Last week's survey on whether to include the value of the principal place of residence in eligibility tests for the age pension drew 2,000 responses and much debate. We thank everyone who shared their views and opinions.

Our readers had a lot to say - for and against the policy change - so here we present a summary of the findings. If you want to delve into more detail, including the 1,000 plus comments, linked here is a complete results report.

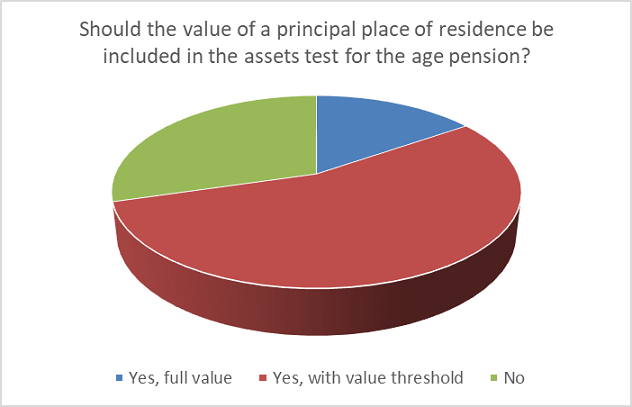

Q1 Should the value of a principal place of residence be included in the assets test for the age pension?

In the 'yes' corner, we had 70% of respondents with 15% wanting to see the full value of the home included in the asset test and 55% thinking a value threshold is needed. That left 30% opposing inclusion totally.

Threshold values

We asked for views on what threshold might be appropriate. After zero, suggested amounts ranged from $500,000 all the way up to $2 million with varying caveats and allowances, including indexation, basing off median values by suburb/LGA/region (or median + a percentage), different levels for couples versus individuals, taking into consideration price fluctuations, stepped introduction over many years, using unimproved (land) values only, no retrospective changes ... the list seemed almost endless.

There were calls for the entire tax system to be overhauled (mmm, no small task), the reintroduction of death or inheritance duties for homes that are left to the next generation, or the abolition of negative gearing.

The idea of a universal pension, which is taxed along with any other income, was also commonly floated.

A big concern was if pensioners would be forced to sell the family home, rather than make use of home equity redraw products. Many suggested more equitable access to the Pension Loans Scheme or similar. Issues surrounding proximity to family and social networks, medical care, and even using the eventual sale of the home to fund age care costs were also raised.

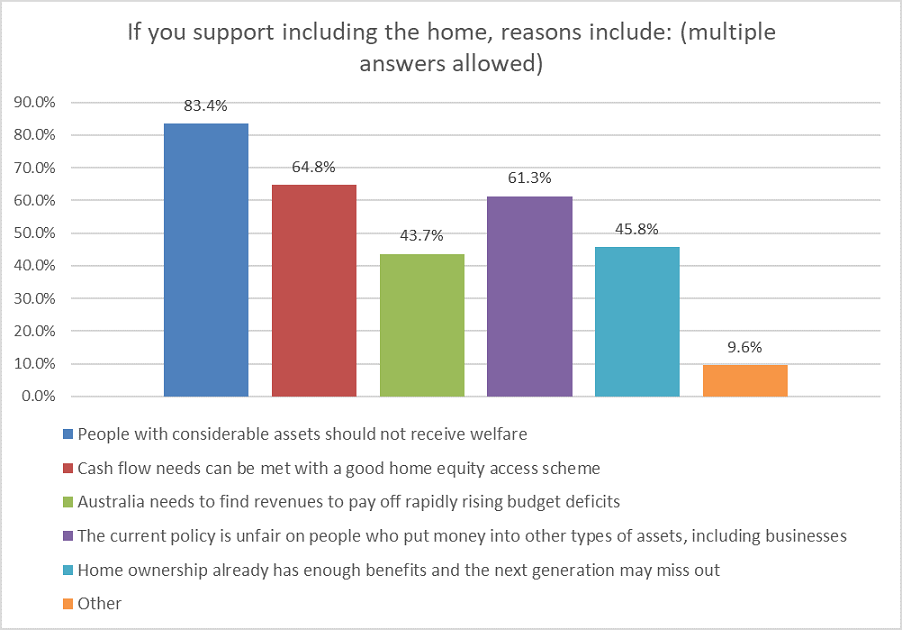

Q2 If yes, for what reason(s)?

The most common reason given by those answering 'yes' was that people with considerable assets should not receive welfare (83%), followed by the use of home equity to fund retirement cash flow needs (65%), and the inequity of the system compared to those who have invested into other assets throughout their lives (61%).

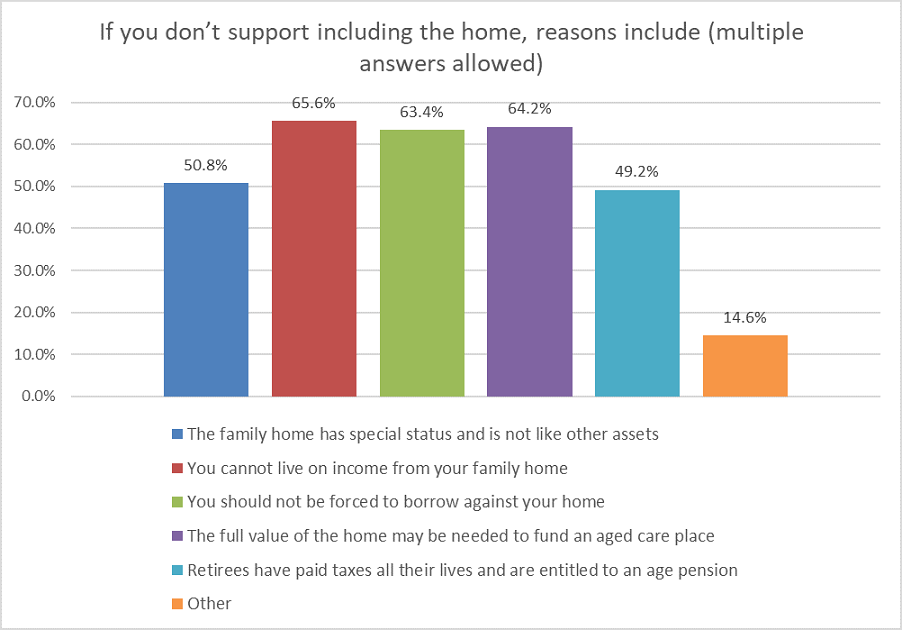

Q3 If no, for what reasons(s)?

The top reason given for not including the value of the home was that people's primary residence is non-income producing (65.6%), closely followed by using the home to fund an aged care place (64%) and an aversion to being forced to borrow against the home (63%). Over half still viewed the home as having a special status that should be left alone.

Further comments

We received over 450 comments in the final open-ended section, which can be viewed in this full report (a meaty 58 pages).

Leisa Bell is an Editorial Associate at Firstlinks.