John M Malloy, Jr is Co-Head of Emerging & Frontier Markets at RWC Partners. He joined RWC in 2015 from Everest Capital and has focused on emerging markets investing for 23 years.

GH: We have not published much on emerging and frontier markets this year. Can we start with definitions of what countries are included?

JM: Emerging markets are defined as developing countries in terms of their GDP per capita, their stage of economic development, their banking systems, their foreign exchange and interest rate markets. The previous expression ‘less developed nations’ has become emerging markets. For example, the Morgan Stanley (MSCI) Emerging Markets Index includes 33 countries, the largest being China through to smaller ones such as Egypt and Pakistan. It covers a broad range. We have China, Korea and Taiwan developing at a fast pace, and Taiwan has a GDP per capita that's on par with some developed countries but it is considered emerging because it doesn’t have an open capital market.

At the other extreme, we also invest in frontier markets (up to a maximum of 20% of our strategy) which are less liquid and less developed than emerging markets. In the MSCI Frontier Markets Index, the largest country is the Philippines. It also includes Vietnam, Peru, Colombia, the Ivory Coast. We own a company that we categorise as Zambian called First Quantum. It's listed in Canada but close to 100% of its assets are in Zambia and Panama.

GH: If you invest in a country like Zambia, how do you follow events there?

JM: On-the-ground due diligence is key, although that’s compromised during COVID. We continue to have close contact with our target companies. We've traveled to these places for many years. I started in emerging markets in the early 90’s and James Johnstone, who co-heads the strategy with me, has almost 25 years of experience. We also have a unique consulting arrangement with Rice, Hadley, Gates & Manuel. Condoleezza Rice, the former Secretary of State under Bush, started a consulting firm, and they speak to world leaders, they have contacts, they have very good access. Bob Gates was a former Secretary of Defence for Bush and Obama, Steve Hadley was a National Security Adviser. These contacts give us good perspectives, and our analysts also travel a lot.

GH: Why are you underweight China and Taiwan?

JM: We have shifted. We were close to a market weight earlier in the year, and both those markets have done well for us in the past. But as stock prices have appreciated, most of them have hit our price targets, and we are very disciplined, and we sell if we don't see additional upside. So, over the past two months, we've rotated capital out of China and Taiwan and into other places such as Zambia, Korea, Brazil and Russia on the expectation of a global recovery.

GH: In emerging markets, and maybe even more so for frontier markets, do you feel that you're getting a greater reward for greater risk? Or do you analyse companies in a similar way as developed market stocks?

JM: The fundamental due diligence is similar. We model the income statement, balance sheet, cash flow statement, we have a price target, we have our own internal ESG scoring system. However, where there are differences is in the macro risk. So when investing in, say, a Chinese company, there is Renminbi risk or in Brazil, the Brazilian Real risk, so you need to understand the dynamics around the currency. The other difference is that some of these markets include companies that are run or owned and controlled by the government. Is this company run for the shareholders or for other stakeholders? Additionally, you have to ensure information is good, especially accounting standards. All this requires experience and we have 20 people based in Miami, London and Singapore.

GH: Does a typical emerging markets portfolio have greater volatility for the return than in a developed markets portfolio?

JM: My view is that if you invest in these markets, you should demand higher returns. So for example, it doesn’t make sense to invest in a low volatility emerging markets strategy. Investors are not compensated for the risk. We have produced higher returns with higher volatility, compounded strongly over the nine years that we've run the strategy.

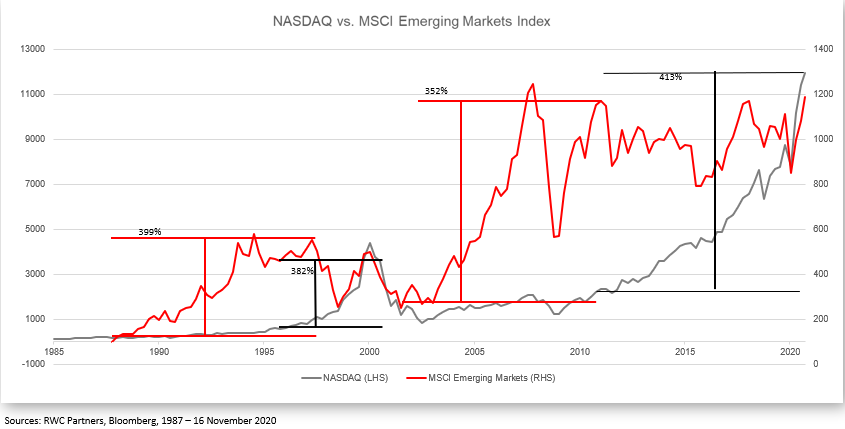

Emerging markets are cyclical, as shown in the chart below. From the late 80’s to the mid 90’s, emerging markets did phenomenally well (up 399%), and then did nothing for about a decade. Then they did well again, from early 2000’s to the GFC around 2010 (up 352%). And since then until recently, they've done nothing. So we believe there's an opportunity, especially with the dollar weakening and an enormous amount of quantitative easing, that emerging markets are set to do well.

