[This article uses data current as at 8 April 2020. The COVID-19 issue is moving so fast that the article’s relevance may change with circumstances. Some principles will prevail which might guide a risk-managed return-to-work strategy.]

Australia needs to get back-to-work. The tricky part is how to go about it. For example, the Government has enforced a 14-day quarantining of all arrivals and overseas travel is banned (with some special exceptions). These two provisions need to continue until all major foreign countries have minimal active cases of COVID-19. We must not be intimidated into stopping this too early by airline and travel lobbies. The major source of our cases so far is contact made outside Australia by returning travellers. We do not need the arrival of people to keep our economy going.

Strength of our health system

Having isolated the older population of people over 70, we should have some confidence that our unique universal health care system can build extra capacity and allow a risk-managed return-to-work strategy. This is subject to giving top priority to looking after our health care workforce and ICU and ventilator capacity. The Government appears to be well on the way to achieving this.

The ‘flatten the curve of cases’ has been a simplistic strategy to show the initial largely imported cases have been accommodated. The future course of locally-transmitted cases, however, remains a big unknown. It will probably take building a model of the virus in action in an isolated region to determine its characteristics in a typical Australian flu season.

Overseas experience in the UK and Italy almost certainly indicates a high level local transmission although data is not yet available. I have therefore focused on death numbers to imply the level of stress on health systems. Proportionate to these death numbers will be the much larger numbers (possibly 3 to 5 times) of admissions to hospitals, some of whom will have already recovered and majority of whom may still be in care.

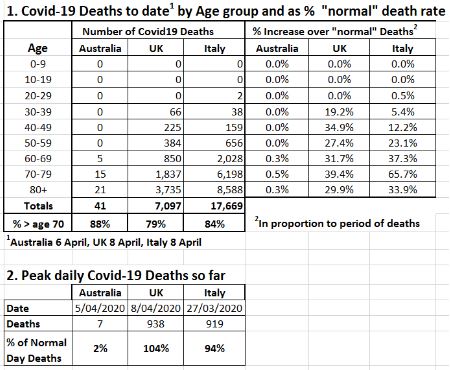

Table 1 below presents the latest data available (as at 8 April 2020) on the age distribution and other statistics of deaths in Australia, United Kingdom and Italy. It highlights the nature of the virus in other regions and small amount of data that we have to judge Australia's circumstances.

Some observations on the figures are:

- The percentage concentration of deaths in the over 70 age groups and the rationale for over 70s isolation is self-evident.

- The distribution of deaths in UK and Italy extend down into more younger age groups than Australia has experienced to date. A possible explanation is the number of the Australian deaths related to cruise ships and returning overseas travellers, who are often retirees. This suggests we need to build a database of the population with respiratory system risks (particularly under age 70) from a range of sources (Medicare claims, eHealth etc.).

- The numbers on the right-hand side show the deaths from COVID-19 as a percentage of 'normal' deaths which could be expected to occur (using for simplicity of calculation, Australian Life tables). Thus normal deaths plus COVID-19 deaths indicates the extra pressure on health system on average over the period.

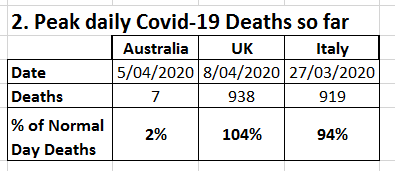

- The more exceptional case of health system peak stress might be indicated by peak daily deaths (to date) relative to ‘normal’ daily deaths. This is shown in the table below.

The back-to-work strategy

The top epidemiologists in Australia are well aware of the risk of Australian transmissions breaking out to extreme levels as displayed in the UK and Italy, if current restrictions in place are released. The Government is being advised by the Doherty Institute. The Director of the Institute, Professor Jodie McVernon, is (based on seeing her in forums) a very experienced epidemiologist with a clear awareness of risk of such a breakout and able to communicate advice forcefully.

A back-to-work strategy must be carefully risk-managed based on advice from expert epidemiologists. We also need to consider the human health risks of people currently staring at screens at home and in isolation and the businesses that are shut down.

First, the small business sector is the major employer of people of all ages in our communities. These people take greater financial and personal risks than most corporations contemplate. They mortgage their houses to obtain capital, and must survive in industries with failure rates of 40% or more in the first five years. An enforced government shut down for six months may mean that when they start trading again, half their clients have gone or will be severaly strapped for cash. The health stress here extends to family and future life prospects and needs consideration.

Second, another imperative to get people back to work is social. Many people derive their main social satisfaction from work mates and customers. Sadly, some men and women find time at work is an escape from relationship tensions in the home. This extends to concern about domestic violence risk.

Third, adolescent and young adults at high school and university face mental health issues which can quickly become catastrophic. The lack of social groups and peer support will be an increasing health risk.

The back to work strategy is therefore a judgement between, on the one hand, confidence of epidemiologists in the future behaviour of the virus in Australia versus the concern for population health of the unemployed and socially excluded. The limit of financial budget support is the time pressure to put the best minds available into action advising government.

The population needs to trust the difficult government decisions and balancing act.

Possible principles and frameworks for a risk-managed return-to-work and school

To allow (almost) everyone to go back-to-work and school will need a clear communication programme which enforces a reframed approach to isolation, risk management and social behaviour. This Includes the rational segregation of high-risk people who need continued isolation, operating as follows:

- Isolation to be required for all people over the age 70 (with extra social support) and anyone suspected of having COVID-19 and awaiting test results.

- Isolation to be required for all people (and school children and teachers) with significant comorbidity conditions (particularly respiratory) who have been shown to be in high-risk conditions associated with coronavirus. There may need to be some ‘conscientious objector’ isolation provisions for teachers who feel uncomfortable returning to classrooms.

With this in place, businesses would be allowed back-to-work and workplace social distancing requirements could be made case-specific or generally slightly relaxed. A permanent reminder on washing hands and encouraging people to stay away from others (and absent from work) if they get a cold or flu would ne required.

Some lateral thinking might be needed, such as for workforce segments which do not have a current open workplace. Converting foreign students to online courses and making them resident back home would take pressure off local casual employment options.

Like the engineers who stayed in the Fukashima reactor to stabilise it, it may take a brave, isolated region of Australia to take the first step so epidemiologists can learn from this before a major city attempts a back-to-work strategy.

Bruce Gregor is a Demographer and Actuary, and Founder of Financial Demographics. This article is general information only and does not consider the circumstances of any investor.