Deep pools of capital chasing prime non-residential assets combined with low funding costs will continue to be a feature of the Australian market in 2020.

Globally, governments have reverted to a more accommodative monetary stance amid the risks of slowing economic growth and muted inflation. This ‘low for longer’ theme supports investment fundamentals in real estate.

Institutional investors around the world dedicate an average of 10.4% of their portfolios to real estate, below the average target allocation of 11.4% (that is, their strategic intention). Allocations are rising, with just under two-thirds of the 154 institutions participating in the ANREV, INREV and Pension Real Estate Association (PREA) Investment Intentions Survey planning to ramp up their real estate exposure in 2020. About 95% intend to deploy new capital into the sector in 2020.

Popularity of Sydney and Melbourne

These global institutions expect to invest over US$100 billion into real estate in 2020 and Australia is well placed to capture a slice of this capital deployment.

In terms of investor’s regional allocations, 77% plan to increase existing allocations to Asia-Pacific, with just under 7% expecting their current allocations to decrease.

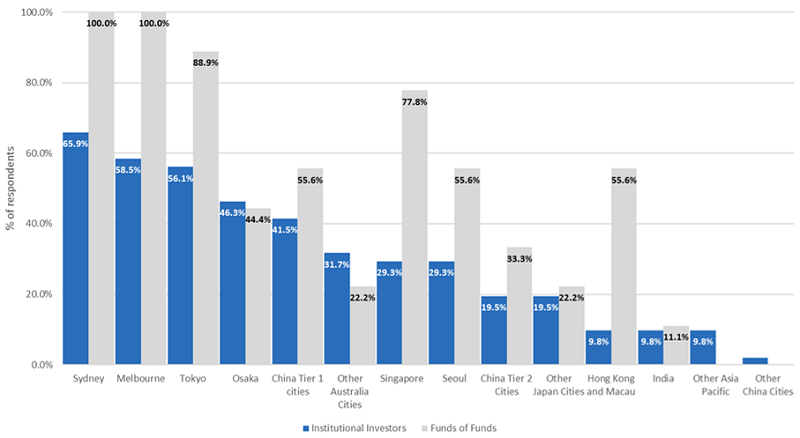

Of those looking to invest in the Asia-Pacific region, Australia remains the preferred investment destination, with Sydney and Melbourne topping the list for the fourth consecutive year. The two Japanese powerhouse cities, Tokyo and Osaka, rounded up the top four investment destinations (Figure 1). Sydney was the overall top pick, highlighted by two-thirds of investors.

Figure 1: Preferred Asia-Pacific Investment Locations for 2020

Note: Based on sample of 50: 41 institutional investors and 9 fund of funds

Source: ANREV, INREV, PREA

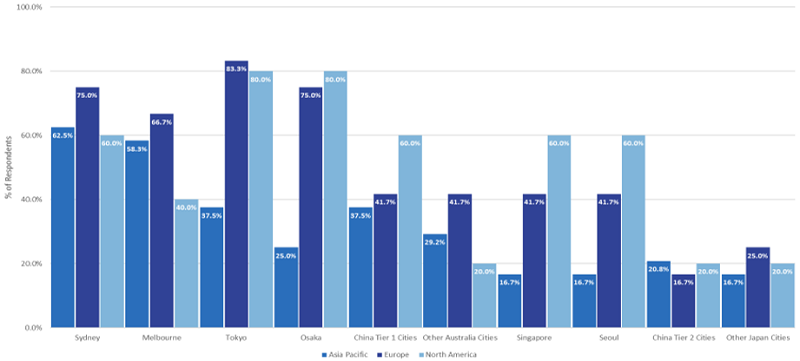

When breaking down by investor domicile, European investors are more optimistic on Sydney and Melbourne than investors from Asia-Pacific or North America (Figure 2). The latter two are more focused on the Japanese cities of Tokyo and Osaka.

