Steve Bennett is Chief Executive Officer at Charter Hall Direct and was elected President of the Property Funds Association in April 2019. He oversees in excess of $6 billion of direct property investments.

GH: Which property sectors have been most and least adversely impacted by the pandemic?

SB: Most sectors have been impacted in some way if you look at it from a foot traffic or tenant usage view. Most adversely are the large discretionary shopping malls, which were hit by the lockdowns. Plus places like Melbourne office buildings where the State Government mandated people to work from home. And then the least adverse are assets such as Bunnings which in most parts of the country continued trading strongly through the pandemic, and industrial assets have been positively impacted. When people order things online, it doesn't just magically appear with click of a button. It comes out of a warehouse and goes onto a truck, and industrial logistics is a long-term trend and the pandemic has really speeded it up.

GH: Did Charter Hall make any lease adjustments, especially in the beginning around March and April?

SB: Not really. We've been fortunate in two main ways. The first is that the whole Charter Hall Group focusses on long WALE (Weighted Average Lease Expiry) properties as a thematic. So we haven't renegotiated any material leases that were up for expiry because they are pushed well into the future. And secondly, the Group focuses heavily on government and highly-rated corporates. These are financially-strong counterparts which don’t need special treatment.

Where we've had to be accommodative is for SMEs who were suffering financial hardship or stress. Under the Government's National Code of Conduct, SMEs were provided some rent relief to help our smaller tenants come through the other side. It’s in everyone's interest.

GH: Could you give an example of a type of tenancy and property where you relaxed the lease terms?

SB: If you think of a large premium-grade office tower, typically there's a coffee or a sandwich shop in the foyer. And when the foot fall through CBDs plummeted, we needed to help with the rent because everyone wants the amenity to stay there, particularly for the operators who were trading well and had always paid the rent. And in non-discretionary retail, such as in neighbourhood centres anchored by Woolworths or Coles, we’ve helped some of the smaller specialty stores although most of the food operators have traded well.

GH: Many of our readers will be familiar with residential leases, but can you highlight some ways a commercial lease normally varies from a residential lease?

SB: There are three big differences. First, the length of the lease. Most residential leases are six to 12 months, while we have leases to governments and major corporates such as Woolworths and Coles for up to 20 years. Our office fund’s average lease term is eight years and industrial fund is over 10 years. The second is the income yield. Most of our funds are paying somewhere between 5.5% to 6.5% per annum income whereas if you're getting 2.5% to 3% in residential, you're doing well. Plus commercial leases are typically net leases where the tenant is responsible for all the costs. So the return is after all those costs are paid whereas in residential, the landlord has to cover body corporate fees, sinking funds and agents fees, and that’s just the start.

GH: Tell me about it, I should sell my investment apartment this afternoon.

SB: Exactly. There's a place for residential in some portfolios but commercial property stacks up well for investors who want diversification and to avoid the hassle of a single, short-term leased residential asset.

GH: Across the many property sectors you cover, where do you see the best opportunities?

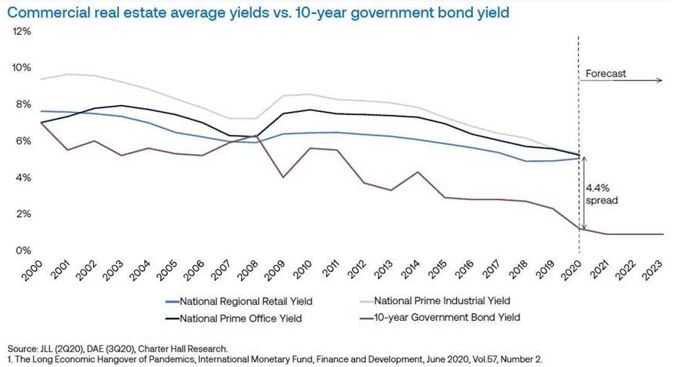

SB: The best opportunities, and we're hearing this from institutional investors globally, are the long lease assets with some type of a monopolistic feature, such as a long lease Bunnings in a great metro location. They are well bid by almost everyone from high net worths to institutional managers. And a long lease asset regardless of the sector with a very strong tenant will continue to do well. For example, we own a new office building at Macquarie Park with a 10-year lease to the New South Wales Government and it's throwing off 5.5% income. In a world where interest rates are close to zero or negative in real terms, it’s easy to see why that style of property is popular. As the chart below shows, the yields spread between commercial real estate and government bonds is wider than ever.

GH: Where is that office asset held?

SB: That one is in our Direct PFA Office Fund, open to SMSFs and high net worth investors.

GH: What are your expectations on the medium- to long-term consequences of working from home changing the city office market?

