Airports have become important assets in most infrastructure funds, and investors should consider whether the fundamentals will ensure the strong past performance is likely to continue in the future.

Since the development of commercial aviation during the post-World War II era, passenger volumes at major commercial airports have grown at multiples of GDP over any medium-term period. This growth reflects many underlying factors including increasing wealth, real reductions in the cost of air travel, developments in aircraft technology and improvements in international airspace regulation.

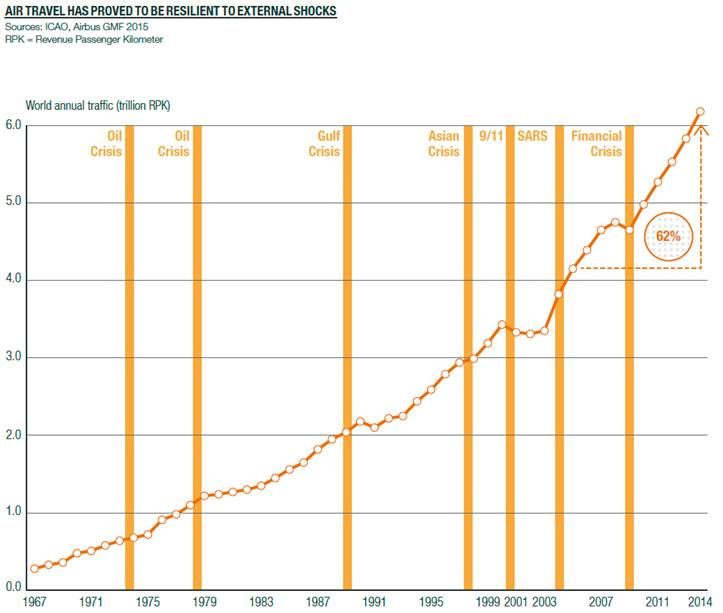

Global passenger growth is illustrated in Chart 1 below, showing the fairly consistent growth of airline passenger volumes since the mid-1960’s and more recently, this measure has grown by 62% over the last 10 years [Airbus, 2015]. More importantly, the chart illustrates the resilience of air travel to external shocks and the speed of the recovery to a long term upward trajectory.

Chart 1: Air travel has proved to be resilient to external shocks

Source: ICAO, Airbus, GMF 2015. RPK = Revenue Passenger Kilometre

High quality airports benefit from a near monopoly stream of passengers from which they are able to generate both aeronautical and commercial revenues. Regulation is structured to allow the aeronautical operations (including passenger, landing and ancillary fees) to earn returns in line with the cost of capital, whilst there are typically no restrictions placed on the returns that can be generated from non-aeronautical operations, such as retail, parking and commercial property.

Stock example: Aeroports de Paris (ADP)

Stock example: Aeroports de Paris (ADP)

ADP is the owner and operator of the Paris airport system. This includes both the Charles de Gaulle and Orly Airports. In 2014 these airports handled 92.7 million passengers, making it the second largest system in Europe after London.

Key points on Paris airports:

- Passenger traffic at the Paris airports was up 3.0% over 2015

- This was despite the shock of Paris seeing its second terrorist attack in November 2015

