Much has been written about the fact that Australian retail investors’ portfolios are heavily weighted to Australian equities, despite the domestic market representing a small proportion of global equity markets. It is not difficult to understand the reasons for this home bias given the benefits of the dividend franking system in Australia, the difficulties of direct investing in foreign markets and currency risks associated with offshore investing. The universe of global equity investment opportunities is vast, but researching and selecting the right shares to invest in is a challenging task for the average investor.

Plenty of ETFs and LICs on the ASX

There are numerous indirect options for Australian investors to gain international exposure, in both managed and passive form. Many Exchange Traded Funds (ETFs) offer global exposures, usually as ‘passive’ investments designed to track the performance of a certain index, but increasingly in 'active' form. There are also a large number of unlisted global managed funds.

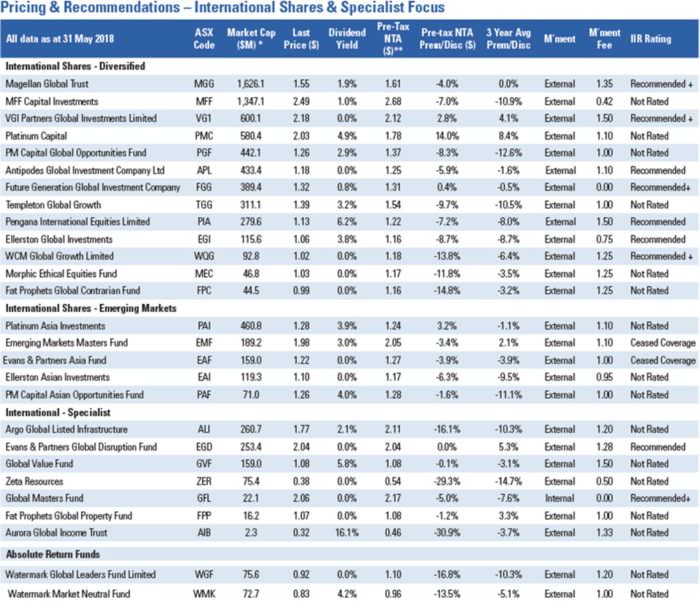

For investors looking for actively-managed international equity exposure with the benefits of ASX market liquidity, there are an increasing number of listed investment companies (LIC), listed investment trusts (LIT) and active ETF options. Our tables (annexed at the end, or see the full monthly report) list the 27 LICs and LITs which invest solely in international equities (excludes those with blended portfolios of Australian and international shares), and the 18 active ETFs with international share strategies. We do not cover or provide ratings for any of these Active ETFs, so our data is for information only.

In our tables, we split the 27 international-focused LICs and LITs into different categories according to their investment strategies. There are 13 LICs/LITs that have diversified global portfolios, five with emerging markets exposure and seven with specialist strategies. There are also two Watermark absolute return funds that are predominantly invested in global equities.

The majority of the international LICs/LITs are trading at discounts to pre-tax NTA and at the end of May 2018, the average discount was 7.4%. Platinum Capital (ASX:PMC) was the only LIC trading at a significant premium of 14.0%. It is unclear why so many of the international LICs/LITs are trading at discounts and, in our view, this provides a good opportunity for investors to add international exposure to their portfolios.

Recommendations on nine LICs/LICs

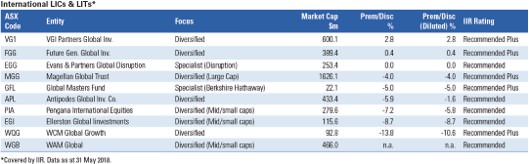

IIR covers nine of the 27 international LICs/LITs at present with more to come. The table below lists these nine entities showing premiums and discounts at the end of May 2018. We have also added WAM Global, which listed at the end of June.

Click to enlarge

For those LICs/LITs with options on issue, we have calculated an options-diluted premium or discount. There are only two LICs/LITs trading at small premiums. We view all the LICs/LITs on the list as suitable investments at current prices, although those at larger discounts represent better value. In our May 2018 LMI Monthly Update we wrote about WCM Global Growth (ASX:WQG) (formerly Contango Global Growth) which we believe represents good value at a 10.6% discount to option diluted pre-tax NTA (the discount has narrowed since the end of May).

For investors looking for a well-diversified portfolio of international equities, it is hard to go past Future Generation Global Investment Company (ASX:FGG), a fund of funds LIC. It invests in a portfolio of 15 funds managed by Australian fund managers who forgo management fees so that the LIC can make a 1% annual donation to charities. The charity donation is less than the fees that the managers would normally charge, with the difference being to benefit of investors in FGG. The managers also forgo performance fees, also to the benefit of investors in FGG. The portfolio is well-spread across geographic regions and has a mix of large, mid and small cap exposures. FGG shares were trading close to pre-tax NTA at the end of May.

Magellan Global Trust (ASX:MGG) is the largest of the global listed managed investments. It primarily invests in large international companies and has a high weighting in US technology companies. Pengana International Equities (ASX:PIA), Ellerston Global Investments (ASX:EGI) and the newly listed WAM Global (ASX:WGB) all invest in mid and small-cap shares, providing a point of differentiation. PIA also offers the benefit of a high, fully franked dividend yield.

This article provides a brief overview of the international LMIs (LICs) that we cover. For more details we encourage investors to read the individual two-page profiles in our Listed Managed Investments Quarterly Reviews.

Peter Rae is Supervisory Analyst at Independent Investment Research. This article is general information and does not consider the circumstances of any individual.

LICs & LITs which invest solely in international equities

Active ETFs with International share and security strategies