A Cuffelinks reader has asked about the options and opportunities for the younger generation to financially assist their parents. He says:

“People in my situation would be curious about tax-effective ways of giving money to parents:

- Any tax schemes (such as spouse contributions) applicable between parents and their adult children

- Centrelink implications of any strategies

- Ensuring that in the event of early death/TPD of an adult child, that parents receive some or all of the insurance/inheritance/estate payouts regardless of the marital status of the child.

Using myself as an example, let’s say I die – my understanding is that my wife would receive all of my assets and any insurance payouts as she is my spouse. However, my wish is that my mother, father and wife each receive an equal share of my wealth if I die early. How do I ensure this?”

This question is not addressed much in Australia as it’s usually the other way around with parents helping out or passing on wealth to their adult children. However, this reader is Asian where the younger, working generation is pulling out of poverty and gaining affluence, so more people will want or need to assist financially-strained parents. Please note, I only refer to Australian laws for the purposes of this article.

There are no specific strategies or tax-effective schemes that I can think of to gift money to your parents. Tax is not payable on gifts either by the receiver (the parent) or the giver (you). Of course, if you need to sell assets to make the gift, then capital gains tax could apply.

It is probably the estate planning and Centrelink effects that are more important than the tax issues in most cases.

An important starting point would be to determine the reason for the gift. Is it to help with everyday expenses, to give them a roof over their head, to buy a specific item such as a car or a holiday, to provide an income stream or to pay for aged care?

Next, ask what should happen with the money or gift if or when they die? If you want to ensure that it flows back to you or to your beneficiaries such as your spouse and children, then this should be provided for in your parents’ will.

Buying your parents a home

Joint Tenants

If you buy your parents a home and want to retain some control, one option is to buy it in joint names with you as one of the owners. This means it is held by each of you jointly and equally and does not form part of your parent(s) estate, so long as they predecease you. On the death of one joint tenant, the surviving joint tenant(s) split the shares equally. If there’s only one other tenant, they inherit the whole share.

In theory this means that you will own the asset entirely upon the death of your parents. However, if you predecease one or both of them, your share goes to them and you have lost control. There is no guarantee that it will end up back in your estate.

From a Centrelink point of view, your parents will be treated as ‘homeowners’ and the property will be exempt from the Income and Assets test.

Owning the property yourself

Buying a home in your own name and allowing your parents to live there rent free would provide more certainty in terms of where the asset ends up.

Centrelink would treat your parents as ‘non-homeowners’ which imposes a higher Asset Test threshold than homeowners. The property is not assessed as an asset of theirs.

On balance, from both an estate planning and Centrelink point of view, it may be best to own the house yourself rather than buy it in their name, however be aware that if you have borrowed to buy the house, negative gearing benefits may not be available as you are not receiving market rate rental income from the property.

Gifts and paying expenses

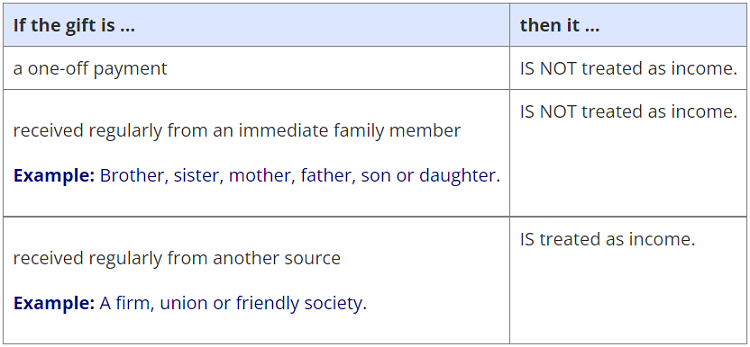

A simpler way to help out may be to give occasional gifts or pay their ad hoc expenses from time to time. From the “Guide to Social Security Law”:

Buying a gift such as a car in your parent’s name will be treated as an asset by Centrelink/DVA.

Paying for aged care

It is not unusual for family members such as adult children to pay for their parents’ accommodation costs in an aged care facility. These facilities charge an upfront amount called a Refundable Accommodation Deposit (RAD) often amounting in the hundreds of thousands. Whilst paying this RAD for a parent won’t affect their age pension, it may result in them paying higher ongoing fees in the facility known as ‘means-tested’ fees as the RAD is counted for the calculation of this fee, so take that into account.

Your early death

Now to briefly address the final question of distributing wealth to parents in the event of your early death. The first step is to make sure you have an up to date will. If you have a will and then get married, the will may be invalid so make sure it is updated after marriage.

Take care here. If your wife and family have not been adequately provided for, there may be grounds for a Family Provision claim. In the drafting of your will, make sure your wishes and the reasons for them are very clear, and ideally you should explain the context to your spouse and children.

Insurance and superannuation payouts are generally dealt with by beneficiary nomination forms rather than the will. Unless your parents are considered your ‘dependants’ under both the superannuation and tax laws, it is generally more tax effective for your spouse to receive your super balances.

It’s best to seek advice if looking to provide substantial financial assistance to your parents. There are other important issues which we will explore in a subsequent article.

Alex Denham is a Financial Services Consultant and Freelance Writer. This article is general information and does not consider the personal circumstances of any individual and professional advice should be obtained before taking any action.