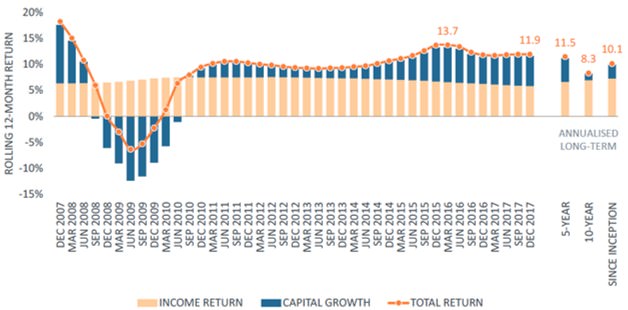

Seven years into an upcycle, Australian non-residential (commercial) real estate returns have stabilised according to the latest PCA/IPD Australian Property Index published by MSCI. The Index, which tracks the performance of more than 1,470 institutionally owned office, retail, industrial, hotel, and medical properties, generated a total return of 11.9% in the year to December 2017. This is below the peak of 13.7% recorded in the year to 31 March 2016 but is still above the 5- and 10-year averages of 11.5% and 8.3% respectively (Figure 1).

Figure 1: Non-Residential Real Estate Total Returns: 2007 – 2017

Source: MSCI

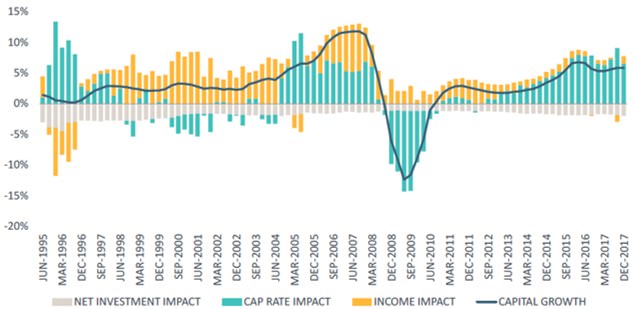

Non-residential real estate, like most asset classes, has been buoyed in recent years by bond yields falling to record lows. Most of the returns from real estate in the past few years has been due to capitalisation rate (yield) compression (as cap rates go down, values go up) rather than income growth (Figure 2).

Figure 2: Drivers of Non-Residential Property Investment Returns: 1995 – 2017

Source: MSCI

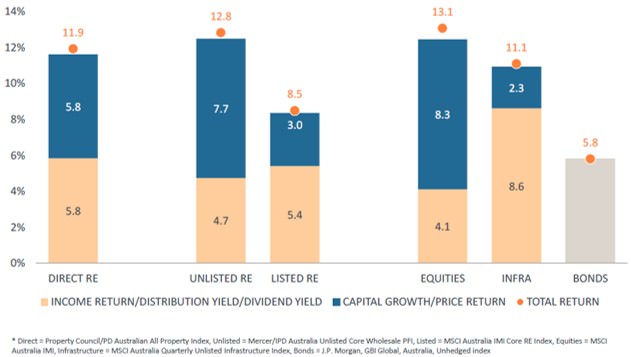

Direct real estate (returning 11.9%) and unlisted real estate (12.8%) typically have gearing between 20% and 50%, and they outperformed infrastructure (11.1%), listed real estate (8.5%) and bonds (5.8%), but underperformed equities (13.1%) during calendar 2017 (Figure 3). Investors hunting for yield were well rewarded if they invested in infrastructure and direct real estate with income returns of 8.6% and 5.8% respectively.

Figure 3: Asset Class Returns: Year to 31 December 2017

Source: MSCI

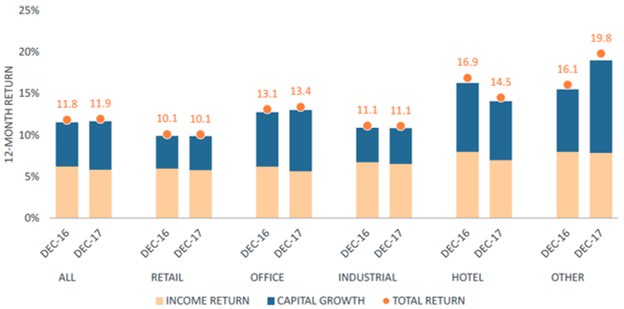

Sub-sector performance highlights demographic trends

Drilling down into the various sub-sectors shows a wide variation in performance. The best performing sector was ‘Other’ (medical, health, seniors living, and car parks) with a total return of 19.8% in the year to December 2017 followed by hotels at 14.5%. Notably, both these sectors were also the best performers in 2016.

