Discussions about the gender wealth gap in Australia often centre on superannuation yet it’s not as simple as a shortfall in super contributions. A closer look at the numbers reveals a more complex picture, with broader economic and behavioural factors at play.

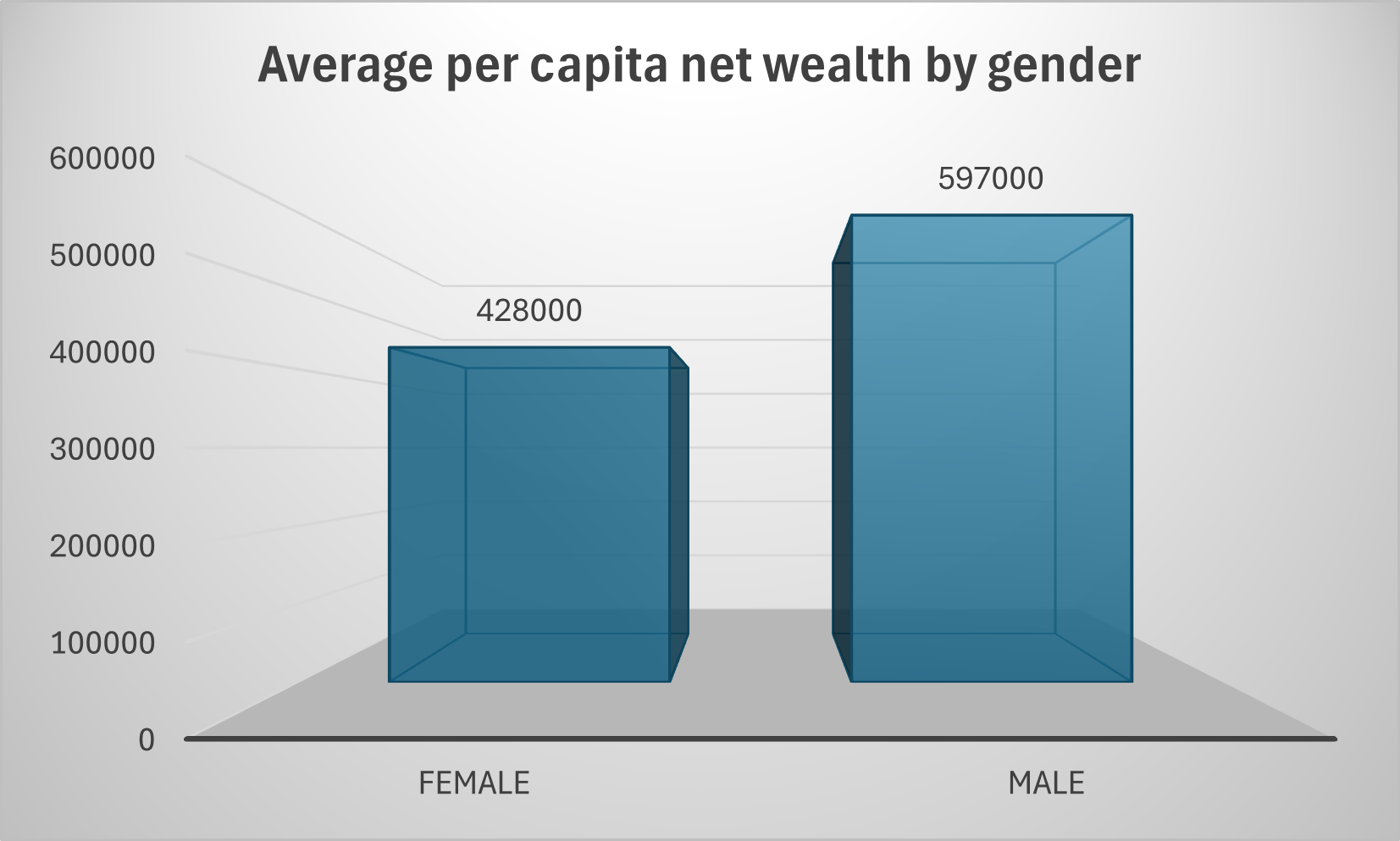

Just-released Finder research 'The State of Women’s Wealth - April 2025' shows that the average Australian woman has $428,000 in net wealth - an impressive figure on its own. However, the average Australian man holds $597,000, meaning men have 40% more wealth than women. This disparity is because men’s wealth has grown faster in recent years. This is due to the exceptional performance of Australian property market and global sharemarkets over the past five years, both of which are dominated by male investors.

