Superannuation fund trustees face a challenging objective for pension options to achieve relatively strong investment returns while managing downside risks. However, the different circumstances of pension options – including different tax rates relative to accumulation options – present an opportunity for trustees to tailor investment strategies to better meet retiree needs.

Opportunities for super trustees

Broadly, we see three main opportunities:

1. Investing a slightly higher portion of equities in Australia (relative to the accumulation period) to take advantage of franking credit benefits

2. Reducing pension option volatility to improve the likelihood of meeting (after tax and fees) return and risk objectives, which could include:

- investing in assets that have more downside protection (which may give up some return)

- reducing overall equity exposure

- increasing exposure to lower volatility strategies (for example, low beta equity or alternative risk premia strategies)

- consideration of derivative strategies (for example, put options, cash plus call option strategies, which could be implemented across equities, interest rates or volatility markets).

3. Increasing portfolio diversity to improve risk and return outcomes, such as a higher or lower exposure to illiquid assets.

Separation of accumulation and pension strategies

It would be ideal for accumulation and pension sections to be managed separately to ensure that all matters, especially tax, are appropriately considered for both phases.

This is not always happening but is starting to evolve. Funds are introducing a variety of approaches including:

- A ‘bucket’ approach where several investment pools are created to reflect different time horizons

- A ‘life-cycle’ approach where exposure to growth assets typically reduces as a member’s age increases

- An ‘income’ approach including offering annuities (or income-focused investments) to members to meet the need for a stable income

- An alternative ‘static’ approach, adopting a traditional strategic asset allocation but specific asset classes or strategies are tailored to better meet retirement needs (e.g. low volatility equity strategies).

Risk, returns and sequencing

In terms of return objectives, superannuation fund trustees can look at a range of options for pension members, including income-based objectives (once they have made the distinction between investment income and retirement income), a cash +x% objective (if this approach can keep up with the rising costs of living) or a CPI +x% objective.

We believe the latter approach is the most appropriate for the majority of pension assets.

Another key consideration is the sequence of returns in the pension phase. As superannuation fund members enter the pension phase at different times, it’s impractical to eliminate sequencing risk but it should be managed. The key focus should be to limit both the frequency and magnitude of negative returns.

While the industry-developed Standard Risk Measure (SRM) gives some indication of the potential risk of an investment choice option, the measure has several flaws, such as not considering the magnitude of losses or inflation impacts. Using the SRM in isolation as a risk objective for the pension (or accumulation) phase is of limited benefit.

We advocate a greater focus on the risk of not meeting the return objective and ensuring that any under-performance against the return objective is limited to the extent possible.

Investment strategy for retirement

The investment objectives of pension options should be broadly similar to accumulation options. It makes little sense spending your entire working life targeting one set of investment outcomes, only to change the target materially when retirement hits.

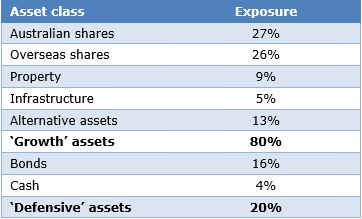

A typical ‘growth-oriented’ accumulation investment option might look like this:

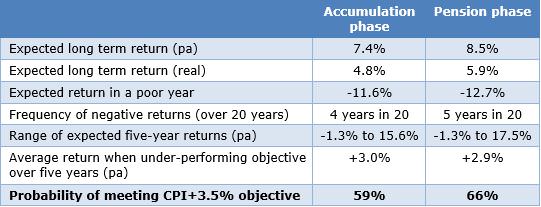

Based on our modelling of very long-term asset class returns, the expected characteristics of the above portfolio are set out below (assuming a return objective of CPI+3.5% pa after tax and fees). We have shown this for both the accumulation and pension phases:

For any given asset allocation, a pension option typically has higher risk and return characteristics than the equivalent accumulation option, simply due to it not being subject to tax.

Some superannuation funds have adopted an approach of adding a margin to the return objective for their pension options, to allow for the higher expected returns. Others have kept the same return objectives as the accumulation options but have accepted that there is a greater likelihood of meeting the return objective for the pension option than for the accumulation option. We believe a better approach would be to directly consider the precise circumstances of pension options, rather than constructing pension fund objectives by making spurious adjustments to accumulation option objectives.

Adopt a lower volatility option

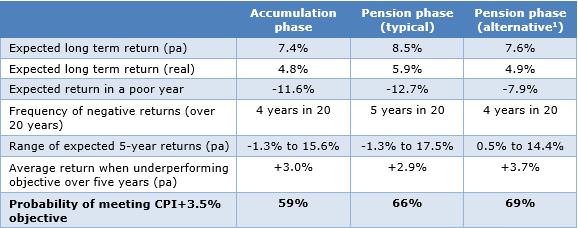

An alternative approach could be to implement a lower volatility investment strategy for a pension option with a CPI+3.5% p.a. objective by increasing the allocation to defensive assets by 20%. The following results could be obtained:

1. The alternative asset allocation aims for a less volatile approach by increasing exposure to defensive assets by 20% and reduces exposure to higher risk assets.

The alternative allocation is based on a long-term, strategic view of investment portfolios, rather than a shorter-term tactical view. In the current environment, a 20% increase in exposure to cash and bonds would reduce the likelihood of meeting return objectives so we would advocate greater diversification of both growth and defensive assets to meet risk and return needs. This would include a higher exposure to investments with limited economic sensitivity and/or alternative risk premia strategies.

Compared with the previous pension portfolio, the updated pension portfolio has:

- A higher probability of meeting the return objective

- Materially better returns when under-performance occurs, and

- A lower frequency and magnitude of negative returns.

The overall expected return is lower than the more growth-orientated portfolio, but given the benefits above, we believe the updated pension portfolio is a superior asset allocation than simply using the same asset allocation as the accumulation phase.

A lower volatility portfolio may be more aligned to a pension option’s investment objectives. This is not to move down the risk/return spectrum per se, but to create a portfolio that increases the likelihood of achieving performance objectives. We also highlight that the above analysis is based on long-term assumptions, meaning an immediate move to a lower volatility strategy may not be the most appropriate course of action.

Paul Taylor is a Senior Investment Consultant at Willis Towers Watson. This article is for general information only and does not consider the circumstances of any individual.