In our recent Reader Survey, about 40% of respondents reported portfolio losses of over 20% between January and March 2020, although the market rise since the lows has pared back some of the pain. Anyone relying on their investments to fund regular spending will not only be concerned about the loss in capital value, but also the reductions in dividends. National Bank has lowered its interim dividend from 83 cents to 30 cents and ANZ Bank has cancelled it completely in a sector which traditionally provides one-third of all dividends in the listed market.

Market recovery patterns

Contrasting 'investors' with 'traders', most people do not make radical changes in their portfolios based on short-term volatility. That's a good thing, as picking tops and bottoms is almost impossible, even for professional fund managers who stare at screens all day. A well-designed investment plan should focus on long-term goals and needs, and not worry too much about monthly variations. Volatility is the cost of participating in the long-term benefits of share investing.

Regardless of an investor's ability to look long term, two questions remain:

1. How often does a diversified share portfolio lose money?

2. How long does it usually take to recover?

We opened the Morningstar Direct data base for the Australian All Ordinaries Accumulation Index to measure the total returns (including dividends) over one year, three years and five years since 1983. For the five year, we did a check using the Canadian Total Return Index, given the similarities between the Canadian and Australian markets.

There are good reasons to take comfort from the charts, and the pictures 'tell a thousand words'. Of course, Covid-19 is a unique threat, and only time will tell whether 'this time is different'.

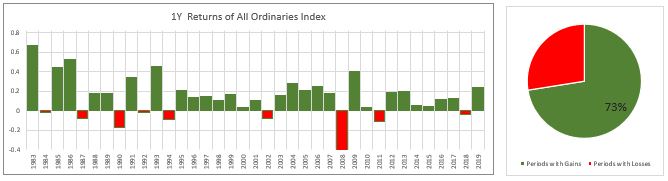

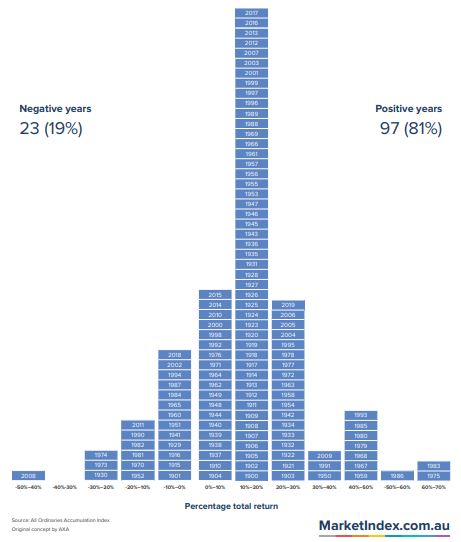

One-year returns

Australian equity investors should expect to lose money for one year in every four to five years. Anyone who considers this loss of capital unacceptable should hold a more diversified portfolio including other asset classes, because over time, the same pattern will probably repeat.

(In the chart, 0.1 equals 10%, 0.2 equals 20%, etc. Yes, the All Ords rose 67% in 1983, and fell 40% in 2008 and rose 40% in 2009).

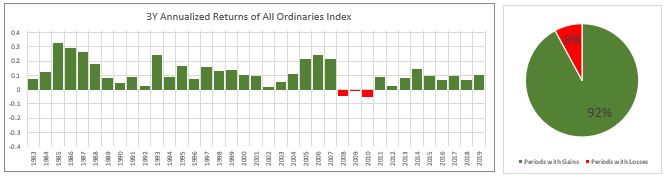

Three-year returns

Moving to a three-year horizon of annualised returns (that is, 1985 shows total returns over 1983, 1984 and 1985, annualised) shows good years regularly offset down years, such that over 90% of three-year periods produced a positive result. Over the period, only the severe loss of the GFC carries into other years.

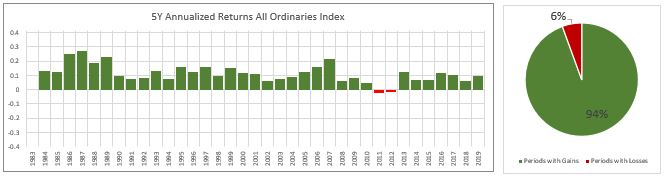

Five-year returns

Similarly for five-year performance, now about 19 times out of 20, the All Ords produced a positive result.

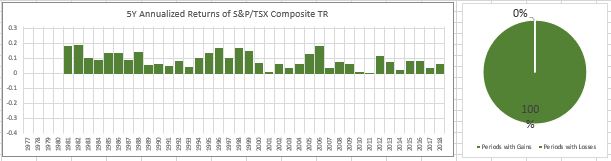

Canadian Total Returns over five years

The Australian economy has experienced almost 30 years of economic growth (which will be punctured in 2020), so as a quick check on whether the above numbers are an Australian miracle, here are the Canadian Total Returns numbers for five years. There are no five-year losses.

A longer-term perspective of 120 years

Taking the data back to 1900 shows annual returns are positive in 80% of years, and the average annual return (nominal, not adjusted for inflation) for the All Ords Accumulation Index is 13.2%. Remember that inflation has reached double digits in the past so this number in no way reflects real returns or the potential for the future.

Over this longer horizon, and measuring returns over a decade, Australian shares have generated positive returns 100% of the time and 82% for US shares.

All Ords Accumulation Index, annual returns for all years since 1900

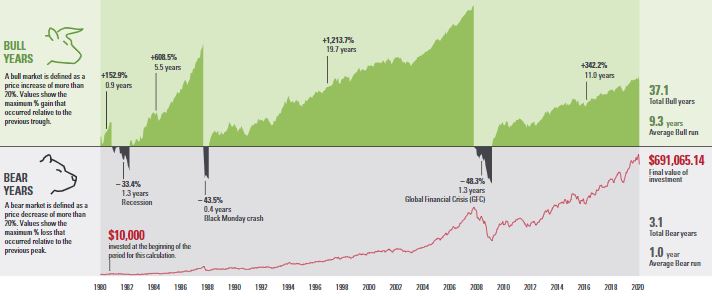

Bull and bear years since 1980

Finally, defining bull and bear years as 20% rises or falls in this Vanguard chart of the All Ords index shows that in the last 40 years, persistence with equity markets usually pays off. The bear markets have been much shorter and shallower than the bull markets.

Is the past a prologue?

We will only know if this time is different when we look back in a few years, and given the uncertainty in the market, there could be another leg down from the recent drop. Taking history as a guide suggests those who do not panic are likely to be rewarded over the long term.

Graham Hand is Managing Editor of Firstlinks. This article is general information and does not consider the circumstances of any investor. Past performance may not be repeated but it's the best guide we have.