When people ask me what I do for work, I often tell them I spend my time lending money and getting it back. Those who understand lending often laugh. Anyone can lend money, it is getting it back that makes a lender profitable. This has two key components: the initial analysis and the ongoing monitoring.

The initial analysis

The importance of initial analysis is understood by pretty much all lenders, in that they have some process for making a risk assessment. In my experience working in banks, the initial assessment for institutional loans is typically very long (10-100 pages) and often requires the approval of several risk committees. Much of the report is copied and pasted from previous reports, with true original risk analysis often lacking.

The reason for the length is that many lenders haven’t yet figured out how loans go bad and thus spend a lot of time covering potential risks that aren’t really risks at all. The Narrow Road Capital process zeros in on volatility, ratios and structure as the key risks and initial assessments can be kept to a reasonable length. The old banker’s saying that “there are no new ways to lose money” is a reminder that a healthy knowledge of previous defaults and their causes is the best guide to the future.

The ongoing monitoring lacking for Arrium

Getting the money back requires ongoing monitoring. My experience here is that many lenders, including the major Australian banks, do a poor job of this. Monitoring covenants and quarterly reports is typically given to a junior staff member who simply confirms that the ratios don’t breach the covenants. There’s little or no meaningful analysis done by the experienced staff. It wouldn’t take much time, perhaps 15 minutes per company per quarter would be sufficient to pick companies that are deteriorating and where action should be taken.

In the case of Arrium the banks claimed that they were shocked when presented by management with a proposal that would have seen them take a 45% loss on their exposures. They shouldn’t have been surprised. Arrium had been struggling for years and anyone who was conducting regular monitoring would have seen the problems coming.

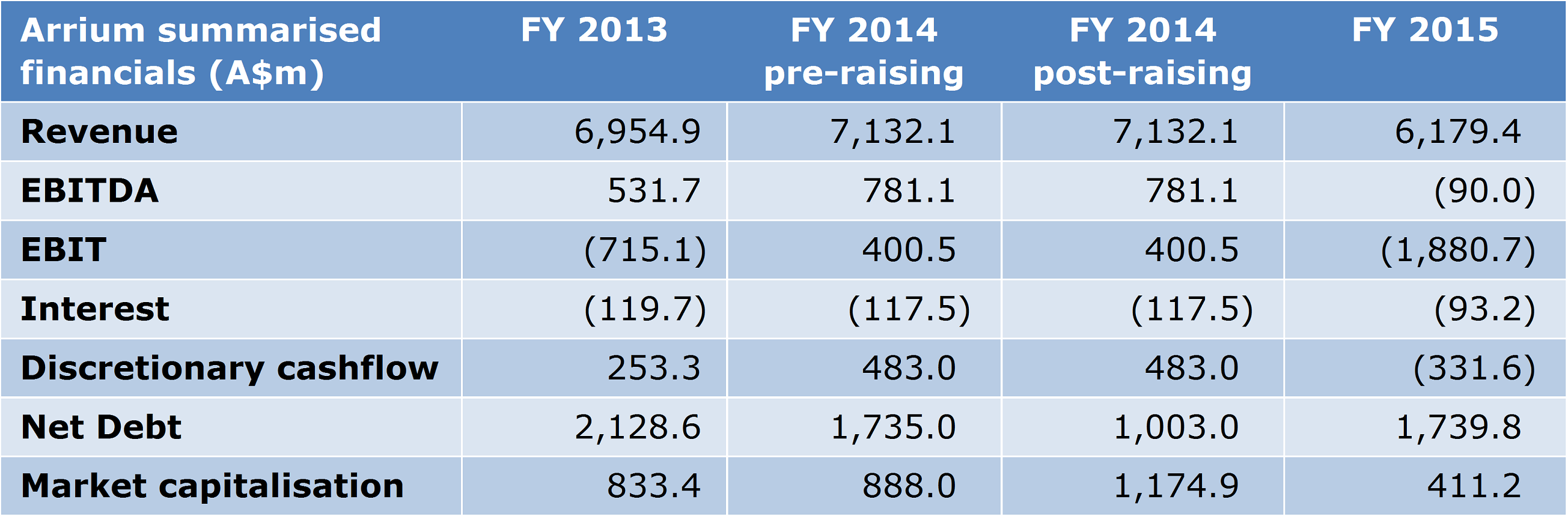

In September 2014 Arrium undertook its infamous capital raising. $754 million of new equity was raised, but the share price was trashed in the process falling from 65 cents to 40 cents. The net proceeds of $732 million reduced debt levels materially, but only increased the market capitalisation by $287 million. Just after the capital raising was an ideal period for an alert lender to sell their loans. The business had recorded losses, was poorly managed and had two high cost business units (steel and iron ore mining) that had deteriorating fundamentals. Despite this, the banks didn’t act.The problems are obvious in the 2013 financial year, with substantial write-downs leading to negative earnings before interest and tax (EBIT). The market capitalisation was very small when compared to net debt. This was clearly a sub-investment grade credit. Despite this, in June 2014, US$725 million of unsecured debt was renewed at an interest rate of roughly 4%. The failure to increase the interest rate to reflect the sub-investment grade risk and the failure to take security is mind-boggling. That was compounded by the lack of proper covenants, which would have given the banks a clear warning of later problems.

Ongoing deterioration

By December 2014 the share price reached $0.16 with the market capitalisation below $500 million. At this point the banks should have known that they were on their own, equity wouldn’t be able to stump up any reasonable amount to de-lever their position. When the half year results were announced in February 2015 there was another round of write-downs and the business was unprofitable even on management’s ‘underlying’ results. Net debt rose by $427 million in the three months from the capital raising to the end of the period. It was now clear that the company could not de-lever from either an equity raising or positive cashflows, without an enormous increase in the iron ore price. The writing was on the wall a year before the debt haircut proposal was announced.

The 2015 full year results in August 2015 contained another $310 million increase in net debt. The half year results in February 2016 added another $336 million of net debt. By this stage, net debt of $2.077 billion towered over the market capitalisation of $146 million and the ‘underlying’ EBIT of $7 million. Days after the February 2016 half year results announcement, management put forward their restructuring plan which involved the lenders taking a 45% haircut. The banks claimed they were blindsided by the plan, but what alternative did they have? The potential sale of Moly-Cop was never going to yield enough to see the debt repaid in full. If Moly-Cop was sold Arrium would have been left with a rump of unprofitable business units and debt they had no hope of servicing.

The mistakes made by the banks illustrate a failure to monitor their borrower and to structure their lending appropriately. A proper credit process would have:

- not rolled over the debt in 2014 and forced the company to take seriously sale options

- if debt was extended it would have been with security and with much higher margins

- kept the facilities much smaller, restricting Arrium’s ability to incur more debt

- implemented proper covenants so that the underperformance would have triggered a default event

- sold the debt in late 2014 or early 2015, even if a small discount to par was required.

The big four banks are now looking at a loss of 30-60% of their exposures ($75-150 million each) and an extended workout period. In my time in workouts I’ve seen many examples like Arrium, situations where it was obvious 12-24 months in advance of a crisis point that a loss was highly likely. Arrium showed again that the banks have been asleep at the wheel. At a time when everyone is focusing on return on equity, arguably the best investment return would be found by properly monitoring their existing loans.

Jonathan Rochford is Portfolio Manager at Narrow Road Capital and this article expresses the personal views of the author at a point in time. It is for educational purposes and is not a substitute for professional financial advice. Narrow Road Capital advises on and invests in a wide range of securities.

As with any article published on Cuffelinks, we welcome comments with a contrary opinion.