Rounded to the nearest 1,000. Source: Finder Consumer Sentiment

As covered previously in Firstlinks, the gender super gap is a systemic issue driven by a range of structural factors, including:

- Unpaid caregiving responsibilities

- Higher rates of part-time and casual work

- Career interruptions due to parental leave and caring duties

- Occupational segregation, where women are overrepresented in lower-paying industries

- Limited access to leadership roles and promotions

- Bias and discrimination in hiring, pay negotiations, and workplace policies

Another revealing factor in the wealth gap is property ownership. Among Gen Z Australians, 48% of men own a home compared to just 33% of women. Furthermore, 18% of Gen Z men own their home outright—double the 9% of women in the same cohort. For millennials, the disparity continues. While men and women are almost equally likely to have a mortgage (45% vs 43%), men are 50% more likely to own their home outright (15% vs 10%). Given that property is one of the most significant wealth-building assets in Australia, the lower homeownership rates among women have long-term financial implications.

Beyond property, investment trends also play a role. Studies have consistently shown that men are more likely to invest in equities and take on higher-risk, higher-return investments. Women, by contrast, tend to favour lower-risk assets, which, over time, can result in lower overall returns.

Let’s dive into what the wealth gap looks like across different life stages.

Childhood and adolescence

Recent findings from Finder’s Parenting Report suggest that boys receive more pocket money than girls, earning an average of $10.30 per week compared to $7.50. Over a year, that’s a difference of $145.60. Boys tend to be paid for outdoor chores like mowing the lawn, while girls are expected to complete unpaid “indoor” work, such as tidying up. Experts also note fathers are more likely to discuss money with their sons, while mothers talk to their daughters about financial matters with less confidence.

Interestingly, the biggest gender gap in superannuation balances occurs in adolescence, with the average young male holding $11,710 in super, while the average young female has just $7,455—a difference of 57%. A closer look at employment data reveals why; young men are more likely to work in full-time roles or enter trades straight out of school, whereas young women are more likely to pursue higher education. Finder’s Consumer Sentiment Tracker shows that 25% of 18–20-year-old men have a full-time job, compared to just 15% of women.

Studying/starting a career

According to QILT data, salaries between men and women within six months of finishing university remain close, with male graduates earning just 2% more than their female counterparts. Yet within three years, this pay gap widens to 10%. What causes this shift? While industry selection plays a role (with more men entering higher-paying fields like engineering), differences in salary negotiation and career advancement opportunities may also be contributing factors.

Finder’s research highlights that men are more likely to request a pay rise, with 24% of men negotiating for higher wages compared to just 14% of women. Even when both genders ask for a raise, men receive an average pay bump of $4,000, whereas women receive just $2,424—almost half. Additionally, men are 33% more likely to actually receive the pay rise they request, according to the report “Do Women Ask?”.

Participation at senior levels – and receiving commensurate pay – is a complex topic, but with simple data points. The Workplace Gender Equality Agency (WGEA) reports that while women make up 51% of the workforce, they hold only 32.5% of key management positions and just 19.4% of CEO roles. Are women not in senior roles because of that common argument that men are better negotiation capabilities? Or is it a lack of opportunity in certain industries? Or intrinsic bias from hiring managers? Perhaps a combination of all these but consequently, women, on average, retire with significantly less wealth than men.

Motherhood and early career

A generation ago, having children didn’t carry the same financial weight it does today. With the rising cost of living and the need for dual incomes, the decision to start a family now has lasting financial consequences—especially for women.