GH: What challenges in particular has COVID thrown up in analysing emerging markets companies?

JM: Obviously, it's a global shock, and many of these governments don't have the fiscal strength to put in the types of stimulus offered by countries like Australia, the US or parts of Europe. But what they do have is the ability to put in place stringent measures and for the most part, the populations adhere to them. On the stringency tests conducted by Oxford University, which looks at things like shutting down mass transportation, closing down schools and contact tracing, many emerging markets score better than developed markets. It’s why we’re not seeing a great second wave of cases in these markets.

Asia is a good example. Taiwan is a phenomenal story, and with 24 million people, they didn't close down the economy and they've had less than a dozen fatalities. How do they do that? They obey government rules on wearing a mask, social distancing, tracing on cell phones, personal quarantining. In contrast, some developed countries have handled COVID incredibly poorly. Some emerging markets had a sharp decline, but they are experiencing a very sharp V-shaped recovery.

The second point is the demographic backdrop, including younger populations who are less obese. In the US, a large proportion of the deaths are older people and people with health problems.

GH: They are interesting points. It would be easy to assume that the countries with the best hospital systems and money to spend would manage the pandemic the best. Let’s look at ESG. How do you handle investing in countries with problematic rules of law, a lack of democratic elections, different media freedoms, etc?

JM: We focus on ESG using our internal scoring system to check governance, environment and social issues. Often, third party providers such as Sustainalytics, Morgan Stanley or Bloomberg don't fully cover the full emerging markets universe. ESG compliance is improving, much better than even five years ago. More companies openly engage about doing the right thing, including disclosure, data privacy, diversity and minority issues. Governments are also improving, such as China moving on sharemarket access and inclusion into the Global MSCI Index.

There's more focus on community, on education, on social issues, because companies recognise that there’s a real cost to having a strike or a boycott of their products or as in Bangladesh, a factory collapse.

GH: Can you describe the technology in the countries that you deal in? For example, how good is the rollout of the internet and smartphones? And how far behind or maybe ahead of developed countries are they?

JM: There are two buckets. China, Korea and Taiwan are highly advanced and they are rolling out 5G aggressively. In the US, the real 5G is located only in city hotspots but China and Korea are really rolling it out nationwide. Their 5G networks will be 50 to 100 times faster, which allows technology such as autonomous vehicle driving, drone technology, faster communications and remote operation such as a doctor operating by a robot from 1000 miles away.

Then in the second bucket, like India, Brazil and South Africa, they are leapfrogging over countries with basic technology. So they won't even build branch networks for banks because they're going directly to digital banking and digital payments via their smartphone. And these are not Apple smartphones costing $1,000. A company we own called Mediatek is selling semiconductor chipsets into these markets, and the smartphones cost $100 with the same functionality as Apple. In a place like India, if hundreds of millions can suddenly tap into e-commerce or digital payments, it changes the dynamics of the country. They are literally becoming wired overnight. It's incredibly disruptive for some companies but it's very positive for technology leaders.

GH: Can you name three companies that you're most confident about in coming years.

