Editor’s note: The peer-to-peer (sometimes called P2P or marketplace) lending market has many different operating models, and it continues to evolve as a competitor to banks. There is a question whether it has become more a source of loans for fund managers and large institutional investors rather than a genuine peer market. Here are two views on the local scene. An older article from Forbes magazine is linked here, entitled ‘The Disappearance of Peer-to-Peer Lending’.

Paul Wylie of Mason Stevens writes on P2P lending and John Cummins of SocietyOne responds.

------------------------------------------

Is peer-to-peer lending self-disrupting?

Paul Wylie

"The power of crowd sourcing always remains with the crowd, not the technological implementation." - Jay Samit

For businesses hyped as the great disruptors of the banking industry, peer-to-peer lenders have lately been doing a better job of disrupting themselves. In peer-to-peer lending (or debt crowdfunding), individuals lend money to other individuals or businesses at a fixed rate of interest. There is usually a formal structure to the debt repayment plan and a fixed return. On the peer-to-peer platform, investors can sometimes sell their debt to other investors prior to maturity and exit the investment.

Is P2P becoming B2P?

The peer-to-peer sector model is to provide a platform where borrowers and lenders can meet. An ‘eBay for loans’ so to speak that would benefit both borrowers and lenders by cutting out banks. Borrowers receive a lower rate and lenders a higher rate than at a bank. The peer-to-peer lender makes money by taking a cut on any loan.

The role of the peer-to-peer lender was to provide the platform or marketplace for loans. It was up to the lenders to decide who they lent to, i.e. who was creditworthy. But as they (and myself as an early seed investor in one of these) found out, most investors don't have the skills to work out what makes one client creditworthy and what makes another one not.

Due to this issue, the original incarnation of peer-to-peer lending has not lasted. The industry appears to agree that users' interests are best served by a ‘black box’ approach to arranging loans (which some call a 'big sausage machine'), rather than allowing individuals to pick and choose who they lend to. This provides simplicity and scale but means, for all their talk of disruption, peer-to-peer lenders are looking more and more like banks.

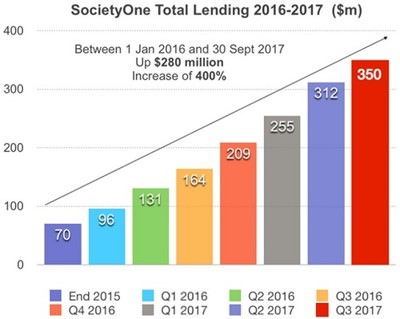

Australia's major peer-to-peer lender is SocietyOne. It currently has $350 million borrowed through its platform, and is growing rapidly. In fact, loan volumes in the first three quarters of this year have totalled $141 million so far, surpassing the $139 million in loans facilitated over the entire course of 2016, as shown below.

But whilst they have a strong and growing base of borrowers, they are struggling on the lender (investor) side. In October 2017, they announced they had a lender base of 320 individuals, with the remainder of funds being secured from ‘partner’ banks. In other words, they look a lot more like a consumer finance company as they borrow from banks to lend to individuals.

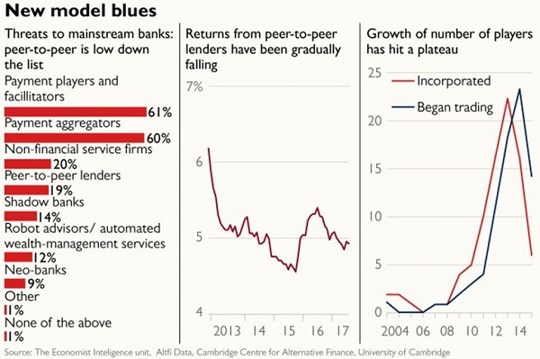

Maybe because they still rely heavily on banks for funding, banks do not see peer-to-peer lenders as a significant disruption risk. Or perhaps it is because the uptake has been so small (US peer-to-peer market is about US$4.5 billion). Either way, they are not the disruptor they originally thought or intended to be.

