At a headline level, the recent reporting season provided several reasons for optimism with Corporate Australia beginning to successfully adjust to the more subdued growth environment.

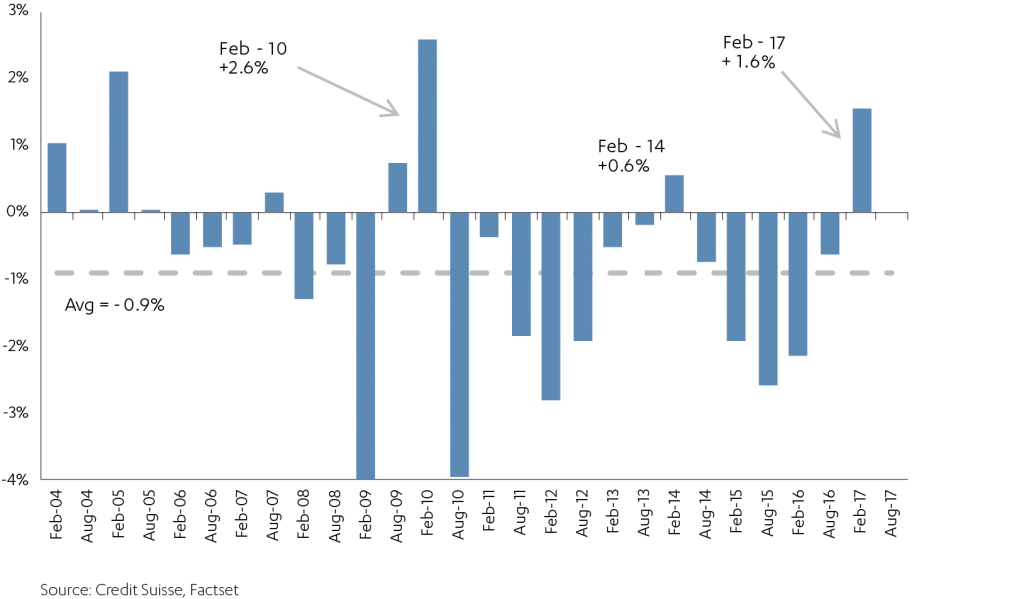

At first glance, the results do not deviate too far from historical norms: 22% of companies upgraded while 32% downgraded which, while better than last season, is broadly in line with the long-term average. More telling is the change in aggregate expected earnings for the S&P/ASX 200 in FY17, which increased by 1.6% as a result of reporting season. While this may not seem like much, as the following chart shows, it is the best result since February 2010 and stands in stark contrast to the average downgrade of -0.9% that follows reporting seasons.

S&P/ASX 200 EPS upgrades / downgrades for FY17

The upshot is that the S&P/ASX200 remains on track for its first financial year of positive EPS growth since FY14, with upgraded expectations now at 16% growth for FY17, following -13% in FY16 and -3% in FY15. This is a remarkable turnaround, given the market expected 8% EPS growth for FY17 as recently as August 2016.

Resources resurgent

The caveat to all this positive momentum and earnings upside is that it was largely the result of a resurgent resource sector. Soft data at the end of 2015 saw the Chinese authorities administer an economic adrenaline shot via a credit injection and a renewed focus on infrastructure spending in early 2016. The result was an uptick in demand for resources which, in conjunction with supply disruption and discipline in iron ore and coal, have seen commodity prices soar. This, in turn, has seen a surge in cash flow and earnings for the miners, with their operational leverage enhanced by several lean years of cost cutting and, in some cases, near-death experiences. The turnaround has been spectacular, with cash flow funding debt reduction, dividends and buybacks, and share prices have surged accordingly.

We would caution against excessive exuberance regarding the turnaround in earnings; it is not broad-based and, while resource companies have been adept in controlling costs and capex, it has been the exogenous factor of commodity prices which has driven their success.

Industrials less spectacular, but significant

Beneath the turnaround in resources there is something perhaps more surprising and potentially more significant: the market ex-resources (ie the industrials) did not, on the whole, disappoint.

