If there was ever a market environment when quality stocks are expected to perform, we believe it is now. 2023 has marked the ‘first act’ of what life looks like in a high interest rate environment.

We have had a 13-year runway of varying degrees of capital allocation that paid little attention to fundamentals and valuation. Today, the Federal Reserve (‘Fed’) effective fund rate is 5.06%. In essence, there has been a rapid interest rate hike – 4.98% since March 2022 – which has exposed risk in financial markets.

While the SVB, US Regional Banks & Credit Suisse stories don’t require further explanation – their failures are arguably the first domino to fall in what will likely be a volatile period in markets. Leverage is everywhere in financial markets and capital markets are particularly fragile in what has become an increasingly difficult inflation battle.

Central bankers are fearful of inflation setting in and they therefore collectively seem more likely to keep interest rates higher for longer. Labour markets are structurally tighter than they have been for 20 years – and the risk that central banks overreach with rates hikes remains elevated.

What does this mean for equity markets?

Macroeconomic conditions heavily influence the performance of certain investment styles.

While Growth and Value stock approaches arguably have larger footholds in most institutional portfolios – we believe quality stocks are perfectly aligned for a sustained period of outperformance.

Our definition of Quality allows us to identify high quality businesses from across the market cap spectrum, companies with durable business models and sustainable competitive advantages, strong management teams, businesses with high ROE, stable earnings, strong balance sheets, and low financial leverage.

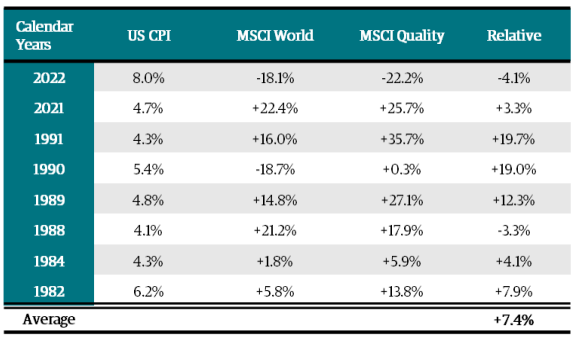

Over the last 40 years, the Quality investment style has performed well during periods of inflation. Since 1982, there have been 8 calendar years where US CPI has exceeded 4%. The MSCI World Quality Index has outperformed the MSCI World Index by an average of 7.4% in those years. The only two instances where the “Quality – Inflation” rule failed were in 2022 and 1988 when Quality lagged. What was interesting about that time period was the magnitude of the subsequent mean reversion. In the 3 years following 1988, Quality outperformed by an average of 17% p.a.

Market returns (in USD) during calendar years when US CPI exceeded 4% (last 40 years)

- Quality has outperformed by an average of +7.4%

- Quality has materially outperformed in 1990 and 1991

- Quality has lagged in only 2 out of 8 years

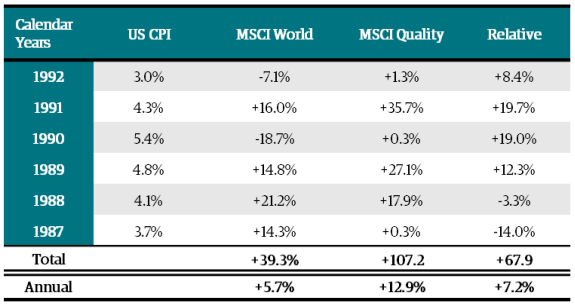

Market returns (in USD) during the 1987-92 period of sustained inflation

- Quality has outperformed by an average of +7.2%

- Quality has materially outperformed in the market drawdowns of 1990 and 1992

Sources: BAM, MSCI, Bloomberg Finance L.P. Indices used: MSCI World Index (MSCI World) and MSCI World Quality Net TR Index (MSCI Quality). Past performance is not an indicator of future performance.

We expect that markets are poised to reward quality stocks for the next few years.

We view value-companies as more vulnerable to sustained earnings weakness as they tend to exhibit a combination of leverage, poor pricing power and economic sensitivity.

While growth-companies have clearly dominated in recent times, except for 2022, they are likely more susceptible to earnings multiple compression. As at the end of March 2023, the MSCI World Growth Index was trading on a forward P/E of 23.8x which represents a 45% premium to the broader market. We would also argue that the large cap growth stocks which have dominated equity market returns in recent years are far less likely to repeat their recent earnings growth performance.

Quality over the longer-term

With the expectation of slowing global growth, peaking/falling inflation and the ongoing earnings downgrades, Quality and low risk companies are expected to be rewarded over Value.

