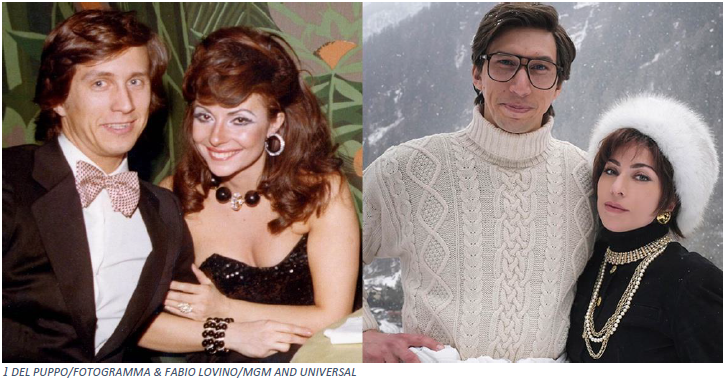

The crime drama movie released last year, House of Gucci, is Ridley Scott's controversial interpretation based on the true story of Patrizia Reggiani and her conviction for murdering her ex-husband Maurizio Gucci.

The prestige product manufacturer, Gucci, has seen the potential for negative publicity for its brand arising from the film and has asserted that it is a work of fiction. I have no way of knowing if the film is factually incorrect but, from 25 years of advising family business owners, I would say there is no doubt that there were disputes in the family.

In 1993, after one grandson, Maurizio, sold his inherited 50% interest in Gucci to the same investment firm he had brought in to buy up his relatives’ shares, there was no longer anyone from the Gucci family involved in running the firm. His lavish spending and lackluster management left the company in a parlous position when he finally relinquished control.

Maurizio would go from reluctantly joining his family firm to ruthlessly removing his relatives to execute his vision to save the company.

He was murdered on the steps of his office building in Milan in 1995. The film explains that his wife, Patrizia Reggiani, was sentenced to 29 years in prison for orchestrating the murder, and she was released in 2014 after serving 16 years. She could have been released even earlier but she turned down a work-release programme, reportedly saying, “I never worked a day in my life, and I don’t intend to start now.”

The movie ends with an inheritance dispute as often happens. In our experience, behind most such disputes there is family drama that could have been handled much better.

After her release, Patrizia was asked by paparazzi in the street why she hired a gunman to kill Maurizio rather than do it herself, she said, “My eyesight is not so good, I didn’t want to miss.” According to the new afterword in the movie tie-in edition of the book on which the film is based, the wife succeeded, against her two daughters who presumably wanted the inheritance, in her claim for a substantial annuity from the Gucci estate. In 2014, she said, “I still feel like a Gucci – in fact, the most Gucci of them all.”

The other family members did not fare much better. Another grandson, Paolo, filed for bankruptcy in 1993 while his father, Aldo, served time in prison for tax evasion.

Roberto, one of Aldo’s sons not depicted in the movie, went on to run a small leather goods business in Florence after selling his shares of the family company, and once said, “The Guccis were a great family. I ask forgiveness for all their mistakes. Who doesn’t make mistakes?”

I first came across this story in a book considering family succession by Alan Crosbie called 'Don’t Leave It To The Children'. Crosbie writes with authority being the fifth generation of an Irish newspaper dynasty. He writes:

“Guccio Gucci suffered from a bad sense of parental fairness. He had two sons, and in order to be fair to both of them, he divided his company equally between them: each son received 50% of the shares in the family firm. Now, that figure has a certain magic to it. The expression ‘They divided the business 50-50’ has a wonderful ring to it. Unless you’re one of those accountants or lawyers who has had to mop up the results of such an even split between family members.”

At Legacy Law, we are one of the mopper-uppers. The way to avoid family disputes is to have good communication, adequate preparation and helpful dispute resolution - by which we mean avoiding the civil and criminal courts.

Well-respected commentator on family business, Dennis Jaffe, recently opined:

“Major decisions were hard to make since the brothers were equal owners and it was never clear who was in charge. As in many families since biblical times, interpersonal dramas and sibling rivalry were dominant, and they were on course to disrupt a thriving business”.

The film ends with a note that acknowledges the company’s current leadership and that it has an estimated value of US$60 billion. It just has no family owners.

In the book, as Maurizio rises in the company, his own father Rodolfo tells his wife, “Once he gets money and power, he will change.” As humans, we all change but it is positive change that is required if families are to avoid falling victim to disputes and miss the opportunity to Be A Better AncestorTM.

If you have a business, ask yourself if you want to build one of the great business families. They are plenty of good and bad examples but the good ones do a lot more than rely on good luck and goodwill.

Have you simply left the shares equally to the children? Equality, without more governance, communication and consensus can leave a family business exposed to public ridicule, or worse.

Donal Griffin is the Principal of Legacy Law, a Sydney-based legal firm specialising in protecting family assets, and author of 'An Irish book of living and dying' (the first book in the 'Be A Better Ancestor' series). Legacy Law is not licensed to give financial advice and this is general information.