The fixed income world is beginning to undergo a multiyear transition as monetary accommodation and government spending across key economies drive higher near-term economic growth rates. The result could be a shift to higher real rates as output gaps narrow, as well as moderately higher but stable inflation.

In our opinion, this bodes well for risky assets, but will likely be accompanied by increased volatility and changing correlations.

Investment implications are quickly changing

For the past dozen years since the GFC, the overall environment for fixed income investors has been largely unchanged. Global growth has been sluggish across the developed and emerging markets. Central banks have unleashed a range of programmes aimed at supporting growth and financial assets. And fixed income investors have been persistently rewarded for positioning for low nominal yields, low real yields and a low-inflation (or even disinflationary) environment.

Whether it’s government bonds, credit instruments or even trends in the equity markets, these powerful trends in yields and inflation have significantly influenced the return outcomes of a vast swath of financial instruments.

This backdrop, to which investors have grown accustomed, is quickly changing, and we think investors need to position for a different and more complex environment. In our view, this is not a one-quarter or two-quarter shift, but likely the beginning of a multiyear transition to a different fixed income world.

What characterises this new environment?

It’s continued aggressive monetary accommodation, coordinated with remarkably high fiscal spending across a range of key economies, that will drive substantially higher growth rates over the near term. For fixed income investors, it means a transition to higher real yields as output gaps narrow globally.

We expect significantly more volatility around real yields in the coming quarters and years than we’ve experienced in the recent past. Intuitively, that’s due to uncertainty about whether this higher fiscal spending will drive quasi-permanent higher growth rates, or whether growth fades as fiscal stimulus eventually fades.

Real yields in perspective

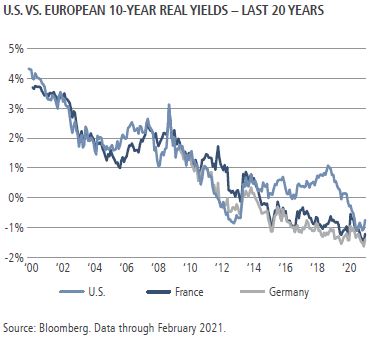

As the chart below highlights, developed market real yields have been in a constant decline over the past 20 years, with acceleration lower after the financial crisis and then again in response to the COVID crisis. Relatively weak growth across the global economy has been the primary driver.

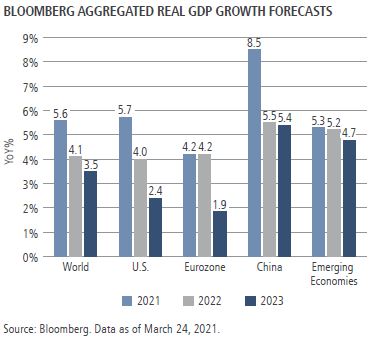

Markets currently appreciate that the growth outlook for 2021 will be strong given the reopening of economies and pent-up demand in many services sectors. However, we think investors under-appreciate how strong the growth trajectory could be after this year. Although declining, fiscal stimulus should support major economies well into 2023. Household savings rates are relatively high and will drive continued consumer spending. And, as consumption patterns change as some forms of work-from-home become permanent, we expect multiyear adjustments toward higher goods spending.

As the chart below highlights, this should all result in significantly above-trend growth in the three major economies not only this year, but over the next three years.

What does a multiyear period of higher growth rates imply for markets?

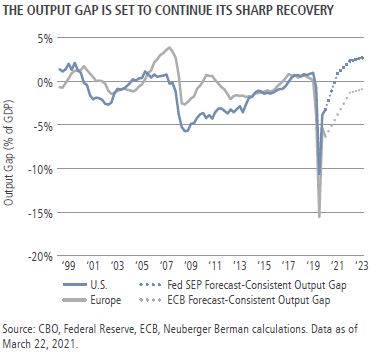

We are entering a 'period of transition', where strong growth will help close output gaps across the world, and where very accommodative central bank policies will increasingly feel different given these higher growth rates.

For fixed income investors, this should translate into a period of structurally higher and/or rising real yields, reflecting the more persistent and stronger economic backdrop.

We have three key conclusions about the emerging transition to higher real yields.

First, of all the factors that can impact the appropriate level of real rates, we expect that output gaps - or realised growth relative to potential growth - will be the main driver of equilibrium levels. As highlighted in the chart below, this analysis points to continued and sustained upward pressure on real yields in the coming quarters as aggressive policies continue to drive above-trend growth rates.

