One of the misconceptions investors have is that the $123 billion listed property index is primarily exposed to residential real estate. In fact, only 4% of the value of the index is trusts exposed to residential property. Further, this exposure primarily comes from developers selling finished apartments or home and land packages, not from actually owning housing real estate that is rented out.

Last month, Mirvac announced they would be bringing Australia’s first major build-to-rent apartment development to market in a move that could potentially address housing affordability issues. The question is why have institutional investors shied away from investing in residential developments, unlike in the US and the UK where this sector is a growing part of the listed property indices? Indeed, in the US, the residential sector accounts for around 25% of the $US2 trillion in institutional property investment, placing the sector just behind office.

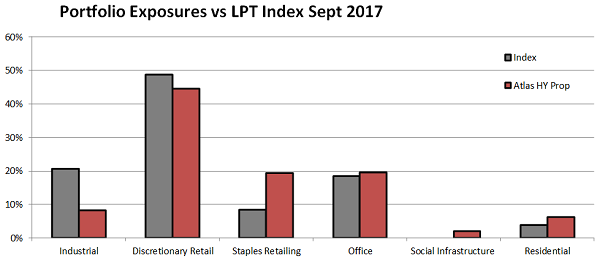

Residential property has attracted little interest from institutions because retail investors have an investment edge. The chart below shows the property exposures of the S&P/ASX 200 A-REIT index by sector in September 2017. The residential exposure of $4.7 billion is dwarfed by the value of the discretionary retail ($59 billion), industrial ($25 billion), and office ($22 billion).

Listed property by sector exposure

Source: Atlas Funds Management, index versus Atlas High Yield Property Fund.

Three structural reasons for retail investors dominating residential

Whilst the smaller transaction size of buying a two-bedroom apartment is attractive to retail investors compared with an industrial warehouse or an office tower which may be valued in the tens to hundreds of millions, there are three structural reasons why retail investors dominate residential property investment.

1. Capital gains tax breaks for home owners ‘crowds out’ corporates

Although the domestic rental sector exists in listed property trusts (LPTs) in the US and Europe, in Australia the tax-free status of capital gains for owner-occupiers selling their primary dwelling has had the effect of bidding up the purchase prices of residential real estate. For example, when a company generates a $500,000 capital gain from selling an apartment, they would be liable to pay approximately $108,000 in capital gains tax, whereas the owner-occupier pays no tax on the capital gains made on a similar investment. This discrepancy in the tax treatment encourages owner-occupiers to pay more for the same real estate assets and contributes to low yields.

2. Negative gearing

Similarly, individual retail investors benefit from the generous tax treatment in Australia that allows them to negatively gear properties. There are three types of gearing depending on the income earned from an investment property: positive, neutral and negative. A property is negatively geared when the rental return is less than the interest repayments and outgoings, placing the investor in a position of losing income on an annual basis. Under Australian tax law, investors can offset the cost of owning the property (including the interest paid on a loan) against other assessable income. This incentivises individual high-taxpaying investors to buy a property at a price where it is cash flow negative and maximise their near-term tax returns and bet on capital gains. Whilst companies and property trusts can also access taxation benefits from borrowing to buy real estate assets, a rich doctor on a top marginal tax rate of 47% has a stronger incentive to raise their paddle at an auction.

3. Yields on residential property too low

At current prices, the yields that residential property offer are not very attractive for listed vehicles. At the moment, the S&P/ASX 200 A-REIT index offers an average yield of 5%. This is higher than yields from investing in residential property. SQM Research reported that the implied gross rental yield for a 3-bedroom house in Sydney was 3% with a 2-bedroom apartment yielding 4% in July 2017. After borrowing costs, council rates, insurance, and maintenance capex, the net yield is estimated to average around 1%. With listed property investors focused on yield receiving on average ~ 5% from property trusts investing in office towers and shopping centres, such a low yield would only be accepted if it was offset by high and certain capital gains.

Mirvac’s new ‘build to rent’ fund

In August 2017, Mirvac announced its intention to develop a ‘build to rent’ fund with assets based initially in Sydney. This fund is likely to target institutional investors rather than retail, who generally already have a significant exposure to residential real estate. This looks to be an opportunity for Mirvac to access both development profit (profit margin +25% in FY17) and also an ongoing funds management fee on the completed assets. However, we would be surprised to see much of Mirvac’s own capital invested in the fund. In 2017 Mirvac generated an 18% return on the $1.8 billion of capital invested in its residential development business (ROIC). Mathematically it is hard to see how investing in their own finished product will generate returns higher than the trust’s average cost of capital.

Our take

Whilst the residential sector is a large part of the stock of Australian real estate assets, without significant taxation concessions it is hard to see this sector garnering much interest from institutional investors, especially for income-focused investors. We see that the majority of returns over the next 12 months will come from distributions and income from writing call options over existing holdings, rather than spectacular capital gains.

Hugh Dive is Chief Investment Officer of Atlas Fund Management.