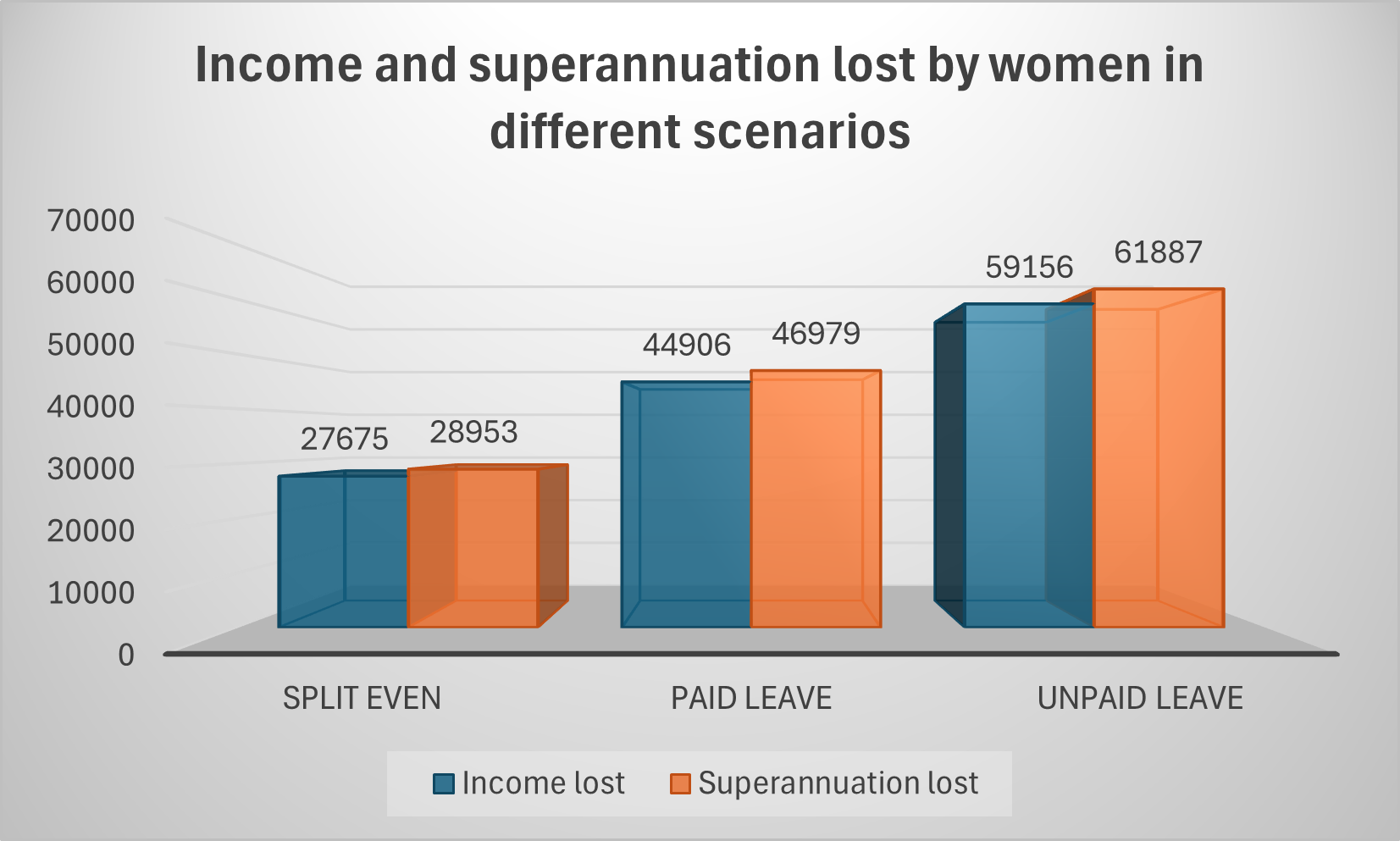

Finder’s report 'The State of Women’s Wealth' shows women continue to take the vast majority of parental leave, accounting for 83% of all primary carer leave used. Government support has increased in response; paid parental leave will rise to $23,810.80 over six months by July 2026, and for the first time, superannuation contributions will also be included. This will help reduce the long-term financial impact of career breaks, as women currently lose an estimated $4,580 in super contributions for each child which grows to $46,979 come retirement.

Split even: both partners take 6.45 months of annual leave and are paid for 2.2 months of this by their employer

Paid leave: women take 9.1 months of leave and are paid for 2.2 months of this by their employer

Unpaid leave: women take 9.1 months of leave and do not receive any paid leave from their employer

Source: Finder Consumer Sentiment Tracker

They also forego $4,906 of income, making it a total of $91,885 of superannuation they have missed out on by retirement. By contrast, men lose just $11,136 ($5,693 in superannuation come retirement + $5,442 in income lost).

