People often take out personal insurance early in their working career, but if it is done without adequate advice and knowledge, a significant proportion will then drop their coverage later in life at the very time they are most likely to need it.

When paying off debt, funding lifestyle needs and saving for retirement are competing with the cost of holding personal insurance, the former are often treated as a priority, particularly as the cost of some personal insurance premiums rises substantially in later years.

Many only realise in hindsight that different personal insurance planning decisions made earlier in life would have made a significant financial difference.

Long-term understanding of premiums

In the early years of a working life, understanding how best to fund personal insurance can significantly affect the ability to retain cover while still being able to save for a quality retirement, or meet other expenses.

The two most common premium-funding options are level premiums and stepped premiums.

With a level premium, the cost of the cover remains the same of over the lifetime of the policy except for CPI increases in cover.

With a stepped premium, the cost of cover starts lower than level premium, however the rates increase each year based on the insured person's age plus CPI increases in cover.

Under either funding option, the insurer can also increase the rate charged over and above the annual rate change.

While a level premium seems more expensive than a stepped premium when first starting out, a long-term view shows a significant difference over the life of a policy.

For instance, as the table below shows, the year-on-year increase in a stepped premium policy in the early years is not as steep as in later years.

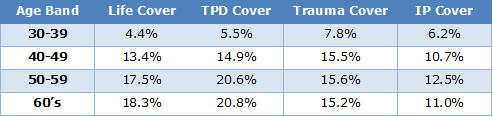

Average year-on-year increases for stepped insurance premiums, nil indexation

(TPD = Total and Permanent Disability, IP = Income Protection)

In addition, the percentage increases will have more of an impact at an older age when the premiums are higher. For example, a 5% increase on a $100 per month premium is $5, which is more palatable than a 15% increase on $600 per month, or $90. What’s more, with a 15% year-on-year increase, the premiums will double every five years.

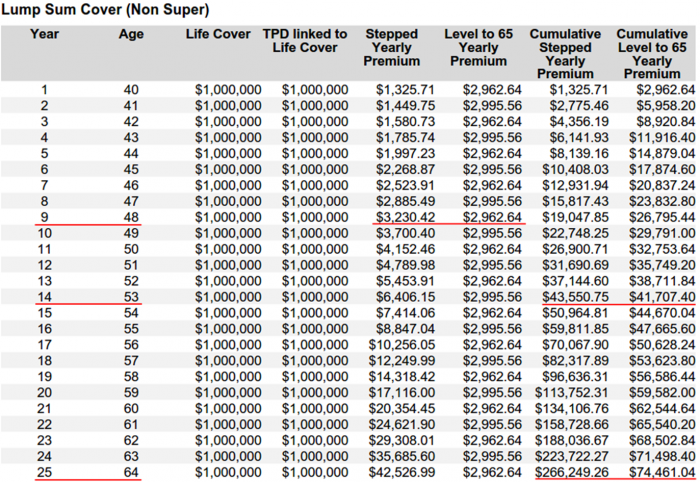

The total stepped premiums for a 40-year-old male taking out $1,000,000 Life and TPD cover (with nil CPI increases) until age 65 will cost $266,249 while level premiums will cost only $74,461.

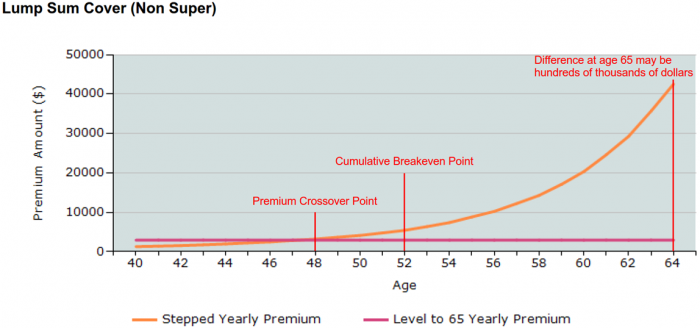

The following chart illustrates graphically the difference in cost between stepped and level premiums over the lifetime of the policy. After age 52, the age when people are most likely to need cover, the cost of the stepped premium rises dramatically.

As a general rule, for a 40-year-old with Life and TPD cover for $1,000,000, not indexed to inflation, it will take eight years for stepped premiums to catch up to level premiums, and another five years on top of that to reach the break-even cumulative point.

For example, a specific insurer provides this table although the general principles apply.

If all cover is held to age 65, the savings on a level premium can be hundreds of thousands of dollars.

Minimising the burden of insurance policies

Steps can be taken to ensure insurances are retained that might otherwise become such a financial burden that the cover is reduced or given up entirely when most needed. They include:

- Life cover and TPD – in early years with a young family, ongoing income and mortgage debt is higher than it is as children get older and debt is paid down.

Solution: place a portion of cover on stepped premiums and maintain for 15–20 years, with the remainder on a level premium ensuring this cover remains affordable in later years.

- Income protection – generally the cover will be required across an entire working life.

Solution: maintain a level premium until policy expiry at either age 65 or 70.

- Trauma cover - in the early years of greater family financial commitments, cover may need to be higher than in later years.

Solution: place a portion of the cover on stepped premiums to manage cash flow with some cover on level premiums for the longer term.

Risks with level premiums

Level premiums offer long-term financial benefits but other factors must be considered:

- Product may become obsolete: the insured person is locked in with a single insurer and product series and could be left in an old or closed product. Medical definitions and premium rates for the policy may not be up to date with the current market.

- Rates are not guaranteed: Insurers always reserve the right to increase base premium rates at any time (this is applicable under both stepped and level options).

- Inflation cover can change the original premium rate: If inflation-proof cover is chosen with CPI increases in cover each year, some insurers will charge the original level premium rate when the policy commenced but a new level premium rate for each age range for the increased portion of cover.

Nevertheless, forward planning of insurances and a sensible approach of using a blend of stepped and level premiums could have good financial outcomes.

When obtaining advice it is important to be furnished with the complete illustration of the stepped and levels options of the insurer to enable an understanding of the long-term overall cost.

Insurance discussions with adult working children

As people grow older and their children make their own way in life, they do not give much thought to the impact as a parent if the child became disabled due to sickness or accident. What often happens is the parent steps in to support the child. The financial burden could be huge and impact significantly on retirement savings.

Increasingly, we are seeing parents step in and fund the personal insurances for their adult children, at least in the early years. If a 25-year-old is earning $50,000 a year, the income could be insured for as little as $40 per month. In the event of a disability, if the benefit period was to age 65, they could receive $2,800,000 with claims indexation of 3%. This is a small price to pay to ensure retirement assets are protected, and the child can take over the premium payments at a later stage.

Roy Agranat is a specialist risk adviser with Fairbridge Financial Services. This article is general information and does not consider the circumstances of any individual, and the rates quoted are indicative only and may not apply for all people.