With company reporting season now behind us, we take a look at how the listed investment company (LIC) sector fared. The majority of LICs reported lower earnings for the six months to 31 December 2016, mainly due to lower dividend income. Some LICs, mainly those with a small cap-focus, experienced lower capital appreciation from their investment portfolios. The potential for lower earnings had been well-flagged by many LICs given the lower dividends from the mining, energy and retail sectors and ANZ Bank.

Dividends flat despite lower LIC profits

Despite lower reported earnings, most LICs reported good portfolio returns (pre-tax-NTA plus dividends) for the period with the S&P/ASX 200 Accumulation index up 10.6% for the six months to 31 December 2016. The average portfolio return for the large-cap focused LICs under our coverage was 7.8% while the mid/small-cap focused LICs produced an average portfolio return of 3.7%.

The apparent disconnect between the good portfolio returns from the large-cap focused LICs and the lower reported earnings reflects the fact that most, particularly the larger, long established LICs, report only dividend income and realised profits in the income statement. These LICs are long-term investors, so unrealised portfolio revaluations are not recognised in the income statement. Many of the newer LICs, particularly a number of the small-cap focused LICs, tend to hold investments for shorter periods and their reported earnings rely more on capital appreciation, with both realised and unrealised gains and losses reported through the income statement.

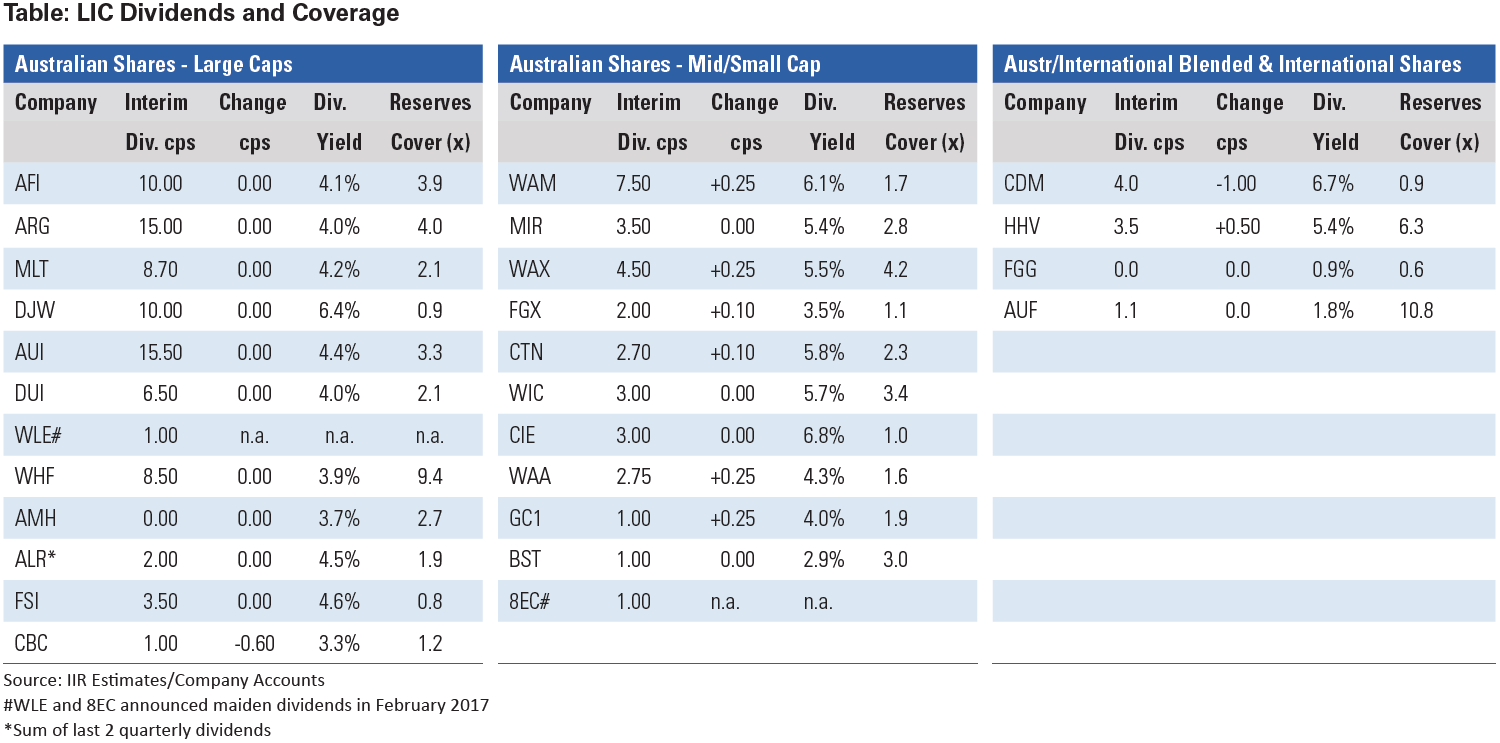

Given the trend of lower reported earnings, it was not surprising to see few increases in interim dividends. As shown in the table, all of the large cap focused LICs in our coverage held dividends flat, except CBG Capital (ASX:CBC) which reduced its dividend. A number of the mid/small-cap focused LICs announced modest increases in dividends. Amongst the LICs with an international focus, Cadence Capital (ASX:CDM) reduced its dividend, not surprising given relatively low profit reserves, while Hunter Hall Global Value (ASX:HHV), which has a high level of profit reserves, increased its dividend despite reporting a lower profit.

Update on dividend sustainability

In our August 2016 LMI Update, we discussed dividend sustainability and how this is a critical issue when choosing LICs. We mentioned that LICs that rely largely on dividend income for earnings are less likely to report losses during periods of market downturns, and therefore the dividends they pay to their own shareholders are likely to be more sustainable. However, if the companies they invest in are forced to lower dividends due to reduced earnings, then, depending on their own payout ratios, the LICs may also be forced to reduce