It is a question most working Australians face – when is the right time to retire? When do we punch that time card for the last time and make our farewell speech, thrilled to be stepping into the world of retirement leisure ? Well as with many decisions, it is complex, personal, and hopefully, voluntary. Finances are an important component but non-financial elements such as health and work enjoyment are also vital. How these elements are weighed up depends on personal preferences.

Benefits depend on income level

From a financial aspect the benefits of deferring retirement differ across the population, largely depending on income levels. To explore this further we need a measure of retirement outcome. This in itself is a somewhat controversial area. It is common to use a replacement rate measurement. This measures the retirement income (age pension, drawdowns from an allocated pension, and payments from income stream products) as a percentage of pre-retirement income. Treasury advance this gross measure further by using an expenditure replacement rate which takes into account taxes paid and savings made; essentially it compares what we have available in retirement as a percentage of our pre-retirement expenditure levels. I concur with Treasury’s approach.

If we defer income there are two somewhat obvious but important financial implications. The first is that we do not draw down on our superannuation savings. The second is that we actually make further contributions to our super accounts. The net effect of this is that instead of beginning the process of drawing down on our retirement savings account for the rest of our lives we actually add to our savings and then when we do retire, we are drawing down on those retirement savings for fewer years. The financial impact of this deferral process will differ across households, largely based on income levels. For lower income households the age pension will make up a large part of retirement income, whereas higher income households will be relying more on their own savings to fund their retirement. It is higher income households who experience a more substantial improvement in retirement outcomes by deferring retirement.

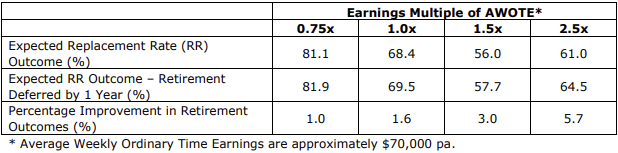

The exact effect on financial outcomes is unknown. Why? Well simply put we do not know our financial outcome. There are many sources of uncertainty the most significant being variability in real investment returns and age of death. However we can estimate the impact through using simulation. I undertake such calculations in an academic paper I wrote in 2011 titled “Variability in the Projected Financial Outcomes of Australians.” The results are summarised in the table below.

As we move across the table we move from low income to high income levels (based on a multiple of average weekly earnings (AWOTE). So 1.0x means a household on average earnings).

The last line in the above table represents the annualised expected improvement in replacement rate outcomes. It is clear that retiring is a more financially important decision for higher income households relative to lower income households. For example, someone earning $175,000 a year can improve their retirement outcome by a healthy 6% by delaying retirement only one year.

Treasury undertook similar analysis as supporting information for the Henry Tax Review. The numbers are not exactly the same (we do not know all the assumptions and details of Treasury’s modelling) but the theme is consistent that deferring retirement increases expected replacement rate outcomes and that the increase is larger for higher wealth households. This forms part of the reason Henry recommended changing both the age pension eligibility age and the superannuation preservation age to 67.

Permanency of retirement

An important related issue is the permanency of the retirement decision. Is it possible to return to work once one has retired? This represents flexibility which could prove valuable if financial hurdles are experienced early in retirement. While Dame Nellie Melba and John Farnham have been able to make countless comebacks and farewell tours, it is generally not as easy for most people to re-enter the workforce. This will differ by occupation and characteristics of employers and the retired potential employee.

However retirement is not just a financial decision, though the finances are very important. A very important aspect is health. Health and mobility may restrict one’s ability to travel in retirement, be an active grandparent, and enjoy an active retirement lifestyle in general. Say at 65 someone believes they only have 10 active years left before they anticipate switching to a less active lifestyle. Then the decision to defer retirement by a year represents giving up 10% of their expected active retirement years. That is a big issue to weigh up. Imagine the frustration of having the retirement income stream to support an active retirement lifestyle only to find the body is not willing. Think of this as a form of regret risk.

Of course this article frames work and leisure in a black and white format: work as dutiful and retirement as leisure. Much of the academic literature reflects this same notion. However it is possible to enjoy and derive leisure from work. If so this may make the decision to defer retirement an easier one – why give up something enjoyable which provides an income? As Nobel Laureate Robert Merton said on the decision to defer retirement:

“Look at how much cash it would take to generate what you generate yourself with your own human capital. And if you generate that cash by doing what you like to do, rather than hitting balls around a golf course, you have a good deal.”

This highlights the merit of actively positioning to have the ability to extend a working career as a conscious choice. This obviously requires foresight, which may entail the explicit decision to seek further education or change career paths. And of course some good luck in the form of a few career breaks would not go astray.

The message is clear. If you are close to retirement, consider your finances, health and retirement lifestyle objectives. If you are younger, focus on a career which you enjoy and create some flexibility around your retirement decision.