“An organization's ability to learn, and translate that learning into action rapidly, is the ultimate competitive advantage.” – Jack Welch

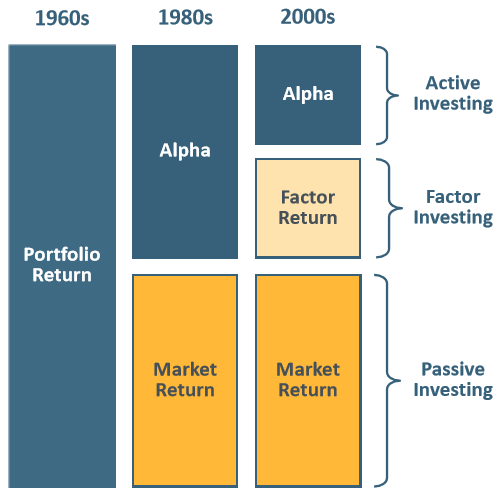

The way big institutional investors invest money has changed over the past 50 years. In the 1960s and 1970s, investors didn’t really distinguish between the sources of portfolio return, with active investing the predominant way of managing long-term portfolios. Then in the 1980s and 1990s, finance research underpinned the adoption of passive investing as an alternative basis for implementation. That involves investors capturing market beta efficiently through low-cost index investing, with a portion (perhaps half) remaining actively managed.

In the 2000s, a third component called factor investing (or smart beta) was introduced. It lies somewhere between passive and active investing and attempts to generate alpha (i.e. returns above index) in a systematic way by exploiting factors such as value, quality, small size or low volatility.

What might be considered a 'state-of-the art' institutional approach at the moment is approximately 50% in low-cost beta and 25% each in factor-based investing and highly concentrated active portfolios (see graphic below).

Source: MSCI

Rebalancing plays a key role

Such an approach minimises the chances of underperforming a benchmark after fees, whilst still striving for alpha (outperforming the market).

When asset allocations deviate too far from strategic benchmark weights, many institutional investors choose to bring them back into line through a process of passive rebalancing, regularly trimming the weights of what has outperformed and increasing the weights of what has underperformed (i.e. selling high and buying low in a systematic way). Such an approach has typically produced better results than market strategists making big-picture tactical asset allocation (TAA) calls.

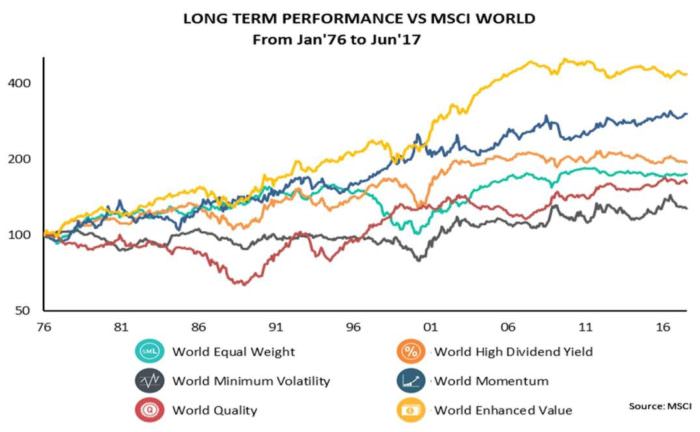

In the field of factor-based investing, many different factors have been tried. Besides producing the market-cap-weighted MSCI World index, the MSCI organisation (and others) also produces several factor-based World indexes, including an equal-weighted one. Each factor has certain advantages but invariably outperforms at certain times and underperforms at other times.

The chart below shows the performance of each factor relative to the standard MSCI World benchmark. Although each one has generated alpha over the long term, there is volatility along the way.

The rise of multi-factor models

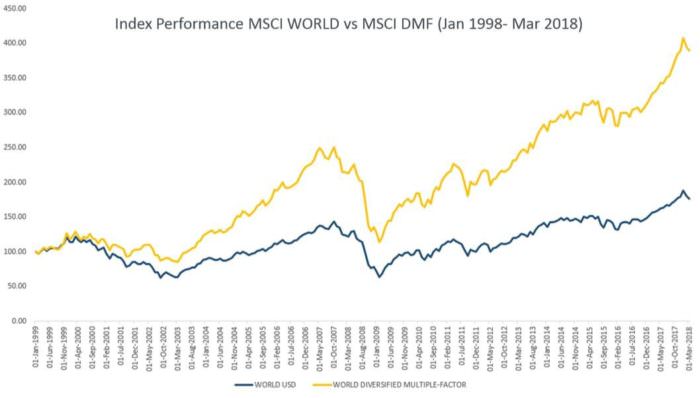

What has emerged is a trend towards multi-factor models that blend the various factors, smoothing out the alpha volatility because the correlation between them is low.

MSCI has blended four factors (Value, Size, Momentum and Quality) into its MSCI World Diversified Multiple-Factor (DMF) Index. They impose additional risk controls around country and sector weights, and exposures to growth, liquidity and volatility. The end result is something that mitigates shorter-term cyclicality, while maintaining long-term potential for outperformance (see chart below).

Source: MSCI

These strategies are available to the average investor, not just to institutions. MSCI licenses their indexes to ETF providers who track them. iShares has an ETF version of the multi-factor World index mentioned above. There is an Australian-listed version, the iShares Edge MSCI World Multifactor ETF (WDMF.AXW), as well as a US-listed version (ACWF.ARC).

They also have an equivalent multi-factor ETF for Australian equities, the iShares Edge MSCI Australia Multifactor ETF (AUMF.AXW), and one for Emerging Markets equities, the iShares Edge MSCI Emerging Markets Multifactor ETF (EMGF.BZX) listed in the US. There is also an Australian-listed version called the VanEck Vectors MSCI Multifactor Emerging Markets Equity ETF (EMKT.AXW). The MSCI indexes underlying these ETFs have a demonstrated history of outperforming their respective market-cap-weighted benchmarks over the long term.

A wide range of alternatives for retail investors

Other ETF providers such as Vanguard, BetaShares and State Street also offer factor-based ETFs listed on the ASX (a list of ETFs can be found in the ASX report on this link in Cuffelinks).

Lessons learned by big institutional investors over the decades (often learned the hard way) are of relevance to the average investor. Investment solutions that were once only available to the big end of town are now available to anyone willing to learn the same lessons.

Marcus Tuck is Head of Equities Research at Mason Stevens. This article is general advice only and does not take into consideration any personal objectives, financial circumstances or needs and should not be relied upon as personal advice.