In consideration of further rate increases from the RBA, fixed income markets are largely ‘pricing in’ the current rate hike cycle. Whether markets are right or not is another matter and often hard to predict. They'll form a path on forward rates expectations based on the outlook from the RBA, view on local inflationary dynamics and global central bank activity.

Floating Rate Notes for a rate hike cycle

Typically, investors will favour floating rate notes (FRNs) over fixed coupon bonds during a rate hike cycle as the coupon on FRNs ratchets upwards as rates increase. Conversely, fixed coupon bonds decline in value.

As such, if the RBA doesn’t raise rates as fast as the market expects then the returns on FRNs would decrease. However, if the RBA raises rates in line with the market and/or higher even, then FRN returns are improved. With this uncertainty involved, it's worthwhile having a diversified portfolio across FRNs and fixed coupon bonds to act as protection when markets melt down. Either way, the outright yields available to investors right now can help to manage the detraction caused by inflation.

Ampol subordinated notes

Below we discuss the merits of an FRN by using the Ampol subordinated notes (ALDAU 0 12/09/2080) as an example of a high grade, BBB-rated security.

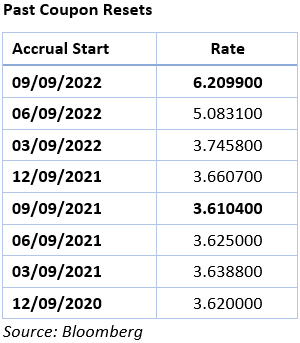

This bond pays a coupon of 3.6% above the 3-month Bank Bill Swap Rate (BBSW) and is callable in March 2026. Coupons are paid quarterly – in March, June, September, and December respectively. In September 2021 (only a bit more one year ago), this bond only paid a total coupon of 3.6%. However, the latest coupon (September 2022), ratcheted upwards to a significant 6.2%. The increase in coupon of around 2.6% from last year is purely a result of the 3-month BBSW being reset as rates increase. For an investor, holding this bond results in higher income from their fixed income allocation. Many investors have struggled to be able to drawdown this as an income stream for many years without eating into their capital.

Below is a table of the past coupon resets on the Ampol Subordinated notes (ALDAU 0 12/09/2080) as well as the current Australian Bank Bills Curve.

Australian Bank Bills Curve

Source: ASX

Currently, the market is expecting rates to reach 4% by June 2023 based on the 30-day cash rate futures curve. In June 2023, a coupon reset with a margin of 3.6% would give a return over 7.6% (3.6%+4%) [note 3-month BBSW usually trades at a premium to the cash rate]. This is a very healthy return for a BBB-rated security in only 8 months’ time.

Furthermore, the expected return on the Ampol subordinated notes looks very good into the future. The notes are callable in March 2026 so have an expected life of 3.25 years. The 3- and 4-year bank swap curve is currently sitting between 4.1%-4.3%. So based on 4.1% (3-yr bank swap curve) and 3.6% margin, this note may earn 7.6% (3.6%+4.1%) into the future. This is commonly referred to as the yield to maturity (YTM) on a security.

For context, one year ago, the 4- and 5-year bank swap curve was between 0.6-0.8%. The notes would have had an expected life of 4.25 years (being one year longer in life). Thus, the notes would have had a YTM of 4.2% (3.6%+0.6%) – 3.4% lower than the current YTM.

A reminder for investors, though, is that the credit risk of Ampol still needs to be assessed and monitored carefully.

Opportunities too in fixed coupon bonds

With all the focus on the cash rate, many investors do not always realise how much medium and long-term bond rates can move very quickly ahead of short-term rates. Nonetheless, short-term rates have now somewhat caught up, creating income opportunities not seen for decades. Although some investors might shy away from adding fixed coupon bonds given the current rate hike cycle, it’s worth acknowledging they currently provide an opportunistic entry point with many bonds trading at a discount to par. If we see a recessionary scenario play out, then we could see upside on those fixed coupon bonds as the curve should flatten and even invert (all-else-equal). Both in Australia and the US, markets are now pricing in rate cuts to start from the middle to late 2023.

Matthew Macreadie is Director of Credit Strategy at Income Asset Management, a sponsor of Firstlinks. To discuss this topic further and access corporate bonds please reach out IAM. This article is general information and does not consider the circumstances of any investor. Please consider financial advice for your personal circumstances, including eligibility for these investments.

For more articles and papers from Income Asset Management, please click here.