The failing financial position of China Evergrande Group, one of China’s largest residential property developers, has captured the world’s attention for fears of a broader economic and social fall-out. Property investment and related construction and appliance activity is a substantial contributor to China’s GDP, up to 25% by some estimates. Hence, the risk of a sudden collapse of Evergrande could threaten capital providers and home buyer sentiment leading to a downturn in property investment and the Chinese economy.

This could have far-reaching implications for the regional and global economy. The challenge is to understand the depth of the issues facing Evergrande, its industry competitors and the Chinese residential market.

Our global REIT portfolio has no direct exposure to the Chinese property developers, including Evergrande. We have long doubted the quality of the earnings and the strength of their balance sheets.

We stress that pontificating on the broader implications for Chinese central planning policy and the consequent outcomes of Evergrande’s collapse is a fool’s errand. Recall few experts predicted the U.S. subprime crisis, and countless pundits have been predicting the demise of the Chinese residential market for a decade. Notwithstanding, we have reached out to a broad range of interested parties to get a balanced perspective.

Chinese housing boom is over

Our channel checks support the view that the housing boom in mainland China is largely over. Having maintained a high-risk capital structure reliant on continued if not accelerated home price dynamics, Evergrande is a high-profile casualty of a changed dynamic and there will likely be others albeit likely not on its scale.

Evergrande is one of China largest property developers and ranked 4th in terms annual housing production. Whilst by itself Evergrande is not too big to fail, the broader consequences on the housing market, financial institutions and the economy are meaningful, particularly if it leads to the rapid collapse of many other highly leveraged players in the market.

Direct stakeholders include purchasers of unfinished homes, construction workers and building materials suppliers as well as its debt and equity investors. Equity investors and offshore bond holders should prepare for the worst, but they should not be shocked given Evergrande’s precarious financial position has been evident for some time.

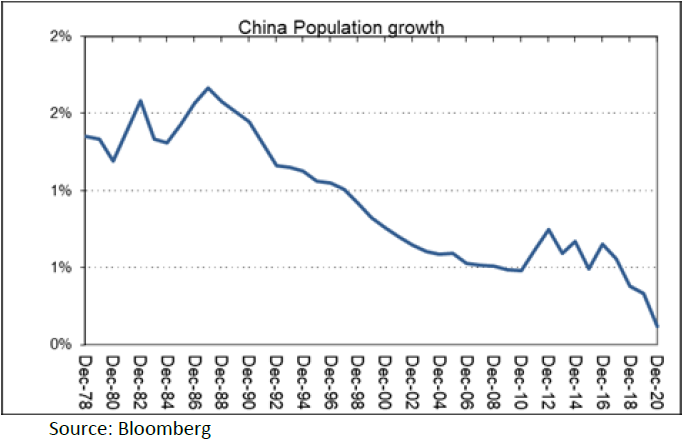

The Chinese Communist Party (CCP) has warned in the past 2-3 years that it is seeking to address some imbalances in the economy. Whilst part of the motive of the CCP is to curb the influence of large private enterprise and high-profile individuals, there also appears to be a deliberate policy to reign in escalating education and housing costs in an attempt to address low birth rates and stagnating population growth.

Specific to the residential property sector, President Xi Jinping is often quoted saying “houses are built to be inhabited, not for speculation”.

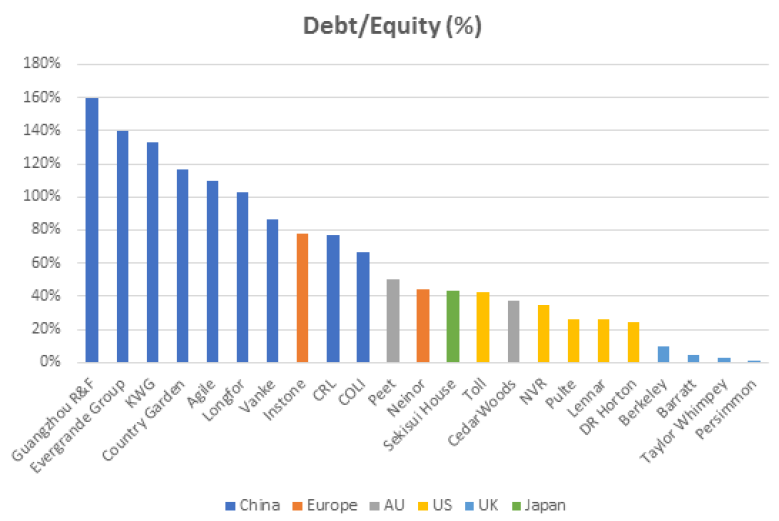

Buoyed by seemingly ever-rising land prices and a constantly growing economy, as highlighted in the chart below, Chinese residential developers have maintained higher financial leverage then their global peers.

