Today’s environment with heightened volatility and risk, interest rate increases, and inflation concerns has investors (institutional and retail alike) scrambling for safe havens amid such uncertainty. For those, like retirees, who need income with strong capital preservation from their investment portfolio, an allocation to Australian Residential Mortgage-Backed Securities (RMBS) could provide both high risk-adjusted income returns and comfort.

Traditionally, RMBS were only available to institutional investors, and in some cases, so called 'wholesale' investors, but they are now increasingly available to retail investors through various funds.

RMBS explained

RMBS are bonds that are backed by pools of residential home loans.

The loans are packaged up into bonds issued by banks (including the big four) and non-banks, and this process is known as securitisation. The bonds are issued in a number of classes (or tranches) with different risk/return profiles. In any given deal, the vast majority (over 90%) of the bonds will be triple-A rated, with the lowest risk and lowest return. It is not unusual to see six classes of bonds with different ratings from triple-A through triple-B and down to unrated, with higher returns as the risk goes up.

Banks use securitisation because it frees up capital for further lending while they retain interest in the profitability of the underlying loans whereas non-banks use securitisation for funding purposes.

Securitisation has been a feature of the Australian financial landscape for over 30 years. As banking regulations have tightened, it has become a more important part of a bank’s funding as regulatory changes make it is less attractive for banks to keep loans on their balance sheet for their full life.

Inflation protection and capital preservation

RMBS are issued as floating rate notes. This means that the interest they pay is linked to current interest rates, and as the Reserve Bank (RBA) increases cash rates, the interest rate on the RMBS increases providing protection from rising interest rates. This means that RMBS are inflation protected.

Investors are attracted to these bonds due to their diversification benefits and attractive returns. The underlying loan pools are highly diversified and consist of thousands of loans.

Australian RMBS have uniquely strong capital preservation characteristics because there are four investor protections in RMBS:

- Home-owners’ equity

- Lender's Mortgage Insurance (LMI)

- Excess interest, and

- Originator takes first loss position.

Let's consider these four levels of protection.

1. Home-owners equity

When an individual buys a house with a mortgage loan, they put in some equity to protect the lender from a fall in house prices. On average, for the RMBS investments of Gryphon Capital Investments (GCI), this is about 35% of the value of the house. This means that house prices need to fall by 35% or more for there to be a risk of loss to the loan (and therefore the RMBS) if the home-owner defaults.

A research study by the RBA notes that for the borrower to default they need to be in negative equity AND suffer a loss of ability to pay such as unemployment. As a result, mortgage defaults are very rare in Australia. That’s the first investor protection.

2. Lenders Mortgage Insurance (LMI)

For RMBS, LMI is often taken up to cover mortgages with a loan to value ratio (LTV or LVR) of over 80%. In the event of a default and after the sale of the house, any shortfall is claimed back from the LMI provider subject to the terms of the insurance contract. This is the second investor protection.

3. Excess interest

When a pool of mortgages is securitised into RMBS, the average interest rate on the loans is higher than the average interest rate on the bonds issued in the RMBS. This excess interest or bank’s profit is a big reason why banks use securitisation: not only do they get their capital back to recycle but they also get the excess interest as a profit stream.

However, they can only receive the excess interest if all RMBS investors have been paid all that is due to them. This excess interest is a powerful third investor protection and aligns the interest of the bank with the bondholders.

4. Originator takes first loss position

For non-banks, the originator of the loans in the RMBS is required to retain the most junior bond in the RMBS structure. In this way, if there are any losses not covered by the first three investor protections, then these are first allocated to the originator’s holding in the first loss position. This aligns the originators interest in the loans with those of the RMBS investors and is the fourth investor protection.

House prices are important for the 'wealth effect' and government coffers but they have a second order impact on borrowers’ capacity to pay their mortgage. An IMF stress test of the major banks concluded unemployment is the most important driver of the performance of home loans.

No payment shock and the impact of rising rates on borrowers

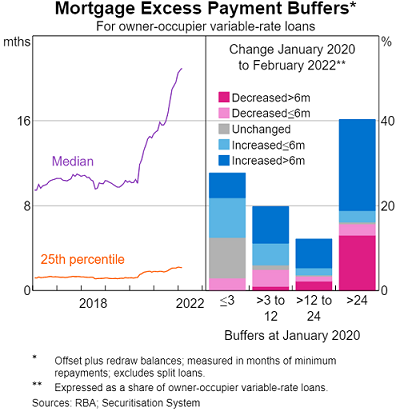

Gryphon’s analysis on the impact of variable mortgage rates increasing by 2% is consistent with the RBA’s conclusion that:

‘… the majority of indebted households are well placed to manage higher minimum loan repayments …’

Stress testing is focused on the borrowers facing the largest increase in their minimum loan repayments and who, therefore, are the most vulnerable to rate rises. For this cohort of borrowers, a combination of serviceability buffers, elevated savings rate, over-payment history and strong employment growth provides effective mitigants against financial stress. Additionally, the substantial build up in borrowers’ equity will also enable any borrowers experiencing financial pressure to voluntarily self-manage their way out of arrears through property sales.

Specialist asset class

Historically this asset class was reserved for institutional investors and requires a selective management approach. Not all RMBS are the same and it takes a dedicated team of specialists to select only the best risk adjusted returns and strongest capital preservation. This requires data collection, processing and stress testing capabilities to support rigorous risk analysis systems. It is not the realm of the generalist fixed income manager who must rely on external rating agencies to guide them. In our case we use in-depth analysis and stress testing to find those bonds with the highest risk adjusted returns that still provide strong capital preservation.

Conclusion

RMBS are structured to protect investors from the kind of environment we are in today. They have four levels of investor protection that provide strong capital preservation. According to Standard & Poor's, no investor in Australian RMBS has suffered a loss when holding to maturity.

A well selected RMBS portfolio will provide investors with regular and reliable income with strong capital preservation and protection from rising rates and inflation.

Ashley Burtenshaw is co-founder and Chief Investment Officer at Gryphon Capital Investments. Gryphon is a fixed income manager specialising in residential mortgage-backed securities (RMBS). Gryphon uses a unique quantitative-based and research-based investment process that improves reliability and consistency of returns. www.gcapinvest.com/our-lit/