesses because they require little inventory and have low capital costs. They also become better businesses as they get bigger because of the network effect (see Facebook below). Some businesses like Tripadvisor have customers that do their work for them. That’s a fantastic business model - customers make the business better for free.

You are the content

Facebook doesn’t buy TV shows. It’s a reality show that is you. Your posts are the content. Unlike other media businesses, Facebook doesn’t pay money to produce shows or write off shows you don’t like. It makes money from your content by placing advertising within your newsfeed. On average, 1 in 20 posts have an advert. In the past 12 months, their global average revenue per user was $10.47. Australia is not broken out but the average US user brings in $34.

All those likes you click add up. Facebook needs 70 likes to understand your personality better than your friends. With 250 Facebook likes, a computer can know you better than your spouse. Facebook has a Superbowl-like audience every day where advertisers can target specific customers with a compelling alternative to television advertising. Facebook doesn’t need to market to sign up new users. Current users help Facebook grow for free as they send out links to sign up friends. The network effects are strong with one billion daily active users. A past example of the network effect is the telephone. The more people who own telephones the more valuable the telephone is to each user. Facebook is the same.

The average gross margin (sales minus costs of goods sold) for S&P500 companies is 33%. A large gross margin means greater potential profitability. Facebook’s unique business model delivers its 83% margin. The majority of expenses are employees researching and developing new services such as Instagram, instant messaging with WhatsApp and virtual reality with Occulus Rift. According to Nielsen, the average Australian spends 1.7 hours a day on Facebook. It’s easy to admire a new age media company that doesn’t pay for the content that drives the business.

Customers working for you

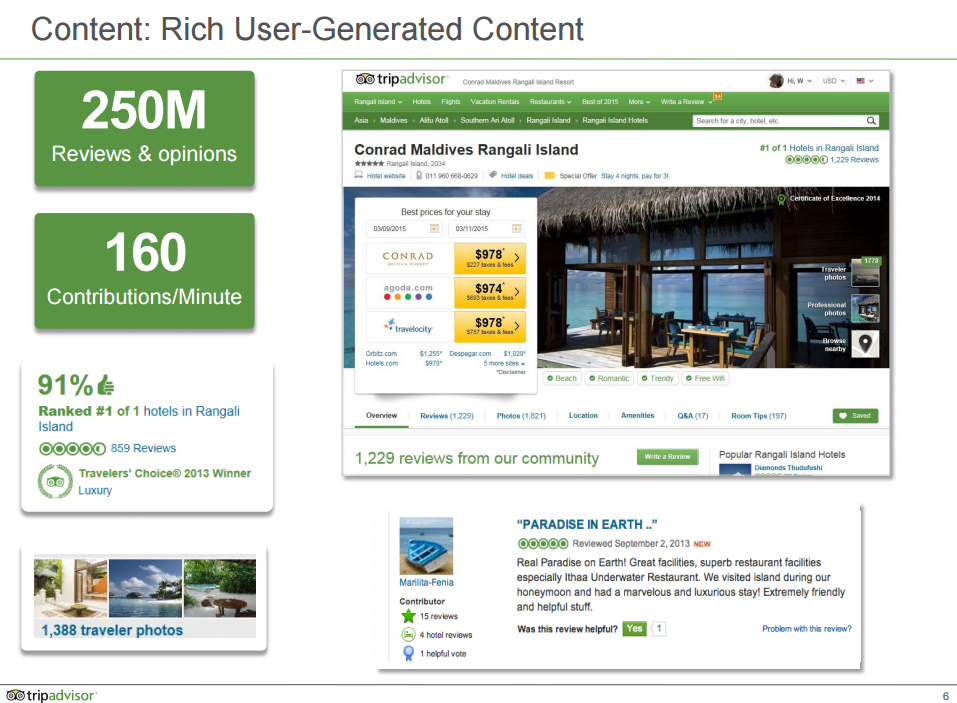

Tripadvisor is a similar user-generated model. It is the world’s largest travel site allowing travellers to plan and book their perfect trip. Tripadvisor doesn’t employ staff to write hotel reviews, their customers do it for them. Every day, the CEO wakes up and customers have added thousands of more reviews every night. I personally like the sound of this business.

Tripadvisor has 250 million reviews on 5.2 million places to stay, eat and things to do. You couldn’t hire enough staff to build it. Frequent reviewers receive virtual badges and you can guess how much that costs. Users are even willing to write reviews on small mobile screens. Like Facebook, it has a virtuous circle where more reviews lead to more traffic which leads to more reviews. Tripadvisor employs only 3,000 staff compared with 18,000 staff at Expedia and 12,700 at Priceline. Gross margins are even larger than Facebook’s at 96% (that’s not a typo). The majority of expenses are sales and marketing, such as television advertising. As the diagram below shows, customers (free employees) add 160 contributions a minute.

Source: Tripadvisor 2Q Investor Presentation

Can the business scale?

Apart from user-generated content, other good businesses involve companies that can grow and scale with little additional staff. As an ex-accountant and fund manager, I appreciate the benefits of scalability. Good people are hard to find. As accounting or law firms grow, they need to add more staff as they win new business. However, as a fund manager grows they don’t have to increase staff numbers commensurately. Look at the success of Magellan and Platinum. Magellan manages $39 billion with only 90 staff.

Another great business model is one that involves large-scale exchange traded funds (ETFs). There is none of the key man risk associated with star portfolio managers, and it’s hard to underperform a benchmark when you create it. In most sectors, ETFs are highly scalable with few of the limits to capacity evident for specialist managers such as hedge funds or small caps. In fact, as an ETF attracts more money it becomes more valuable to customers as liquidity and trading increases. For example, the US ETF provider, WisdomTree (represented in Australia by BetaShares), employs 124 people to manage $60 billion.

High gross margins and scalability

There are many great businesses out there but technology tends to top the list. The reason why the NASDAQ is one of the best performing indexes is because their companies tend to have high gross margins and scalable business models. Anyone in an operating business would love to have these characteristics. It’s hard finding good staff and attracting customers. Let your customers do the work and scale your business!

Jason Sedawie is a Portfolio Manager at Decisive Asset Management, a global growth-focused fund. Disclosure: Decisive holds Facebook in its fund. This article is for general purposes only and does not consider the specific needs of any individual.