A relatively slower capital expenditure cycle is often cited as one factor behind the current tepid economic expansion in many developed markets. However, we believe this top-down view obscures a healthy albeit different sort of capex cycle, one that is more technology-driven and focused on efficiency.

Profits for companies that execute automation well

Rather than driving volume via heavy spending on traditional fixed equipment, companies globally seem focused on gaining more lasting competitive advantages by reducing labour costs while increasing throughput and innovating faster via software-driven automation. This trend is durable and could accelerate profits for companies that execute well. Automation has long been commonplace in manufacturing, logistics and other areas, but we are now seeing a differentiating factor with the rise of ‘smart’ automation and instrumentation.

Underpinning this drive for industrial process innovation and accelerated profit are several things we believe should continue for some time.

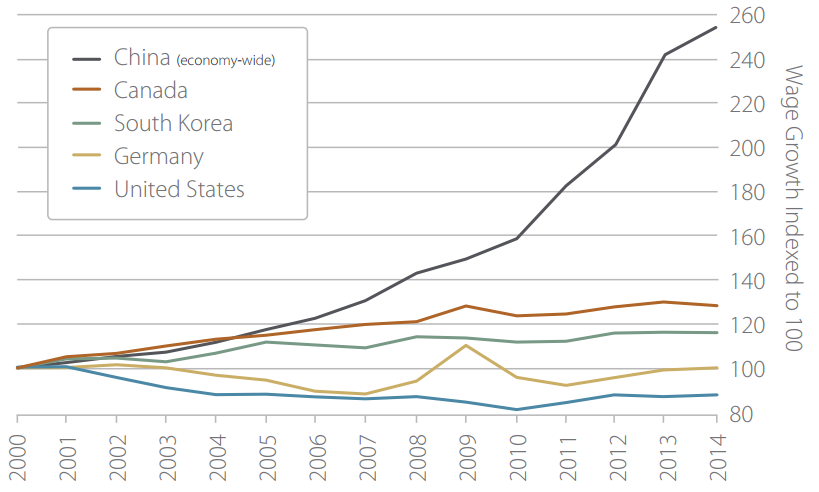

Outsourcing, often to emerging markets, has been one common way for companies to lower labour costs. While there are concerns now of moderating emerging markets’ growth, the prior decade or so resulted in high and persistent wage inflation (see table below). In China and other parts of the developing world, these inflation pressures remain largely unchanged despite expectations of more modest top-line economic growth. Rising wages compress the payback period for automation, creating incentives for investments in equipment rather than labour.

Fifteen years of global wage inflation

Source: Economics and Statistics Administration analysis of data from US Bureau of Labor Statistics, International Labor Comparisons program and National Bureau of Statistics of China.

Cost containment and operational flexibility

Automation gives companies greater flexibility to manage a range of costs since operations need not necessarily be close to a large, manufacturing-based labour pool. Other factors, including local taxes and regulations, existing infrastructure and the political environment, may further increase demand for automation equipment globally. Shipping costs are another key factor.

Despite the recent fall in commodities prices, North America’s ongoing energy renaissance has resulted in all-time high US natural gas and crude production, possibly prompting some companies to locate next-generation automation facilities closer to their large North American customer bases.

These factors are behind the recent trend of manufacturing ‘near-shoring’ to Mexico, which is poised to overtake Canada and Japan as the number-one source of US car imports. As of the end of 2015, Mexico is now producing nearly one of every nine light vehicles bought by US consumers. Global automakers have been building state-of-the-art manufacturing centres in Mexico, attracted in part by cheaper wages than in the US and Canada as well as proximity to America’s massive car market.

Consumers and governments are also demanding improved quality and safety profiles on goods, especially in emerging markets, where growing wealth correlates with demand for higher quality. Across industries, product failure and/or tampering can cause an immediate and lasting, even terminal, backlash. Additionally, many governments are making quality a legal requirement via more rigorous safety regulations and product specifications, a trend we expect to continue.

Investing in industrial innovation, including robots to improve precision, vision systems to manage quality control, and automated packaging and fulfillment systems to mitigate contamination or tampering, can help manage these costs.

Government-directed initiatives

As the world’s largest command economy, China can wield tremendous power in influencing certain sectors. As part of its 12th five-year plan, announced in 2011, the government emphasised seven key sectors, including next-generation information technology and advanced equipment manufacturing for attention. In 2015, it announced its ‘Made in China 2025’ initiative, designed to transform the country into a global manufacturing power not only in terms of volume, but also in efficiency and sophistication.

While China has not traditionally been transparent about the progress of its five-year plans, the intensive focus on these areas, combined with any spending the government commits now or in the future, should add materially to demand for next-generation automation systems, instruments and components.

How can investors benefit?

Benefits from increased industrial process innovation are fairly broad-based, potentially touching any industry employing automation or sophisticated instrumentation. From an investing standpoint, we believe there are several interesting opportunities.

Traditional industrial equipment manufacturers that have shifted to become hardware/software fused offer good opportunities, as do companies producing industrial robots or machine tools overlaid with next-generation instrumentation and smart automation.

There are also opportunities among components designers and manufacturers such as companies designing infrared componentry, advanced sensors or advanced location devices. Investing in components providers allows us to invest in the broader trend of more sophisticated instruments without trying to select which software platform will ultimately win.

Managing risks

We are mindful of inherent risks that could derail the profit-acceleration potential from this trend, such as competition from lower-cost start-ups, particularly from emerging markets. Profit growth could also be tempered by a slower pace in artificial intelligence take-up, which could limit industrial robots’ dexterity.

We look for companies with a large and powerful installed base of hardware with existing clients. Dominant market share can result in an effectively locked-in audience, aiding in future profits from product-replacement cycles, upgrades and cross-selling.

We also prefer those willing to invest heavily in research and development now. Such investments do impact margins; however, investing strategically is one way to fend off lower-cost upstarts and amplify scale advantages.

Companies with scientific research-driven backgrounds have good prospects. They often develop products or software for extreme situations and can alter them for more common applications, giving them a technological head start over competitors or a low-cost advantage.

James D Hamel, CFA, is a Managing Director at Artisan Partners and a portfolio manager on the Growth team. Michael A Schneider, CFA, is an analyst on the Artisan Partners Growth Team, where he conducts fundamental research. This material is for informational purposes only and should not be considered as investment advice or a recommendation of any investment service, product or individual security. Any forecasts contained herein should not to be relied upon as advice or interpreted as a recommendation.