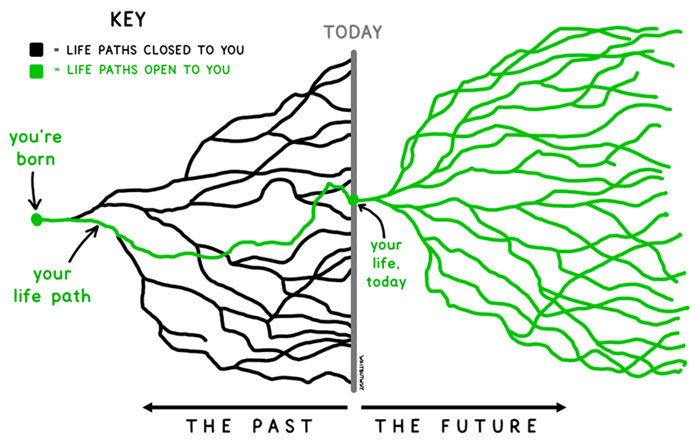

I like the chart below. It shows how when we’re born, we have infinite paths that we can take. Our experiences and decisions take us via a certain route to where we are today. And from now, there are similarly a lot of different directions that we can travel. The question is: what’s the best path for us?

Source: Tim Urban

To make it easier, it can be worthwhile to think about the above diagram in terms of one key aspect of our lives: financial, social, health, perhaps spiritual. And, to consider the best ways to make the most of this part of our lives. To increase the odds of success, if you like.

The future is inherently uncertain. There’s no guarantee that we’ll end up where we want even if we make the right decisions along the way. However, there are ways to lift the probabilities of achieving our goals.

Inverting the problem

How do we this? One strategy can be to turn the question around 180 degrees and look at how not to do it.

Take our health for example. Most of us want to be healthy, to have a good quality of life as well to possibly extend our lifespan. Yet, we often pursue things that will never allow us to reach our goals.

Have you ever dieted before? I know some people who’ve tried every diet there is. Mediterranean, Atkins, high protein, Paleo, Keto, low-fat, intermittent fasting, and the list goes on.

The problem with dieting is it isn’t sustainable. It’s not something that we’ll be able to maintain for the rest of our lives.

The same goes for fitness. Have you ever signed up for a gym membership, and given up after a few weeks? Or go to the gym for a more extended period, then give up for a while, before getting back into it, and then letting the membership lapse again? I know I have.

For many of us, going to the gym isn’t sustainable either. It’s not something we’ll continue over the very long-term, for any variety of reasons.

Often the solution is to look at things that are more sustainable. With diet, it’s perhaps not trying a radical solution but a more incremental one. Instead of going for the Atkins diet, it’s committing to eating a salad for lunch each day. Doing that consistently could do wonders for your health.

Or instead of going to the gym, committing to a sport that you like for 2-3 days each week. Or walking for 30 minutes each day. Anything that you could see yourself doing not only today, but in 10-, 20- or 50-years’ time.

How this applies to investing

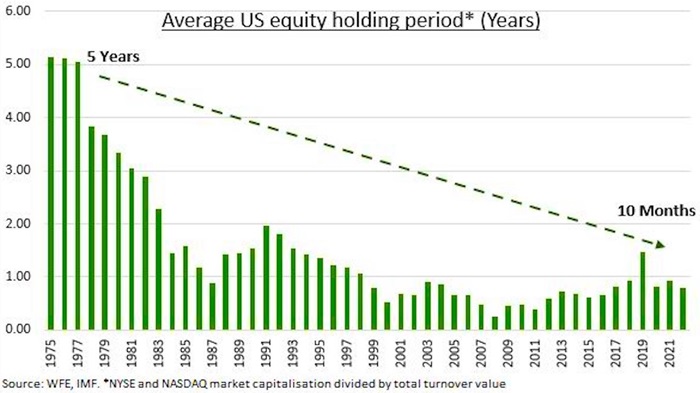

How does this relate to investing? The biggest mistake that I see investors make is constantly switching strategies. One minute, they’ll chase the speculative pharmaceutical stock that they’re sure will soon get FDA approval for a certain drug, or the mining company that’s about to make the next big find, or the next bit of market momentum. And the next minute, they’ll chase the investment manager that’s recently shot the lights out, and we all know what usually happens then.