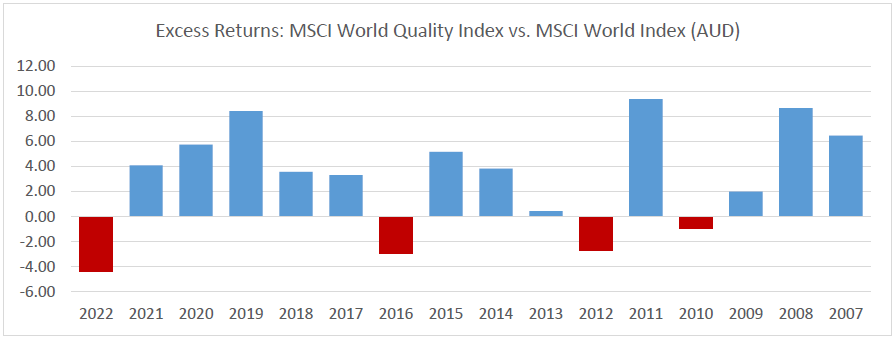

Looking back, since the start of the global financial crisis in 2007 through to 2022, Quality has outperformed the broader index in 11 out of the last 15 calendar years. The only years of underperformance were in:

- 2010 – underperformed by 93bps

- 2012 – underperformed by 274bps

- 2016 – underperformed by 297bps

- 2022 – underperformed by 436bps

On each of the occasions, excluding 2022, quality stocks have outperformed in the subsequent year.

Source: MSCI, eVestment, Bell Asset Management, as at 31 December 2022, shown in AUD

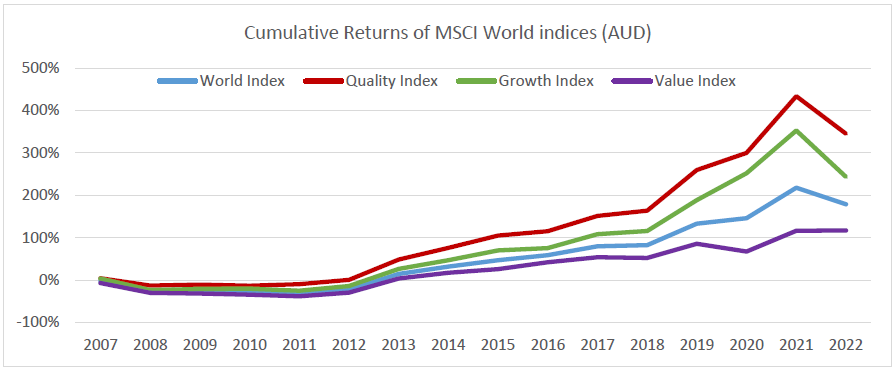

Furthermore, ‘Quality’ has outperformed the broader market and the ‘Growth’ and ‘Value’ factors.

Source: MSCI, eVestment, Bell Asset Management, as at 31 December 2022, shown in AUD

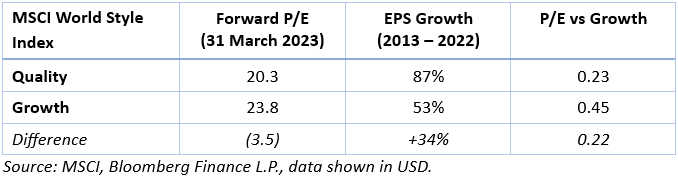

One interesting point is that the recent historical earnings growth of Quality is superior to that of Growth. From 2013–2022, the ‘Growth’ EPS growth stood at 53% vs ‘Quality’ EPS growth of 87%. We believe this apparent anomaly is that “forecast growth” is a key metric that MSCI uses to categorize growth stocks. Quality stocks on the other hand are selected by MSCI based on high ROE, stable year-on-year EPS growth and low leverage.

Another way to think about this is to compare the current valuations with actual EPS growth:

In short, our view is that paying a discount for premium growth, low leverage, and superior profitability is a compelling argument for investors to lift their quality stock exposure.

Stocks we like

Here are two stocks that we think have bright prospects:

SGS – Swiss-headquartered SGS is the world’s leading testing, inspection, and certification company. We owned SGS in the portfolio many years ago and have continued to follow it closely, along with a number of peers in the space. After a recent meeting with the CEO, we gained greater conviction in the long-term outlook and believe that fears over macro impacts are well factored into the current share price and valuation after a big drawdown. Approximately two thirds of the business is driven by regulation which means that revenues should prove relatively resilient regardless of how the macro environment plays out.

Neste – Neste is a highly innovative Finnish based energy company focused on the growing renewable fuels market. It has an extensive network of feedstock suppliers from which they buy animal fats, used cooking oils and other inputs to refine into renewable diesel. Neste has recently opened new refining capacity in Singapore from where they will supply SAF (sustainable aviation fuel) to the many airlines that have signed up to use their product which will help reduce carbon emissions. Neste is a leader in this rapidly growing market, helping them achieve strong margins, plus they have a track record of disciplined capital allocation. The shares currently trade on an attractive valuation, and we see strong upside over the medium and long term.

Ned Bell is Chief Investment Officer and Portfolio Manager, and Mahesh Fonseka is Head of Investment Specialists at Bell Asset Management, a Channel Capital partner. Channel Capital is a sponsor of Firstlinks. This information is not advice or a recommendation in relation to purchasing or selling particular assets. It does not take into account particular investment objectives or needs.

For more articles and papers from Channel Capital and partners, click here.