dividends, or at best hold them at current levels. We have seen this occur in the recent reporting season, with the lower dividend income from portfolios resulting in flat dividend payments by the large-cap focused LICs. In our report we also noted that LICs with a greater reliance on capital appreciation were more likely to be forced to reduce or even stop payment of dividends in a sustained market downturn. However, with positive market returns this has not been the case over the past six months. Portfolio gains and reasonable profit reserves have allowed some of the mid/small-cap focused LICs to slightly increase dividends.

Whilst LICs need to generate profits in order to pay dividends, it is possible for them to pay out more than they generate in profits in a given year by dipping into retained profit or dividend reserves from prior years. So it is possible for LICs to smooth dividend payments to their shareholders by retaining profits rather than simply paying out 100% of earnings each year. The table above shows our estimates (based on the latest published accounts) of the number of years each LIC under our coverage (excluding those that don’t pay dividends) could retain current dividend payments without generating any additional profits. This is a good indicator of dividend sustainability when markets turn down. Coverage of one means that a LIC could maintain its current dividend payout for one year without generating any profit in the current year. There a number of LICs with dividend coverage of more than two years which means they are reasonably well placed in the event of a sustained market downturn.

Attractive yields remain but watch profit reserves

Despite the flat, or modest increase in dividends, the LIC sector still offers attractive yields for investors. We calculate an average dividend yield of 4% across the Australian share focused LICs with most LICs paying fully franked dividends. We think it likely that the LICs will experience stability in their dividend income over the next six months and do not expect to see many reductions in dividends from the sector. It is possible we may see modest dividend increases from some LICs.

It is important to watch management commentary for any indications of potential changes to dividend payments. We note that Djerriwarrh Investments (DJW), one the highest yielding LICs currently, has already said it expects to cut its dividend from 24 cents per share to 20 cents per share in 2017. Also, keep an eye on those LICs that have low levels of profit reserves as this could also be an indicator of a potential dividend reduction.

Peter Rae is Supervisory Analyst at Independent Investment Research. Extracted from IIR’s February 2017 LMI Monthly Update. This article is general information and does not consider the circumstances of any individual.