Concerned about this dynamic, from a policy perspective, the Chinese Government had been tightening lending conditions for developers for some time – most recently initiating the ‘three-red-lines’ policy[1] introduced in August 2020 which imposes three specific leverage metrics targets on property developers. This tightening of lending conditions has been well telegraphed.

Indeed, policy tightening is a major contributing factor to the timing of Evergrande’s troubles, but principally because it was already in a self-inflicted precarious financial position as the graph below illustrates.

Global snapshot sample – Publicly-listed residential property development companies

Source: S&P Capital IQ

Not in the Lehman league

We do not believe the challenges facing Chinese developers and their lenders is likely to be a crisis on the magnitude of Lehmans. Whilst there are 'shadowy' recesses in the financial system, there is limited evidence of low doc NINJA (No Income No Job Applicants) type loans that riddled the US banking system in the lead up to the GFC.

Indeed, the Government has deliberately put in measures to forestall such a crisis. Stress testing conducted by sell-side banking analysts generally concurs that the Chinese banking sector should be able to manage various default scenarios for both Evergrande and the Chinese property sector more broadly. The Chinese banking regulator is directing banks to maintain liquidity to other property developers to avoid a broader loss of buyer confidence in developers’ ability to deliver.

Nevertheless, we acknowledge the CCP’s efforts to balance the economy could fail and wider contagion impacts depend on whether Chinese homebuyer confidence diminishes more broadly. This is accentuated by the way in which off-the-plan home buyers make progress payments throughout the construction phase in China, putting more risk on the home buyer when developers fail and are unable to deliver the completed project.

We will not be surprised to see the liquidation or significant restructure of Evergrande’s affairs but do expect it to be executed in an orderly manner, potentially with State-Owned-Enterprises called upon to assume responsibility for completing major works in progress.

Access to foreign capital is likely to be curtailed for some time so much depends on the Chinese banking system’s ability to fill any voids in order to reduce the extent of a housing slow down.

Crucially, the CCP has no motive to undermine the housing market, the populace has most of its wealth invested in residential and, as mentioned at the outset, it is a significant driver of the economy. Hence, we expect the Government will pull levers necessary to stabilise the market.

Residential affordability a global problem

The challenges facing China’s residential market in relation to demographics and affordability are by no means isolated. The collapse of Evergrande places pressure on Chinese policy makers to underpin property values whilst addressing affordability issues. We stress this is a challenge not confined to China as governments and societies around the world also face the challenge of how to manage residential affordability.

In terms of the broader global REIT sector, financial leverage is moderate, debt sources are diversified and debt maturities are well laddered. We see limited risk of a repeat of the GFC liquidity crisis which impacted the REIT sector. Our portfolio remains skewed towards exposures which have sound balance sheets, prudent management teams and healthy operating conditions where landlords continue to have pricing power.

Andrew Parsons is a Co-Founder and Chief Investment Officer at Resolution Capital, and affiliate manager of Pinnacle Investment Management. Pinnacle is a sponsor of Firstlinks. This article is for general information purposes only and does not consider any person’s objectives, financial situation or needs, and because of that, reliance should not be placed on this information as the basis for making an investment, financial or other decision.

For more articles and papers from Pinnacle Investment Management and affiliate managers, click here.

[1] The three red lines

- Liability-to-asset ratio (excluding advance receipts) of less than 70%

- Net gearing ratio of less than 100%

- Cash-to-short-term debt ratio of more than 1x

If the developers fail to meet one, two or all of the ‘three red lines’, regulators would then place limits on the extent to which they can grow debt.