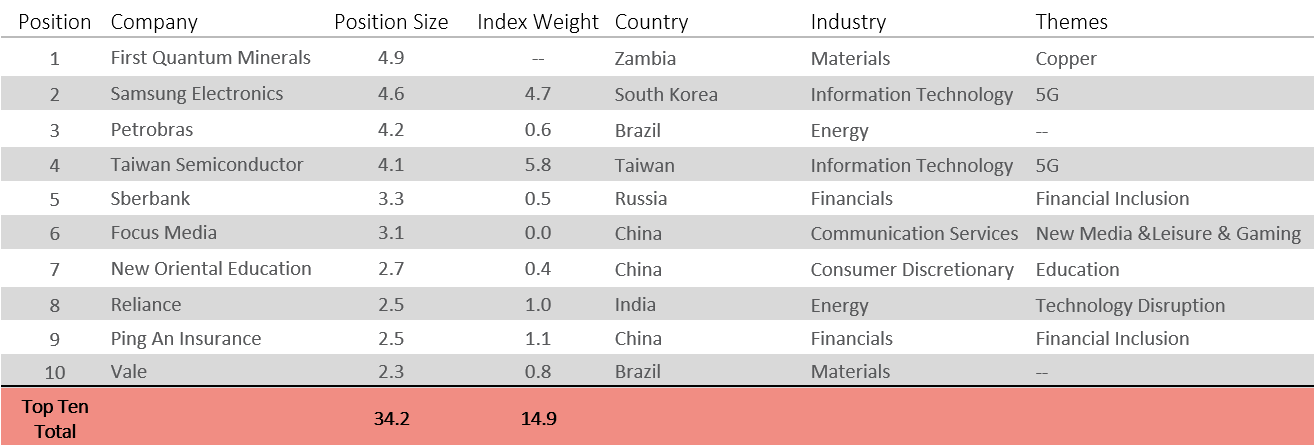

JM: Well, when I look at our portfolio of about 60 names, they are all really interesting. The table below shows our Top 10 holdings, so three I’ll highlight are Taiwan Semiconductor, Sberbank and First Quantum Minerals.

Source: RWC, as at 16th November. Figures may not add up to the total figure due to rounding.

First Quantum is a copper producer, and the growth of electric vehicles, clean technology and clean energy will drive copper demand. An electric vehicle uses five to six times more copper than a traditional vehicle and countries and building out their charging networks. We think First Quantum is a phenomenal company with great management, great assets and a reasonable valuation.

Taiwan Semiconductor is the largest manufacturer of semiconductor processors in the world, increasing market share to 60% versus 30% a few years ago. They're doing a great job against Intel, yet Taiwan Semi trades at only about 18 times earnings. It's also focused on ESG and renewable energy.

And Sberbank is owned and controlled by the Russian Central Bank, but it's run like a private company with a close focus on the stock price and return on equity. They paid out a 9-10% dividend yield two months ago, yet Sberbank is trading on a low valuation. They're a leader in technology and they're closing branches to reduce costs.

We think all of those stocks have strong upside supported by good management teams.

GH: The Bank of America Fund Manager Survey for November 2020 shows a rotation into EM investments. Are you seeing that trend?

JM: We're seeing a good uptick but we expect a wall of money to come into emerging markets in 2021. Ironically, most emerging markets really don't need money. Many are running positive current account balances and don’t need external sources, so the external money should also be good for their currencies. We’ve seen it in Korea and Taiwan and China so far, and we're starting to see it in Brazil and Russia.

But let me say that I'm not a big believer in the growth versus value debate. There’s no point buying a value company that faces a severe technology disruption as it could end up being worth zero. I remember when people thought paging companies were cheap but like Blockbuster, the movie video retailer, they became worthless. Companies within emerging markets can remain cheap for a long period of time because of regulatory risk, state owned enterprises (SOEs), technology disruption or ESG concerns. We are growth at a reasonable price (GARP) investors but we need to top line and bottom line growth. The starting point isn’t valuation.

GH: Many of our readers have traditional portfolios of global and Australian equities, fixed interest and maybe some property. Why should they make an allocation to emerging markets?

JM: If you look at what is happening in countries like India, Brazil, Taiwan, Korea, where they are focussed on infrastructure, opening up their markets and deregulation, it’s good timing for someone with zero exposure. We've gone through a massive bull market in the US and you could argue the valuation case from here. The valuation case in emerging markets is more compelling and we have seen the cycle before. Also, in terms of diversification, it's worthwhile thinking long term and the commodity backdrop should be constructive. There's been a lack of investment in commodities such as copper. There is an element of opportunism in emerging markets because it is a volatile sector, so investors should take a global approach with a manager with the resources to monitor all these markets and not simply a focus on say China or Korea.

Graham Hand is Managing Editor of Firstlinks. This article is not financial advice and is general information that does not consider the circumstances of any investor.

Access to the RWC Emerging and Frontier Markets strategy is available to Australian investors via Channel Capital, a sponsor of Firstlinks.

John M Malloy, Jr is Co-Head of Emerging & Frontier Markets, at RWC Partners, a Channel Capital partner.

For more articles and papers from Channel Capital and partners, click here.