Paul Wylie is a Fixed Income Investment Strategist at Mason Stevens. This article is general information and does not consider the personal circumstances of any individual.

A response: Talkin’ about an evolution

John Cummins

The arrival of the digital peer-to-peer revolution on the global investment scene 10 years ago has been marked by one constant - rapid evolution.

Unlike other forms of fixed income investment, peer-to-peer lending, or as we should call it in Australia, marketplace lending, has had little, if no, time to stand still as the sector has swiftly moved from the margins into the mainstream of investor decision-making.

It’s a question of scale

I would certainly agree with Mason Stevens that the original concept of peer-to-peer, basically one-to-one lending or what you might describe as social lending, has changed, particularly when you consider that to be successful in financial services you need to have a degree of scale.

Few, if any, direct one-to-one lenders are going to achieve that rapidly, if at all, and certainly not in a timescale that will help borrowers, lenders, the intermediary and its backers achieve their separate albeit interlinked aims. These goals include obtaining a loan of a size that they want and can afford, returns that satisfy their investment requirements and revenue that generates cash flow to keep going and profits that produce worthwhile dividends.

To that end, most consumer and business-focused peer-to-peer lenders have accepted (and readily admit) the need to achieve balance in their respective funding mixes, either at the start of operations or someway down the track, to achieve that successful outcome.

In fact, one definition of success is to broaden your offering and appeal to as many investors as possible. This includes an individual looking to put in a small sum, a high-net worth person or SMSF investor searching for better yield or an institution, no matter their size. Most have a mandate to consider new forms of alternative and viable sources of fixed income.

Disruption in different forms

If that means we, as a rapidly-growing sector, are now disrupting ourselves, then we’ll plead guilty as charged!

However, I will on behalf of the industry take issue with a couple of Mason Steven’s more contentious claims. As our global peers in the US and the UK are showing after a decade or so of pretty decent business, they are doing a good job of disrupting the traditional banking sector.

And let’s be clear what disruption really means. Simply, it is to offer a real competitive alternative to those companies which currently dominate the financial and consumer markets to the detriment of the people that they are supposed to serve.

Here, companies like my own, SocietyOne, which launched the Australian version of the digital peer-to-peer revolution in 2012, are considered to be about five years behind in terms of growth and scale.

But based on what SocietyOne has seen since January 2016, where we have experienced a 400% increase in lending to take us past $350 million of total originations since inception, Australians are not only becoming more aware of marketplace lending but are beginning to embrace it.

That’s because we are providing that real alternative for both borrowers and investors alike, with lower interest rates on offer to consumers based on their individual credit histories and solid returns in the range of 7-8% to our funders given our technological and cost advantages in being able to connect the two. We also know that the big four banks are beginning to sit up and take note of the challenge we pose.

And talking of challenges, I think it’s only fair to contest Mason Steven’s claim that SocietyOne is supposedly ‘struggling’ on the lender side.

We can only have achieved the strong growth in providing more than $280 million of loans to borrowers since January 2016 - and now $150 million of that in 2017 alone - because of the support of our investor funders who match each dollar of demand with a dollar of investment.

We currently have $51 million of committed funding available to support further growth with more funders signing up by the week. The investor-funder mix includes fund managers, insurance companies, banks, wealth managers and of course individual wholesale-qualified investors.

And contrary to the assertion that we have moved away from funding by individuals, we started out five years ago with the deliberate intention of having such a broad mix. We can only run a marketplace efficiently if we have a diversified pool of lenders across the investment spectrum and any good funding manager will always look to diversify their funding risk where possible.

Witness our sourcing $100 million of the $350 million we have advanced in lending so far from 20 mutual banks and credit unions, who incidentally were the original peer-to-peer lenders. They see online businesses like SocietyOne as the digital inheritor of their proud history as pioneers in consumer finance.

So, Mason Stevens, nice try but wrong!

John Cummins is Chief Investment Officer of SocietyOne. This article is general information and does not consider the personal circumstances of any individual.