Retirement is often a massive life change for the majority of people who experience it. Most of us will have mixed emotions around the end of our working life and the beginning of our 'second half'. For some it will be a relief, and something they have long planned for and are looking forward to, but for others it will be a source of anxiety. This anxiety could be due to many factors including, but not limited to, concerns around the potential for running out of money, feelings associated with a lack of confidence or a lack of control and other factors we will discuss here.

While individuals’ wealth and health are obviously important for anyone heading into retirement, but we have found there are other factors that are usually more important in determining the life satisfaction for retirees.

Surprising results on retirement happiness

“Retirement: The now and the then” a survey of over 1,500 Australians over the age of 50 by Fidelity International, drilled into the many factors driving happiness for retirees, with some surprising results.

The survey found that the top four drivers of overall life satisfaction for experienced retirees – i.e. those with more than 10 years living in retirement – were:

- purpose

- control

- confidence, and

- emotional experience.

Emotional experience relates to the sense of optimism and contentment that retirees feel. It was the strongest driver of overall life satisfaction and significantly more important that health and wealth.

Positive emotional experiences often correlate with retirement journeys that have been well considered and planned, or ones in which despite retirees’ plans not having worked out but in which they already had a Plan B or a backup plan. Negative emotional experiences are often felt by those people who may not have planned adequately and may have been forced into retirement through job loss or other factors out of their control.

Emotional roller coaster

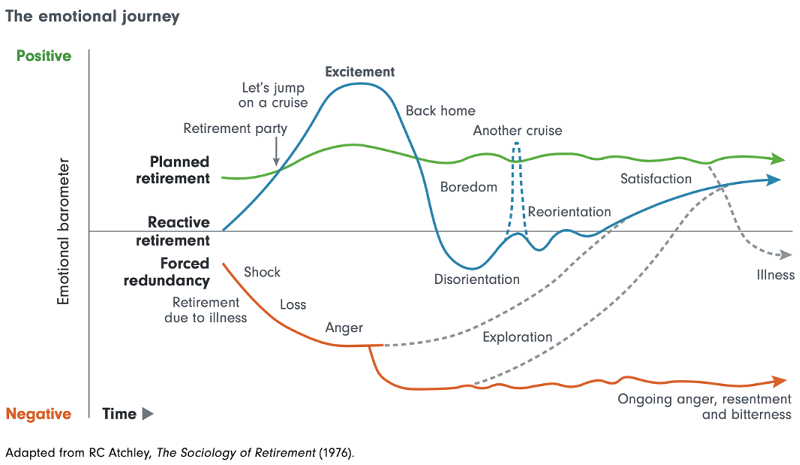

This chart is a useful illustration of what range of emotions are possible during a retirement journey.

The green line shows that the emotional experience of a well-planned and prepared retiree is usually fairly steady with low stress levels and a generally positive emotional experience.

In contrast, the journey of the reactive retirement is much more variable where the lack of planning can lead to significant swings in lived emotional experience.

The journey of the person forced into retirement through an unplanned redundancy is much more unpredictable and can be a difficult period from an emotional perspective. However, it can also be turned around with the right mindset and often with the help of a good financial planner, as the alternative paths highlight.

Promoting a good life

In thinking about how best to prepare for a long and fulfilling retirement, we believe that there are six key building blocks that are important elements of any plan.

We call these the six Cs:

Firstly, there is capability, which is the agency and ability to act and adapt to optimise a good life trajectory. If a retiree has the capability, they have the potential to turn a negative emotional experience into a more positive one.

Then there is confidence, or the peace of mind and optimism to keep looking forward to a good life while still enjoying your existing life. We may all wish we had a bit more confidence sometimes, but this is more about inner confidence and the belief that you have made the right choices and are living, and will continue to live, a good life.

Control is another C. This is about feeling like the master of your destiny while avoiding the pain of uncertainty and failed expectation. Obviously being forced into retirement through a job loss or redundancy is a lack of control but having a plan B already in place can help regain that sense of control.

Circumstance is how we like to bundle health and wealth together. These are critical components for enjoying a good life. A major health problem can derail an otherwise planned retirement but if the other Cs are all there, the overall experience will be better.

Character refers to self-esteem and a person's resilience. These factors can ensure a positive inner narrative which is important for a good life. Again, having the character and discipline to have a plan B already in place, to have a flexible disposition and a positive outlook significantly helps build resilience to life’s unexpected turns.

And finally, there is connection, which refers to a sense of connection with family and the community. Quality relationships and being able to look beyond, or transcend, a purely inward focus are central pillars of a good life. It turns out thinking of others is also good for us too.

Lessons from the 'elders'

There is a lot to be learned from those that have journeyed before us and retirement is no different. Our survey asked experienced retirees about lessons learnt and challenges did they not anticipate.

Many said they underestimated the emotional impact of retirement, such as their sense of loss of purpose and their personal identity when they retired.

Many also said that due to unexpected life events - such as losing a partner, health and mobility issues or dealing with homecare and aged care needs - they needed to be flexible and had to adapt and change their plans during retirement. Some downsized their homes or returned to work, to do more in retirement.

The two most important pieces of advice that late retirees can give to pre-retirees are not financial but emotional.

First, having a positive and optimistic outlook on life received the joint highest vote in our survey at 64% of respondents.

Second, also from 64% of respondents, investing in your health, and do it early, don’t leave it until too late.

Being flexible and adaptable was the next most popular at 61%, followed by finding purpose beyond work at 58% and taking control early with 55% of the vote. Always having a plan B was also important with 52% of the vote.

Plan beyond wealth

We hope that pre-retirees can incorporate some of these insights into their retirement plans. It's not just about wealth, the size of retirement savings and how to build that over time. There are more important factors that can build a satisfying and happy retirement.

The survey showed that having a positive outlook with a sense of confidence, taking control and forming a sense of connection with friends, family and community are significant in building and maintaining a happy retirement.

Richard Dinham is Head of Client Solutions and Retirement at Fidelity International, a sponsor of Firstlinks. This document is issued by FIL Responsible Entity (Australia) Limited ABN 33 148 059 009, AFSL 409340 (‘Fidelity Australia’), a member of the FIL Limited group of companies commonly known as Fidelity International. This document is intended as general information only. You should consider the relevant Product Disclosure Statement available on our website www.fidelity.com.au.

For more articles and papers from Fidelity, please click here.

© 2021 FIL Responsible Entity (Australia) Limited. Fidelity, Fidelity International and the Fidelity International logo and F symbol are trademarks of FIL Limited. FD18634.