Rio Tinto (ASX:RIO) has been a top dividend payer on the ASX for years. In 2019 the iron ore miner topped the list, paying 47% more in dividends than second placed Macquarie Group (ASX:MQG).

A year later the miner blew up a 46,000-year-old Aboriginal cave site. The fallout from the Juukan Gorge incident took the Chief Executive and the firm’s Head of Iron Ore with it.

With bond yields still anchored to the ocean floor, dividend payers such as Rio Tinto are a crucial portfolio fixture for income investors. But many reliable payers are in the resources sector and carry high environmental, social and governance (ESG) risks. What can income investors do?

To untangle this Gordian knot, I’ve looked through the Morningstar database to find reliable dividend payers who also meet stringent ESG and carbon risk criteria.

ESG risk ratings measure the economic value at risk from unmanaged environmental, social and governance factors. In the case of Rio, this could range from water pollution to legal action from First Nations groups.

Over 1,300 data points are analysed to give a score which classifies companies on a 5-point scale from ‘Negligible’ to ‘Severe’.

The carbon risk rating focuses on the unmanaged risks to a company's value stemming from the transition to a low carbon economy, through the amount of carbon emissions in its operations, products, services and investments.

To begin, I look for companies that are:

- Low ESG risk: Classify as ‘Negligible’ or ‘Low’ on both ESG risk and carbon risk

- Reliable payers: Have at least a 3% trailing 12-month (TTM) dividend yield and five year average dividend yield

- Fairly valued: Trading in a range Morningstar considers fairly valued.

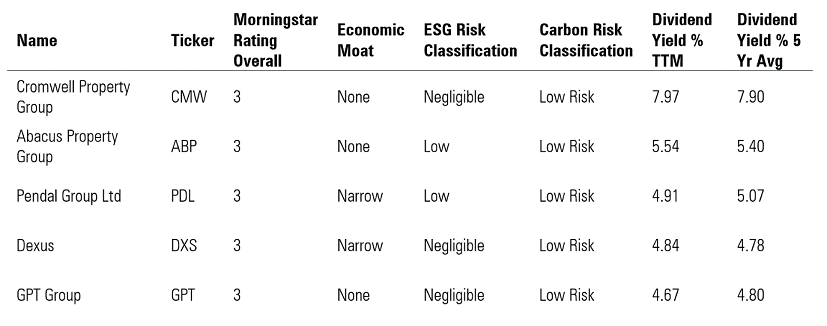

Real estate investment trusts (REITs) and narrow-moat asset manager Pendal (ASX:PDL) top the list for sustainable dividend yields.

Cromwell Property Group (ASX:CMW) is first, with a distribution yield over the TTM and five year horizons north of 7%. The other REITs on the list are near or above the 5% mark.

Of the five REITs, only Dexus (ASX:DXS) qualifies for a Morningstar narrow moat, implying a 10-year competitive advantage.

Sustainable picks based on historic dividend/distribution performance – fairly valued

Source: Morningstar Direct. Data as of 22 June. While similar to a dividend, REITs technically pay a distribution.

Beyond the REITs: G8 Education, Sydney Airport, and IRESS

Australia's largest private childcare operator G8 Education (ASX:GEM) and narrow-moat Sydney Airport (ASX:SYD) are options for those looking outside the REIT sector.

G8 Education and Sydney Airport meet the sustainability criteria and have a five year average dividend yield greater than 4%. Neither has paid a dividend since COVID hit, but Morningstar analysts expect both to provide a dividend yield in excess of 4% in 2022. G8 Education is currently trading at a 53% discount to its fair value estimate.

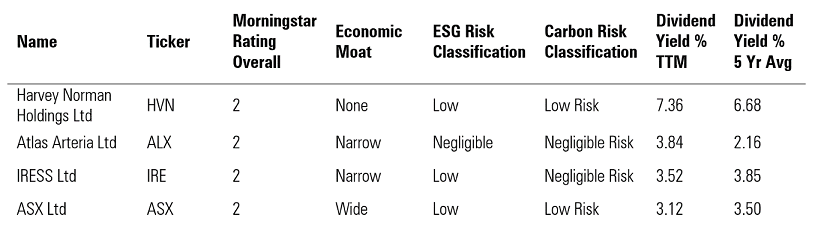

If the net is widened to stocks Morningstar considers somewhat overvalued, investors can consider narrow-moat toll-operator Atlas Arteria (ASX:ALX) or narrow-moat financial software provider IRESS (ASX:IRE). They are trading at an 11% and 19% premium to fair value, respectively.

Sustainable picks based on historic dividend performance - premium to fair value

Source: Morningstar Direct. Data as of 22 June.

Future dividend payers

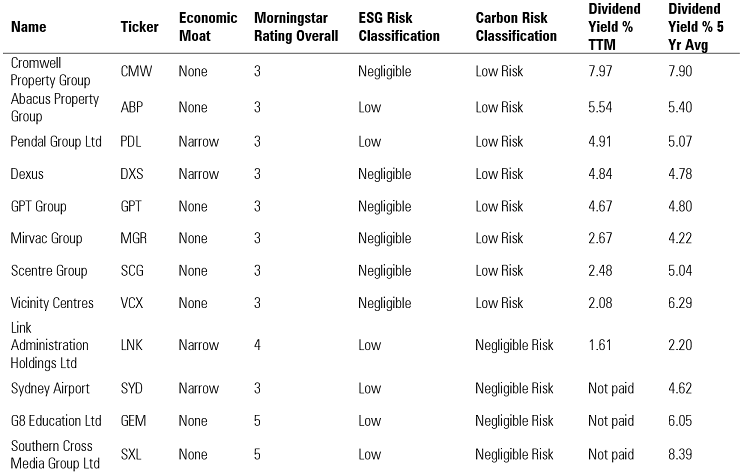

Past performance is no guarantee of future result, so I’ve included those companies that Morningstar analysts estimate will have a dividend/distribution yield greater than 3% in 2022.

The list includes three more REITs, as well as Southern Cross Media (ASX:SXL). The latter has not paid a dividend since September 2019 and closed at a 43% discount to fair value.

Sustainable firms estimated to pay a dividend yield greater than 3% in 2022 - fairly valued

Source: Morningstar Direct. Data as of 22 June. While similar to a dividend, REITs technically pay a distribution.

Lewis Jackson is a reporter/data journalist at Morningstar, owner of Firstlinks. This article is general information and does not consider the circumstances of any investor.

A Morningstar Premium free trial is available on the link below, including access to the portfolio management service, Sharesight.

Try Morningstar Premium for free