The ASFA Retirement Standard benchmarks the annual budget needed by Australians to fund either a 'comfortable' or 'modest' standard of living in the post-work years. It is updated quarterly to reflect inflation and provides detailed budgets of what singles and couples would need to spend to support their chosen lifestyle.

What does modest and comfortable mean?

A modest retirement lifestyle is considered better than the age pension but still only able to afford fairly basic activities.

A comfortable retirement lifestyle enables an older, healthy retiree to be involved in a broad range of leisure and recreational activities and to have a good standard of living through the purchase of such things as:

- household goods

- private health insurance

- a reasonable car

- good clothes

- a range of electronic equipment

- domestic and occasionally international holiday travel.

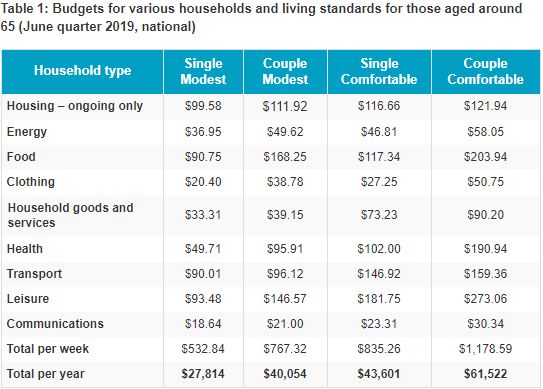

The June quarter 2019 figures indicate that couples aged around 65 living a comfortable retirement need to spend $61,522 per year and singles $43,601, up 0.8% for each on the previous quarter. At the modest level there was an 0.6% increase for singles and a 0.5% increase for couples.

These various changes are more or less in line with the All Groups CPI 0.6% increase between the March and June quarters.

Over the year to the June 2019 quarter, costs were up around 1.5% for couples at both the comfortable and modest levels, compared to the 1.6% increase in the All Groups CPI. This equates to couples needing to spend $918 more a year, and for singles the amount is $648.

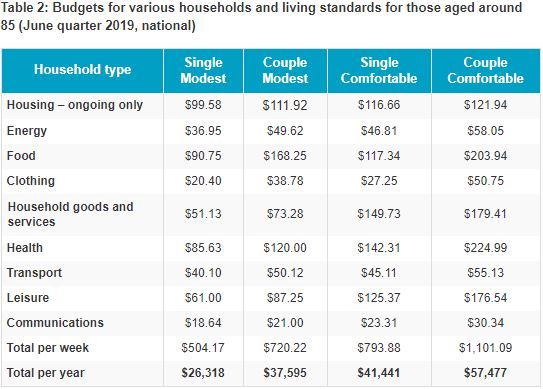

Budgets for older retirees rose from the previous quarter by around 0.7% at the comfortable level and by 0.5% at the modest level.

Many retirees would have welcomed the recent decision to decrease the deeming rate in the asset test for the age pension but at the same time they have been facing increased costs of living and lower returns from investments, such as term deposits. Having sufficient savings in superannuation to support the lifestyle Australians want and deserve in retirement is an imperative. Moving to 12% for the Superannuation Guarantee is a necessity for those not yet retired.

Prices that have risen substantially

However, while the increase in the headline rate of the CPI might not look large, retirees have been facing significant increases in the price of many necessities of life. The drought has impacted the prices of a range of foods, the cost of private health insurance continues to grow at around twice the general rate of inflation, and petrol prices are up.

The costs for retirees that increased substantially over the last 12 months are:

- Price of bread up by 4.8%

- Price of beef up by 6.0% and lamb up by 13.5%

- Price of milk up by 2.9%

- Price of fruit up by 4.9%

- Price of vegetables up by 6.2%

- Price of beer up by 2.5%

- Property rates up by 2.3%

- Price of hairdressing up by 2.9%

- Price of private health insurance up by 3.25% on average

- Price of dental services up by 2.3%

- Price of domestic travel up by 3.5% and price of international travel by 4.1%

The most significant price increases in the June quarter were automotive fuel (10.2%), medical and hospital service (2.6%) and international holiday, travel and accommodation (2.7%).

The figures in each case assume that the retiree/s own their own home and relate to expenditure by the household. This can be greater than household income after income tax where there is a drawdown on capital over the period of retirement. All calculations are weekly, unless otherwise stated. Annual figure is 52.2 times the weekly figure.

More information

Costs and summary figures can be accessed via the ASFA website. ASFA provides individual calculators to help Australians plan for retirement. Australians can find out more about superannuation on the independent Super Guru website.

Martin Fahy is Chief Executive Officer of The Association of Superannuation Funds of Australia (ASFA), the peak policy, research and advocacy body for Australia’s superannuation industry. This article is general information and does not consider the circumstances of any person.