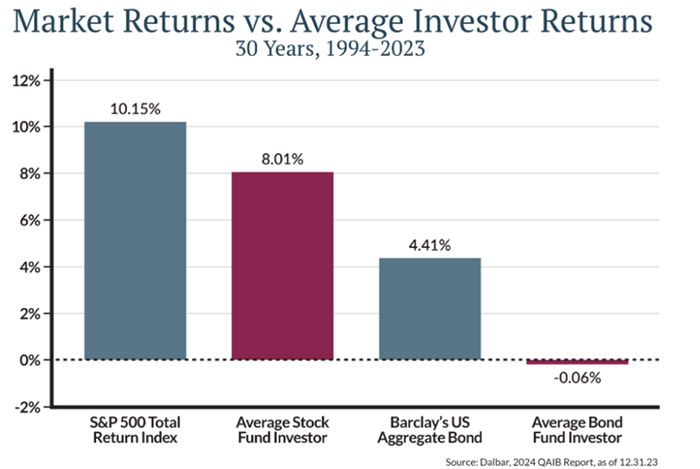

This flip-flopping leads to predictable results. Numerous studies show that the average retail investor underperforms indices by a wide margin.

The chart above reveals the average stock investor has trailed the index in the US by more than 2% each year over the past decade. This may be generous as prior studies have found worse outcomes.

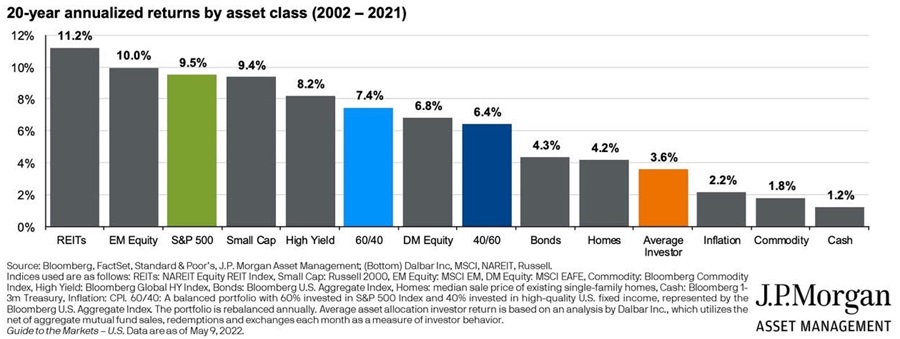

The next chart shows part of the reason why this happens.

Trading and flip-flopping between strategies are what I call lottery investing. There’s a small chance that you can hit it big, but the odds are against you.

How to tilt the odds in your favour

What can improve the probabilities of building wealth? As with our health, the answer usually revolves around what is sustainable, or timeless. What is an investment strategy that you feel comfortable pursuing in the long-term? Framing the issue this way has several advantages:

- It gets you thinking long-term rather than trying to find the next ‘lottery stock’.

- It makes you consider what strategy may suit you best. It’s not about what suits others, but you. Your goals, preferences, and personality.

- It can help identify your investing edge versus others. Warren Buffett once said: “If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.” This can help you avoid being the patsy!

- It can help you ride through short-term market noise and market gyrations, both of which undo a lot of investors.

Notice how I haven’t mentioned any specific investing style or strategy worth pursuing, because really that’s up to the individual.

Possible objections

There are a few potential objections to the strategy of timeless investing:

- Doesn’t it mean sticking with a strategy that’s static and not moving with the times?

- Didn’t Buffett change his style and go on to become successful?

- What if my strategy isn’t working? What do I then?

To the first question, it certainly does mean sticking with strategy – that’s the whole idea.

While it’s true that Buffett did change his investment style, there was a specific reason for that. As you may know, Buffett was a deep value investor when he ran his own fund, before buying into Berkshire Hathaway. Meeting Charlie Munger helped Buffett move towards more of a growth style of investing, which led to famous stock purchases such as Washington Post, Coca-Cola, and more recently, Apple.

What’s little acknowledged is that Buffett was forced to evolve his strategy as he grew Berkshire. He foresaw that what worked previously with a small amount of money wasn’t going to work with a large pot of cash.

As to the last question, that’s a tricky one though it makes it even more critical to ensure your original choice of a strategy is the correct one.

James Gruber is Editor at Firstlinks and Morningstar.