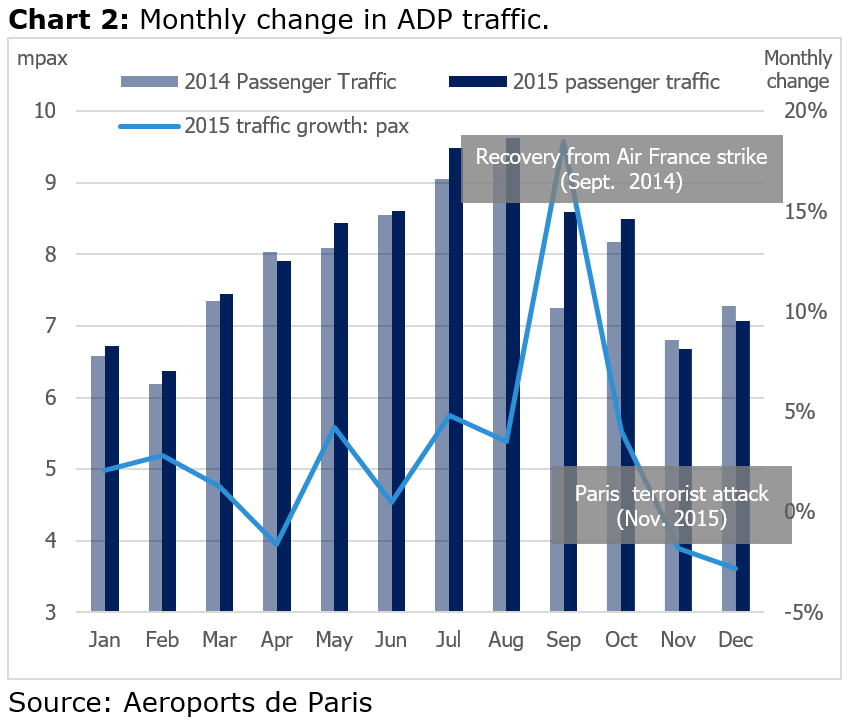

- Chart 2 below shows the very material impact of the terror attacks in November 2015 (with drops of around 4% in traffic for November and December)

- However, by January 2016 passenger traffic had recovered back to 0.9%, with Air France and ADP both reporting that volumes are back to usual

- This is a clear demonstration of the resilience of airports and the ability to bounce back from short-term passenger shocks

Stock example: Sydney Airport (SYD)

Stock example: Sydney Airport (SYD)

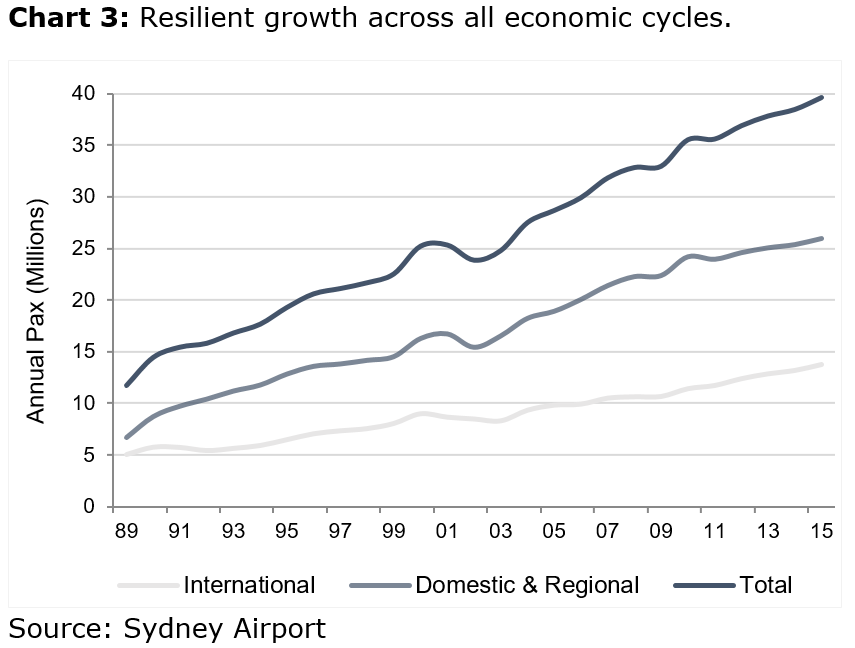

SYD is owner and operator of the Sydney domestic and international airport. In 2015 SYD handled approximately 40 million passengers. The long term resilience is equally evident with SYD as illustrated in Chart 3 below.

Key points on Sydney Airport:

- The notable external shock within the Australian context was the collapse of Ansett Australia in 2001. Ansett was Australia’s second largest domestic airline.

- The rising middle class, particularly in Asia has been contributing to strong passenger growth

In summary, airports form a core part of Magellan’s definition of infrastructure and have, over time, delivered robust financial performance and generated healthy returns for investors. We believe that airports remain a global growth sector and offer an attractive balance of regulated and competitive earnings potential.

Gerald Stack is Head of Investments and Portfolio Manager of the Magellan Infrastructure Fund. He is also Chairman of the Investment Committee and has extensive experience in the management of listed and unlisted debt, equity and hybrid assets on a global basis. This material is for general information purposes only and must not be construed as investment advice. It does not take into account your investment objectives, financial situation or particular needs.