Beyond lost wages, mothers continue to shoulder the bulk of unpaid household labour:

- 34% of women say they handle almost all household duties, compared to just 10% of men

- 63% of women take on at least 75% of the chores, while only 23% of men do the same

- 12% of women say their careers have been impacted by household responsibilities, compared to just 6% of men

Career progression or midlife

Life between your mid-30s and mid-50s is a period of shifting responsibilities, evolving career paths and growing financial pressures. Many women in this stage juggle multiple roles—managing careers, raising children, and caring for aging parents—all while trying to build long-term financial security.

This stage of life sees women carrying a disproportionate share of unpaid caregiving. Australia has 2.65 million unpaid carers, and 72% of primary carers are women. This caregiving burden, combined with part-time work and career interruptions, significantly impacts women’s earnings, superannuation balances, and long-term wealth.

Women’s financial setbacks become increasingly apparent in midlife. While superannuation gender gaps are slowly improving, the latest ATO data (from 2021) shows that the average super balance for women was $150,922, compared to $189,892 for men—a gap of 20.5%.

'The State of Women’s Wealth' also highlights how this gap extends beyond super:

- 48% of women have less super than they expected at this stage of life (vs. 38% of men)

- 57% of women have less savings than expected (vs. 41% of men)

- 52% of women earn less than they thought they would (vs. 37% of men)

- 48% of women feel behind in their career progression (vs. 34% of men)

- 46% of women feel behind in home ownership (vs. 33% of men)

These individual setbacks contribute to the $51.8 billion annual cost of the gender pay gap to the Australian economy, according to WGEA. One major driver of women’s lower lifetime earnings is part-time work. WGEA data shows that 29.7% of women work part-time, compared to just 10.8% of men. More women are also employed casually, meaning fewer benefits and lower super contributions.

Over 50

Women over 50 often continue to feel the pressures of the 'sandwich generation', as well personal upheavals and career shifts. They tend to fall into two broad categories; either they are looking to upskill, seek promotions, or invest to secure their retirement. Or, particularly those experiencing separation or divorce, are rebuilding from scratch.

For a rising number of women, financial setbacks in later life are leading to far greater consequences—particularly homelessness.

- One-third of all divorces (30.7%) are granted to women aged 50+

- Older women are the fastest-growing group experiencing homelessness in Australia

- 31% increase in women over 55 experiencing homelessness from 2011 to 2016, with a further 6.6% rise by 2021

- Homelessness among older women has grown almost 40% in a decade (2011–2021)

This crisis is driven by a combination of low super balances, part-time work, career interruptions, and the gender pay gap, compounded by rising living costs, an unaffordable rental market, and age discrimination in employment.

Research shows that certain factors significantly increase the risk of homelessness for women over 55:

- 28% of women in private rentals are at risk

- 34% of women not employed full-time are at risk

- 65% of single mothers are at risk

- 85% of women with a history of financial insecurity face a high risk

Retirement

The average woman would have to add an extra $236 per month into her superannuation fund, or alternatively, work an extra 11 years, in order to retire with the same super balance as the average man.

The Government, the ATO, various super funds all recognise women retire with 25% less superannuation, on average, than men (according to ASFA), in addition to having lower overall savings. This financial disparity places many women at a higher risk of economic insecurity in their later years, with 1 in 3 single women over 60 living in income poverty.

Finder research reveals that 35% of women aged 65 or older have less than $1,000 saved, compared to just 22% of men. Of those women aged 65 and older who do have savings, the average balance is around $46,650, while men in the same age bracket have an average of $67,920 – representing a 46% difference.

Conclusion

It’s important to celebrate the progress we’ve made. Yet, it’s still not enough. As 'The State of Women’s Wealth' clearly shows, women continue to have less wealth than men, simply because of their gender. The more we talk about the challenges facing women’s wealth and the opportunities for change, the more we learn, grow and overcome. As one teaches one… one becomes many.

Pascale Helyar-Moray OAM was one of the contributors to the Finder report. She's also the founder of Grow My Money, a platform where members can shop with scores of major Australian brands and receive a cashback into their superannuation account. She's the author of the book, Rich Woman Poor Woman.