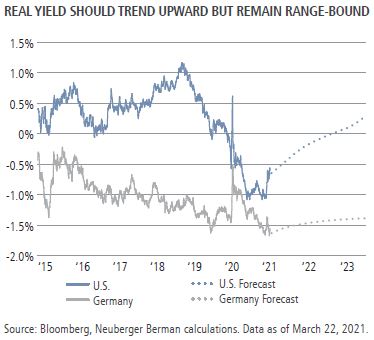

Second, based on our expected evolution of fiscal policy, monetary policy and expected growth, our 'fair value' view for U.S. and German 10-year real yields at the end of 2021 is -0.20% and -1.45%, respectively or approximately 30 basis points higher than current levels (see chart below).

Third, we expect risk assets to perform well in the intermediate term despite rising real rates. If a rise in real yields is exogenous and driven by a one-off tightening of financial conditions, like the taper tantrum of 2013, risk assets have tended to fare poorly. But if real yields are going up because of stronger growth and closing output gaps, it is generally supportive environment for risk assets.

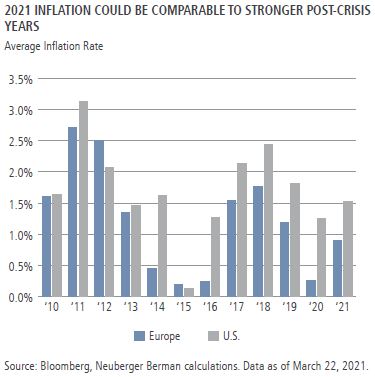

In addition, just as we are transitioning to a higher real-yield environment, we are also transitioning to a higher realised and expected inflation environment. Perhaps the most significant recent change is credible central bank shifts toward conducting policy explicitly to achieve this outcome. Referencing the chart below, we expect inflation rates to return to levels seen in some of the stronger years since the GFC.

This transition to higher real yields and higher inflation rates poses two main risks to markets and economies. We don’t think these issues surface in 2021, but believe it’s not too early for investor consideration.

- Rising government bond supply versus growth sustainability. Expanded deficit spending in the U.S., Europe and China is driven by the premise that accelerated fiscal stimulus can kickstart economies into higher and more sustainable growth rates. If this spending has low or negative multipliers to growth, the risk is an environment of upward pressure on yields without higher growth.

- Rising term premiums. Central bank purchase programs, primarily in the U.S. and Europe, have helped push government bond term premiums to low or even negative yields. Whenever these programs begin unwinding—we do not expect this in 2021—balancing the positives of a stronger growth environment with rising term premiums will likely introduce a different type of volatility into fixed income markets.

Finally, it’s worth highlighting the risk of increasing global divergences. Europe and certain emerging markets may lag in the coming global recovery, particularly versus the U.S. and China. This may result in a more disjointed yield environment globally than has been typical over the past few years, and create opportunities for global investors.

Revisiting our 2021 fixed income themes

Key market themes we identified at the start of 2021 remain intact. With the market movements in the first quarter, we slightly update our views.

- Earn income without duration. This theme was a key driver of relative returns in the first quarter, as short-duration income sectors such as high yield, bank loans and collateralised assets delivered higher returns than other fixed income markets. We expect continued outperformance on both a relative and absolute basis from these areas. However, with the rise in interest rates in the first quarter, tactical opportunities have emerged in intermediate- or longer-duration sectors, such as fallen angels and rising starts in the non-investment grade markets, BBB rated securities in the investment grade market, and emerging market sovereigns.

- Position for rising inflation. We expect continued increases in inflation breakeven rates, driven by the U.S. markets. We continue to believe that emerging market currencies are also attractive expressions of a higher inflation theme, although volatility will remain relatively high as U.S. growth expectations rise.

- Sector and issue selection will drive returns. With relatively tight credit spreads across markets, sector and issue selection will remain key drivers of returns across fixed income. We continue to construct portfolios with an emphasis on secular winners (sectors like telecommunications and media), but are finding attractive opportunities in more cyclical exposures such as commodity-focused companies or countries.

Ashok Bhatia is Deputy Chief Investment Officer for Fixed Income at Neuberger Berman, a sponsor of Firstlinks. This material is general information and does not constitute investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. You should consult your accountant or tax adviser concerning your own circumstances.

For more articles and papers from Neuberger Berman, click here.