Even as the world moves closer to becoming ‘cashless’, we seem to care deeply about our cash. Judging from the reaction to the announcement of the design of a new $5 note, we care passionately about how our cash looks.

For those who haven’t been caught up in the frenzy about the new note, let me briefly fill you in.

The Reserve Bank of Australia recently released images of the new $5 note that will be introduced into circulation from 1 September 2016 year, the beginning of a process of issuing new notes across the range of denominations. New artwork will be added on each new note including different species of wattle and Australian native birds.

The new series of notes will have some significantly improved security features to help prevent counterfeiting. Also, to assist the visually impaired, there is a new tactile element that will mean each denomination of note feels different.

Sounds good, no controversy there ... not!

No sooner had the pictures of the new $5 note gone up on the RBA’s website … controversy. Apart from some who simply want the picture of the Queen to go, most of the criticism was levelled at the wattle. Some think it looks like yellow caterpillars, others see bacteria or even … well, vomit. The tactile features are appreciated, though one comment suggested that “only the vision impaired will like this new note”. Not the reaction Glenn Stevens and his team were expecting.

It’s wonderful that we’ve finally done with notes what we did with coins more than 30 years ago – make them easier for the visually-impaired to use. Some of the simple things in life that most of us take for granted, like having a look at the change we’re given to make sure we haven’t been diddled, are difficult for a significant number of people.

A bit of coin history

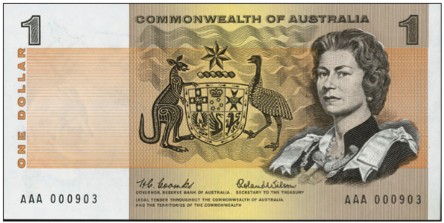

I was part of the team at Treasury that introduced the $1 coin back in 1983-84 with an interrupted serrated edge to assist the visually-impaired identify it more easily. It might actually surprise a lot of people to realise that Australia did not always have a $1 coin. When decimal currency was first introduced on Valentine’s Day in 1966 the $1 denomination was a note. A rather drab, brown-coloured note, which had Queen Elizabeth and the Coat of Arms on it. The decision to switch to a coin meant that another denomination had to be redesigned so that the image of the Queen appeared somewhere on our paper currency. The $5 note, which originally had Joseph Banks on one side and Caroline Chisholm on the other, was chosen and redesigned for that purpose. There was, at that time, almost no opposition to the idea that Australia’s currency had to honour the Queen in such a way.

The design for the $1 coin triggered some amusing internal debate at Treasury. The Treasurer at the time was John Howard, who proposed that we should look for designers to portray Australian industry. The idea of being Aussie in some way was wholeheartedly embraced by staff, but we could not see how a picture of, say, a mining head poppet would distinguish us from any other country that had mines. Fortunately, Stuart Devlin, who’d designed the original decimal coins 18 years earlier, came up with the lovely image of five kangaroos that we still have on the $1 piece.

Many people simplistically assumed that the $1 coin would be bigger than the 50 cent piece since it’s worth twice as much. Apart from the fact that no coin is really ‘worth’ its face value except by the decree of the government, the critics overlooked that it was going to be gold in colour, rather than silver, and so didn’t need to be bigger. Besides, adding a coin larger than the 50 cent piece would have made people’s pockets ridiculously heavy. The size was set as very similar to the 10 cent piece.

Features for the visually-impaired

The easiest way to tell coins apart is from their size and colour. While most people could tell the difference between the gold coloured $1 and the silver coloured 10 cents, the visually-impaired don’t have that luxury. We devised a series of tests, using visually-impaired people and blind-folded staff members, to evaluate a range of physical features. We found that the interrupted serrations worked well.

I must share an anecdote about the tests. A lady who worked in the Treasury typing pool (sigh, yes, I’m old enough to have worked in the days before word processing and desktop computers) was blind. Her work was to type dictated recordings and she was astonishingly accurate.

When we tested the new coin with her she revealed that, though the interrupted serrations were helpful, she personally didn’t need it. She could distinguish every coin by the sound it made when dropped on the table. We rolled them all – 1 cent, 5 cent, 10 cent, etc – or we dropped them or we flipped them, and this lady identified them correctly every time.

A feature to assist the visually impaired was not included in the original note design, but it changed as a result of a campaign started by a young visually-impaired boy. To him and to the officers of the RBA who listened to his arguments, I say ‘well done’.

More goes into the design of notes and coins than meets the eye.

Warren Bird is Executive Director of Uniting Financial Services, a division of the Uniting Church (NSW & ACT). He has 30 years’ experience in fixed income investing. He also serves as an Independent Member of the GESB Investment Committee.