Phil Vernon is Managing Director of ASX-listed wealth manager, Australian Ethical (ASX:AEF), which was founded in 1986. It manages about $3 billion for over 45,000 clients, with two-thirds in a superannuation fund.

GH: Every person who invests with Australian Ethical has their own set of ethics. How do you reconcile yours with theirs?

PV: There are three main elements to that: one is the rigour of our process, two is disclosure, and three, we test our preferences with our clients.

Briefly on each. First, as much as ethics might seem like a subjective issue, we try to make it as objective, analytical and rigorous as possible. I equate the hierarchy of our process to the way a country operates. There’s a constitution, then legislation - which interprets the constitution in a rigorous framework - and then there’s case law.

In a similar way, we have an Ethical Charter that sits in our Constitution, with our high level principles. It includes 12 positives that we look for and 11 negatives we avoid. That's our starting point. Then we develop a set of ethical frameworks that focus on industry sectors and specific issues, with potential crossovers. For example, you might have animal welfare issues that affect different industries.

Many outcomes we look at must balance positives and negatives, so there's a lot of internal discussion which determines where we land on certain things. It's overseen by an ethical Advisory Committee, which is an internal management committee comprised of myself, the Head of Ethics and Chief Investment Officer.

That puts in place an objective standard in the way we view the world. It gives the investment team reasonable certainty on what they can look at. It allows enough flexibility so that if things change over time, and we have to adjust, we can have a robust discussion. That's why I pointed to legislation, which can shift, but we don't change on a whim.

GH: And second, on disclosure and transparency?

PV: Yes, on our website, we explain our position on 42 hot topics, such as on fossil fuels, climate change, animal welfare, human rights. You can see what we believe. We're very active on social media and we encourage people to offer their views. We invest a lot of resources and time in responding. Our ethics team will often give detailed responses and people are surprised by the responses they get.

GH: Yes, I’ve heard you have something like 120,000 social media followers. And the third element?

PV: Third, we check the mood of our community, including our members. We do an annual survey on ethical preferences to make sure that our judgments are in line with the general mood.

GH: Can you give an example of something that has changed over time, a community expectation that you’ve had to reconsider.

PV: The classic example is fossil fuels. One of our key ethical charters is environmental and we've always been strong on climate change. It’s the key thing that our members care about. If we go back a few years, we were a supporter of gas as a transitional fuel to help manage the climate crisis. A classic case of balancing positives and negatives, as we have a charter to lower emissions but we also have a positive charter about human happiness and dignity.

GH: So we have to transition away from fossil fuels in a just way.

PV: Yes, ‘transition’ has become a common term but we were debating that 10 years ago. We reached the point where, after a rigorous debate with lots of external experts, we decided the urgency to adjust for climate change was greater than we previously thought. And the technology to allow a just transition had improved dramatically. For a host of reasons, there was no remaining justification to support gas as a transitional fuel.

GH: If there's an analyst in your investment team who finds a company they like, what's the ethical check on that investment? Do they do the ethical screen before they do the research? Or do they find the company and ask if they can invest in it

PV: It’s a bit of both. The frameworks are done and we have a reasonable assessment of the investment universe, but there's still a lot of bottom-up identification of companies. We don't do 100% screening of the market up front.

GH: Do you think investors give you money for ethical or investment performance reasons?

PV: An outcome of our annual survey is that we categorise our investors, and there are four broad categories. First group we call ‘Highly Ethical’, where ethical decisions are the dominant reason for investing. They're willing to compromise on performance or indeed, whatever market or product they are in, ethics comes first. That's about 10% of people.

Then there's a broader category covering about 40% of people which we call ‘Ethical Action Takers’ where ethics is a strong driver but they look at quality and performance as well. There are two sub-categories in there: people where ethics is the dominant driver and another where performance dominates.

And then there’s a bunch of people where ethics isn’t really a driver at all.

Historically, we've come from people whose dominant decision was the ethics, and they were probably willing to compromise. But it’s changing, and our members are mainly people who want the ethics but not with a compromise on performance.

GH: All fund managers now talk about their ESG (Environmental, Social and Governance) principles. Do you think that the ethical side, which has been part of your DNA since the start, is now less of a competitive advantage than it used to be?

PV: No, there’s a distinct difference. ESG as a philosophy still puts the financial decision as the primary driver. The ESG issues are relevant only where they can demonstrate improved company performance, They are an input to the investment decision.

Our philosophy is quite different. Our ethical conviction exists in its own right, but our belief is that you can make that decision and not compromise long-term performance. So, yes, there’s more competition in that space, but the conscious consumer recognises the distinction.

GH: How do you hire staff? When you're interviewing someone, they must try to interview well and tell you about their ethical values.

PV: It's a really important point. We want a culture where people actually live and breathe the values that we stand for. It's always a judgment but it is an explicit part of our interview process.

GH: What do you ask them?

PV: We ask people to talk about things they’ve been involved in, what they have an interest in, and we allow them to elaborate. One of our corporate values is authenticity, so we search for the authenticity in the answer and sometimes you don't get it. Often, it's obvious that the person is telling us what they've practiced in their response. You can pick it.

GH: There's a lot of debate in the industry about why fees don't fall as funds under management grows, as fund managers achieve scale. How have you coped with that issue in an ethical business with responsibility also to shareholders?

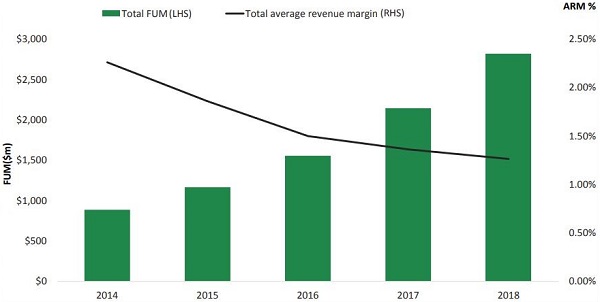

PV: We have a distinct philosophy of sharing the benefits of scale with our customers. You can see how our fees have come down in the last five years. We used to be an average fee margin of about 2.2%. We’re now down to about 1.2%, so we’ve given 1% back to our customers as we've grown.

(Ed. Phil showed me this chart where the black line shows the average revenue margin falling since 2014 against FUM).

PV: I wanted to mention that I read your book (Ed. ‘Naked Among Cannibals’, published in 2001, about failures in the way the banking system operates) many years ago. It was around the time I was reading a number of seminal works that ultimately led to me being here, challenging what was wrong with the normal corporate model, and your book was a master at calling a lot of that out.

GH: Thanks. And 20 years later, we had a Royal Commission.

Graham Hand is Managing Editor of Cuffelinks. Australian Ethical is a sponsor of Cuffelinks. This article is general information and does not consider the circumstances of any investor.

For articles and papers by Australian Ethical, please click here. For a specific example of how Australian Ethical invests, read this article by Tim Kelly, Fixed Income Manager.

This article is part of our Interview Series with fund managers and leading executives.