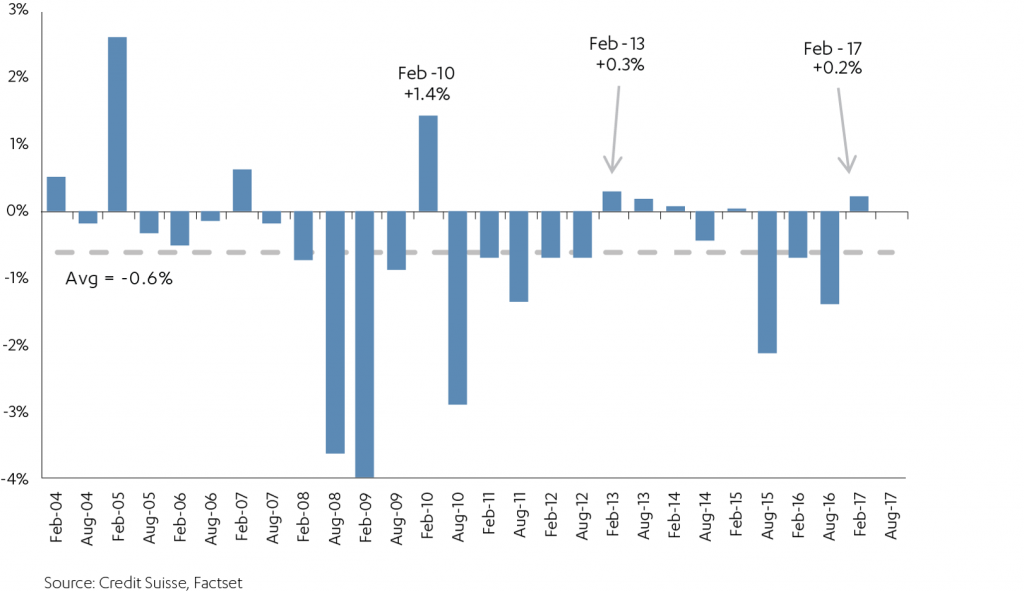

The S&P/ASX 200, once commodity companies are removed, saw earnings expectations increase by +0.2%. Again, this does not seem much, but needs to be considered within the context of the average historical downgrade of -0.6% and the fact this is the best result since 2010.

S&P/ASX 200 ex commodities EPS upgrades / downgrades for FY17

Cost discipline behind earnings upgrades

Earnings quality among the industrials was mixed. For all the nascent signs of optimism in this reporting season, we remain in an environment of muted revenue growth for most industries. Where companies beat expectations in this season, it was often a result of delivering surprisingly high levels of cost reduction.

Qantas provides a salient example. While it reported a 7.5% contraction in underlying pretax earnings due to the combination of softer domestic demand for much of 2016 and an increase in international industry capacity, the stock actually did well, as earnings were $25 million ahead of the market consensus. Cost discipline has allowed QAN’s earnings to be more resilient than the market expected and enabled them to continue to return capital to shareholders.

Declining earnings quality drives underperformers

If cost discipline drove earnings upgrades and outperformance within industrials, any signs of declining cash flow or rising capital intensity drove the season’s underperformers. There was an uptick in companies relying on a range of accounting measures in order to hit earnings targets, such as the inclusion of one-off profits, release of provisions, changes to depreciation and amortization policies, or changes in treatment of working capital. It is possible to discern, in the underperformance of previous market favourites who showed signs of deteriorating quality, a growing focus on cash flow, rather than accounting earnings.

This highlights the need for investors to go beyond headline reported earnings to understand the underlying profitability of the business. Ultimately, accounting earnings can be manipulated, to an extent. Cash flow cannot, and often offers a far more accurate gauge of a company’s true health and fortune.

Look for strong strategy and ability to execute

All in all, Corporate Australia remains in reasonable health, underpinned by strong cost discipline. Management remained focused on capital management in preference to further capex and increased dividends and buy backs should serve to help support the equity market.

We remain mindful that we are in an environment of significant industrial disruption due to globalisation, developments in technology and changes in regulation. The combination of low revenue and industrial disruption sorts the wheat from the chaff in management quality. Only those companies with a strong strategy and the ability to execute will ultimately thrive. This is where we deploy our team and company-level insight to greatest effect, by finding the companies who are equipped to traverse today’s challenging environment.

Crispin Murray is Head of Equities at BT Investment Management, a sponsor of Cuffelinks. This information is general only and does not take into account the personal circumstances or financial objectives of any reader.