SB: We think there are huge advantages in working in an office for collaboration, risk management, providing experience and guidance to younger team members, networking, and obviously the amenity that you get in a CBD location. Having said that, the trend to working from home has been bubbling away for a long time. So, it's undoubted that home will form part of the way we work in future. We believe businesses will provide additional flexibility, so staff might work for a day or two a week at home.

The previous process of ‘densification’, a fancy word of putting more people per square metre into an office, is now reversing, and this move back to lower density will balance working from home. But we are also going through a recession so we shouldn't kid ourselves that in the short term, there will be a reduction in white collar jobs. It shows the value of a long lease strategy.

GH: WFH has its productivity benefits but it’s more difficult to have a collaborative discussion about a complex subject between five or six people on Zoom than it is sitting around a table.

SB: I couldn't agree more. We were launching and refining a new product through COVID and what would have taken one maybe two meetings with the right people in a room and a whiteboard required endless Zoom calls. We speak to a lot of CEOs because of the nature of our business, and there's a consensus building that their companies are losing some of the culture that they've built up over many years. How are junior people going to learn if they are not sitting with their team? I think one of the reasons for the claimed success of working from home is that it's self-reported.

For thousands of years, we’ve had migrations into cities. We've had pandemics before. We're not going to stop the ways we interact and live because there is value in it. I laugh when I read some of these tech companies, the Googles and Facebooks, say they will never have people in the office and then Atlassian announces it will build a billion-dollar property in the Sydney CBD. If it is so unimportant, why do the tech companies group themselves together in Silicon Valley?

GH: Stock market volatility has been extreme in the last six months, and the share price of the Charter Hall company is no exception. January $14, March $5, now back towards $14. Is it possible for an executive to distance from what is happening with the market’s assessment of the value of your company and does that lead to caution in your activities?

SB: It’s one aspect we love about unlisted properties. We don't get caught up in the sentiment that can infect listed markets. There’s a lot to be said for experience as well. I was in London with Macquarie throughout the GFC when the share price went to low single digits. The feeling around the office was that the company was trading through a potential existential threat and the bank guarantee from the government helped pull the banks through.

I never saw anything like that at Charter Hall. We knew the business was extremely sound, we understood how the funds are set up with long lease terms. In fact, some executives picked up more shares in the company as the low price just didn’t make sense. It was a classic equity market mispricing, and it can happen on the upside and the down. If I compare the two experiences, this year and during the GFC, everyone just got on with it this time.

GH: Charter Hall has been on an acquisition drive for many years. Has it continued this year?

SB: If anything, COVID gave us more impetus around the long lease, high quality strategy. We used the opportunity to pick up assets that we probably wouldn't have been able to obtain at such favourable prices, especially in industrial logistics in the September quarter. We also picked up a portfolio of Bunnings. It’s the advantage of having capital to deploy and looking through the cycle with people on the ground to do inspections. We’re also the biggest player in sale and leaseback, helping companies free up capital from their balance sheets and giving us assets to meet the needs of our investors.

GH: So for a Firstlinks reader, perhaps the trustee of an SMSF, with a traditional portfolio of cash, domestic and global equities and fixed interest, but looking to deploy funds into other asset classes, what are one or two of your funds for that sort of a portfolio?

SB: First, they should recognise that quality sources of income will be even more highly valued in the medium to longer term due to where interest rates are. We've got a diversified fund called the Charter Hall Direct Long WALE Fund paying 6% per annum income, paid to investors on a monthly basis. And we have a highly-rated industrial fund, DIF4, with a similar distribution yield, average lease term of 11 years and occupancy rate of 99%.

GH: They are both unlisted?

SB: Yes, and investors should consider whether every part of their investment portfolio needs to be liquid. These funds give high quality income streams from core real estate, and they have low gearing. We could increase the distribution yields by simply putting more debt in but we believe that a gearing range of 30% to 40% is the right place to play.

GH: Is this an unlisted version of the listed Long WALE REIT (ASX:CLW)?

SB: It’s a similar diversified fund but holding different assets and much smaller than CLW at this stage. We mix assets from office or retail or industrial to take advantage of diverse opportunities as they arise. And I’ll just add that we have over 15,000 direct investors in our funds and we’re supported by over 1,200 financial advisers. We manage more third-party capital in commercial real estate than anyone else in Australia.

Charter Hall's free ebook 'Your Guide to Investing in Australian Commercial Property' is linked here.

Graham Hand is Managing Editor of Firstlinks. Steve Bennett is Chief Executive Officer at Charter Hall Direct and was elected President of the Property Funds Association in April 2019. Charter Hall is a sponsor of Firstlinks. This article is for general information purposes only and does not consider the circumstances of any person, and investors should take professional investment advice before acting.

For more articles and papers from Charter Hall, please click here.