Figure 2: Top 10 Most Preferred Asia-Pacific Locations for 2020

Note: Based on sample of 50: 41 institutional investors and 9 funds of funds

Source: ANREV, INREV, PREA

Office and industrial preferred to retail

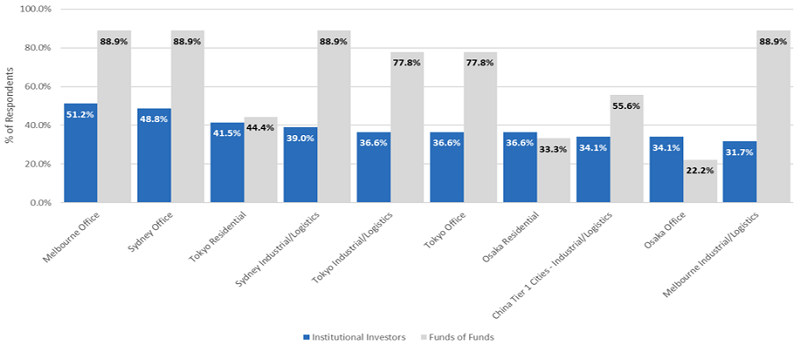

Drilling down to real estate sectors, Asia-Pacific’s top ten destinations are dominated by the Australian and Japanese markets, with Tier 1 cities in China being the only other location represented (Figure 3). In line with the 2019 results, Melbourne office followed by Sydney office remained the most preferred city-sector investment combinations. Sydney industrial/logistics ranked fourth while Melbourne industrial/logistics ranked 10th.

Notably, retail did not feature in the top 10 city/sector combinations. With both structural (e-commerce, changing retail formats) and cyclical (consumer sentiment, retail spending) impacting retail, the appetite for retail assets has substantially decreased amongst institutional investors.

Figure 3: Most Preferred City/Sector in Asia Pacific for 2020

Note: Based on sample of 50: 41 institutional investors and 9 fund of funds Source: ANREV, INREV, PREA

Lower interest rates are supporting prices

Across most Australian sectors and sub-markets, with the exception of large retail centres, the underlying real estate fundamentals are good – positive demand, high occupancy, growing rents and limited supply.

For foreign investors, Australia offers the additional benefits relative to many other global destinations of stability, transparency and governance, and a falling exchange rate has seen currency hedging costs come down considerably in recent years.

Although the upcycle is now into its 11th year, lower interest rates will be supportive for non-residential real estate in 2020. The current yield arbitrage is significant. Australian bond yields are at record lows, with the 10-year bond yield compressing from 5.3% in 2009 to around 1.0% currently. Lower bond yields are flowing through to asset values via lower cap rates (yields).

The yield on non-residential property across most sector and markets is also at record lows. Yet the average premium to the 10-year government bond still offers a significant premium. As table 1 shows, for prime Sydney office the spread is 350 basis points (3.5%), for prime Sydney industrial its 388 basis points (3.88%) and for prime Sydney regional retail centres its 500 basis points (5%).

Back in 2007, the yield spread for prime office, industrial and retail was negative. In other words, yields on real estate were actually below the prevailing 10-year government bond yield.

With the cash rate at 0.25%, and term deposits and Australian government bonds paying between 0.25% and 1.5% per annum, non-residential real estate yields look comparatively attractive.

Table 1: Prime Yields – December 2019

In this lower-for-longer environment, investors are recalibrating their expectations of the required rate of return from real estate. Assets will likely continue to trade on yields which were previously unheard of. There is also limited tier one investment stock to satisfy capital demand from both domestic and global investors, thereby putting further downward pressure on yields and pushing asset prices higher.

Focus on quality

In such an environment, investors need to remain cognisant of risk factors and maintain discipline in investment decision-making. Now is not the time to be chasing secondary assets which are trading at small discounts to prime assets. In every real estate cycle where capital is abundant, some investors desperate to get set misprice secondary assets providing little buffer when the cycle eventually turns.

Across the sectors, we anticipate continued strong demand for office, industrial and real estate backed social infrastructure assets (childcare, government leased, student accommodation etc).

Retail is expected to face further challenges, although those assets focused on convenience, non-discretionary spending (neighbourhood, supermarket anchored centres) will do better than the larger regional retail centres (department and discount department store anchored) that are more dependent on discretionary, particularly fashion, spending.

Ultimately, investing in the year ahead will come down to quality – the quality of the cashflow and asset. Investors should focus on assets in prime locations, with strong tenant covenants, attractive rent review structures and long-term leases. Quality will win in the long run.

Adrian Harrington is Head of Capital and Product Development at Charter Hall, a sponsor of Firstlinks. This article is for general information and does not consider the circumstances of any investor.

For more articles and papers from Charter Hall (and previously, Folkestone), please click here.