The Australian Industrial and Logistics sector entered the COVID-19 pandemic with strong property fundamentals – including a low national vacancy rate (2.2%), limited speculative development activity, relatively strong occupier demand (above 2.2 million sqm p.a. average), and growing capital appetite from a number of domestic and global off-shore groups (A$50 billion looking to be deployed).

According to CBRE, these underlying fundamentals will continue to drive the resilient performance of the Industrial and Logistics sector. In particular, the global structural e-commerce tailwind is relatively immature in Australia and is expected to further fuel the trajectory of growth. The positive outlook has translated to increased demand from investors, evidenced by the growing number of investors and advisers seeking Industrial and Logistics investments from Charter Hall.

The below are highlights from the CBRE report. If you would like to read the full report, please click here.

Capital markets

Australia’s Industrial and Logistics sector has consistently delivered comparatively higher average returns than those generated overseas and has shown low volatility of returns through the current cycle relative to other commercial property sectors. The sector is primed for growth in line with increasing consumer-driven online retail demand. The asset class returns will benefit from a shortage in readily available land supply and a growing demand for logistics and last mile distribution assets.

Australia’s Industrial and Logistics investable universe continues to expand. It currently equates to A$137 billion and is forecast to reach A$186 billion by 2025. This will mainly be driven by higher asset values and demand-led new supply.

Long term market fundamentals

The grocery sector is a significant and stable long-term driver of growth, and demand for Industrial and Logistics space is increasingly driven by major food logistics operators.

Major supermarket retailers contributed to a record 241,500 sqm of Industrial and Logistics floorspace demand in 2020. The online grocery sector will be a supporting factor for floorspace expansion, given online grocery is expected to increase dramatically from A$8.7 billion (or 20% of online retail sales) in 2020-21 to A$14 billion (or 26% of online retail sales) by 2024-25.

The Pharmaceutical Life Sciences sector growth will accelerate and contribute to demand for Industrial and Logistics property.

CBRE estimates the investable universe of the Life Science sector for commercial property currently totals A$13 billion and is forecast to almost double to A$24 billion by 2031. Australia is an appealing destination for occupiers in the life sciences space, due to an adaptive and innovative health care system, a skilled workforce, intellectual property protection, world-leading research institutions, a number of established and emerging precincts, and a range of government initiatives to bolster Australia’s sovereign capability.

COVID-19 has accelerated trends that were already

transforming the Industrial and Logistics sector.

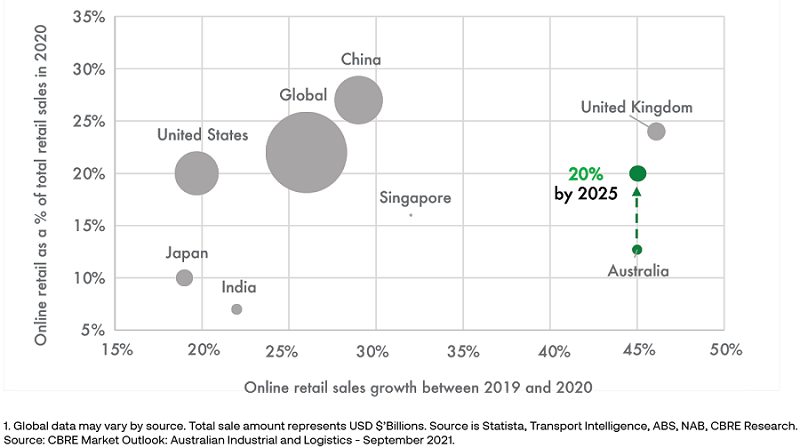

There will be a step change in demand as e-commerce growth will be transformational. Although COVID-19 has accelerated Australia’s e-commerce penetration rate from 9% in 2019 to 13% for the 2021 year to date, the current rate lags the global average rate of 22%. CBRE forecasts Australia’s e-commerce rate to reach 20% (or A$79 billion) by 2025.

E-commerce penetration rate vs. online retail total sale size and growth (2020)1

Sector growth drivers

The returns being generated from the Industrial and Logistics sector continue to be compelling for a range of investors in Australia and globally. The long lease nature of the sector with fixed rental reviews, coupled with a relatively low cost of debt continue to provide attractive yield spreads. With 10-year bonds now trading at 1.50% (as at 30 September 2021), historic relative spreads are still in a healthy state and likely to continue further capitalisation rate compression.

Occupiers holding higher levels of inventory will result in greater demand for floorspace. Spurred by supply chain disruptions from the COVID-19 Pandemic, CBRE expects companies which have moved to lean supply chains with low inventory cover will seek to increase their inventory levels to hold greater buffer stock and adequately service consumer expectations.

Floorspace net demand in Australia reached record levels in 2020 (2.9 million sqm). Over calendar 2021 to date, floorspace take-up has surpassed 2 million sqm (as at 30 June) and is forecast to reach another record year of take-up. Key industry sectors driving growth are transport, postal & warehousing, retail trade and manufacturing.

The Industrial and Logistics sector is projected to deliver real rental growth. CBRE forecasts the national Gross State Product (GSP) weighted Industrial and Logistics rent index will increase by 3.0% per annum from 2022 to 2029. In a low inflation environment, the sector has the potential to deliver real (inflation-adjusted) rental growth of between 1-1.5% over the next 10 years.

Outlook

CBRE believe the outlook for the Australian Industrial and Logistics sector remains positive and the sector will continue to remain an attractive asset class for investors in the medium to long-term. Charter Hall supports this view and will continue to grow Industrial and Logistics portfolios for the benefit of investors seeking access to the asset class.

Capital allocations will increase across the sector and continue to attract a high level of demand from domestic and offshore groups, resulting in further property yield compression across the sector.

The market fundamentals and sector growth drivers across the Industrial and Logistics sector remain increasingly strong, including:

- Longer lease structures with fixed reviews across a resilient tenant base.

- Increased occupier demand from a range of sectors that are forecasted for further growth (e-commerce, food logistics and manufacturing, transport and logistic operators, pharmaceutical life sciences).

- Limited speculative development activity.

- Higher rental growth forecasted over the next decade.

- Favourable long-term economic variables for Australia, with GDP growth, low cost of debt and population growth forecasted above most other mature economies.

Steven Bennett is Direct CEO of Charter Hall Group, a sponsor of Firstlinks, and Sass J-Baleh is Head of Industrial & Logistics Research Australia and Director of NSW Research at CBRE. This article is for general information purposes only and does not consider the circumstances of any person, and investors should take professional investment advice before acting.

For more articles and papers from Charter Hall, please click here.