Health and medical assets are now well and truly on the radar of institutions, as are the other alternate assets like childcare, seniors living, student accommodation, and data centres. Medical and health centres are benefiting from the aging population, changes in the delivery of medical services, and their higher yield relative to office, retail, and industrial assets, although the re-rating of the sector has seen the yield gap narrow in recent times.

Hotels, particularly in the gateway cities of Sydney and Melbourne, are booming. Strong growth in international and domestic tourism and buoyant business conditions in both cities has occupancy levels and room rates at near-record levels. Sydney’s average occupancy in 2017 was 85.9% (on some nights it was near impossible to find a room) and the average daily rate increased by 4.7% to $230 per night. Melbourne’s average occupancy in 2017 was 83.1%.

Figure 4: Non-Residential Real Estate Sectors: Total Returns 2016 and 2017

Source: MSCI

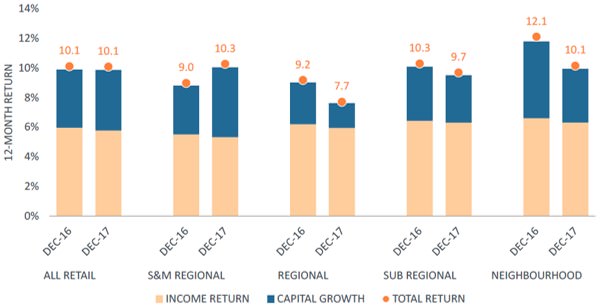

Retail real estate was the worst-performing sector with a total return of 10.1%. Given the challenges facing the retail sector, both structural (Amazon, on-line retailing) and cyclical (high household debt, low wage growth), many would be surprised that retail generated a double-digit return in 2017.

One explanation is that Super and Major Regional Centres (the mega retail centres) comprise almost 60% of the market capitalisation of the Retail Index, and those centres generated an average total return of 10.3% for the year (Figure 5). Globally, institutions are lining up to buy these so-called tier one ‘fortress malls’. The rationale: they dominate their trade area and are perceived to create a community destination (retail, entertainment, restaurants, medical etc.) rather than just a shopping experience. Therefore, they are best placed, of all the retail centre types, to withstand the onslaught of on-line retailing.

Figure 5: Retail Centre Total Returns: 2016 and 2017

Source: MSCI

In November 2017, the AMP Capital Shopping Centre Fund and the AMP Capital Diversified Property Fund each acquired a 25% stake in Indooroopilly Shopping Centre in Brisbane with management rights, in a deal worth more than $800 million on a yield of 4.5%. This was the biggest single-asset retail transaction and represented the first super-regional shopping centre to be sold via an on-market campaign since 2010. Other notable transactions in 2017 include GPT acquiring the 25% interest they didn’t already own in the 153,000 square metre Highpoint Centre in Melbourne for $680 million from their JV partner, the Besen Family, on a yield of 4.25%. GIC, the Singaporean Sovereign Wealth Fund, exchanged a 50% stake in Queen Victoria Building, The Galleries, and The Strand Arcade, all in the Sydney CBD, for a 49% stake in the ASX-listed Vicinity’s Chatswood Chase. The $562 million deal was struck at a yield of 4.75%.

The easy money has been made

Overall, at Folkestone we are underweight retail as we believe the headwinds will continue and there are better opportunities in other sectors. Deploying capital at this point in the cycle requires patience and discipline. With real estate yields across most sectors at record lows, the easy money has been made.

We expect the pace of cap rate (yield) compression to slow and the focus to move to asset-level income generation as the primary driver of non-residential real estate performance. Investors should recycle out of assets that have limited capacity to grow the cashflow and retain or buy assets where there are opportunities to actively manage, refurbish, or reposition to drive income growth. Asset specific factors will be critical including landlord tenant relationships, quality of tenants, lease expiry profile, location, and the active management of the building’s facilities. With record high electricity prices and electricity being one of the major costs of operating a building, efficient operating of the building will be crucial to optimising the bottom line.

Adrian Harrington is Head of Funds Management at Folkestone, a sponsor of Cuffelinks.