Although the worst of the Covid-19 pandemic has passed, its effects on the global economy and real estate markets continue as legacies of supply chain disruptions and inflationary pressures interact with a fresh source of geopolitical tensions and uncertainty. Although volatility is elevated, recent performance suggests commercial real estate in Asia Pacific (APAC) are well positioned to weather whatever comes next.

In the past year, inflation forecasts have been consistently revised upward but do not spell disaster for property values, as rents tend to keep pace with inflation over time. With real estate yields at historical lows, constructing a commercial real estate portfolio that can deliver consistent Net Operating Income (NOI) growth will be crucial to mitigating the risks associated with a transition toward a higher interest rate environment.

Real estate debt, like any income-based asset class, is highly sensitive to inflation's potential to erode returns. Investors are increasingly concerned about what a transition to a higher interest rate world might mean for real estate. Clearly, the current combination of slow growth and rising bond yields poses a threat to sentiment, capital flows and pricing, although the effect was limited during the first quarter of the year.

Key factors supporting the outlook

The outlook for the Asia Pacific economy is well supported by broad border reopenings and the strength of the region's domestic economies. Real estate demand is improving, with strong labor markets underpinning growth in office demand, and the structural demand for logistics and rental housing remains robust.

In terms of a sector snapshot, supply is struggling to keep up with rapidly-rising demand for data center capacity, thereby boosting prospects of attractive NOI growth over time. Investors remain increasingly keen on the sector, especially as they focus on digital assets and infrastructure with a view to future-proofing their portfolios.

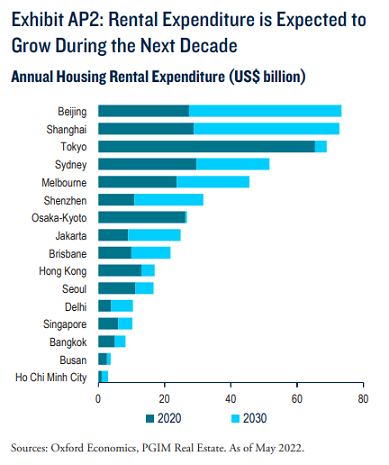

The rental housing market is expected to grow significantly in the next decade across major Asian markets with the lack of institutional depth in markets outside Japan presenting investors with an attractive opportunity to participate in the secular growth of the sector.

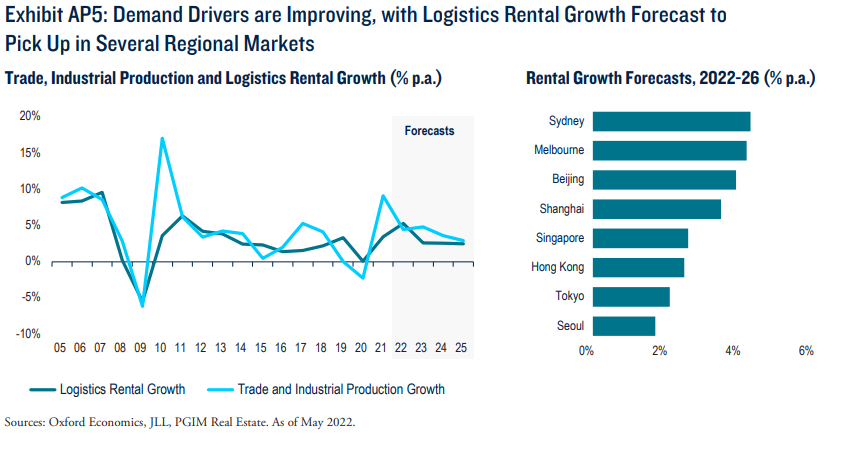

In the logistics sector, opportunities for stronger and more-robust growth are expected for Australia, Mainland China, Hong Kong and Singapore. In Japan, the development of modern assets in regional markets outside Tokyo is also appealing.

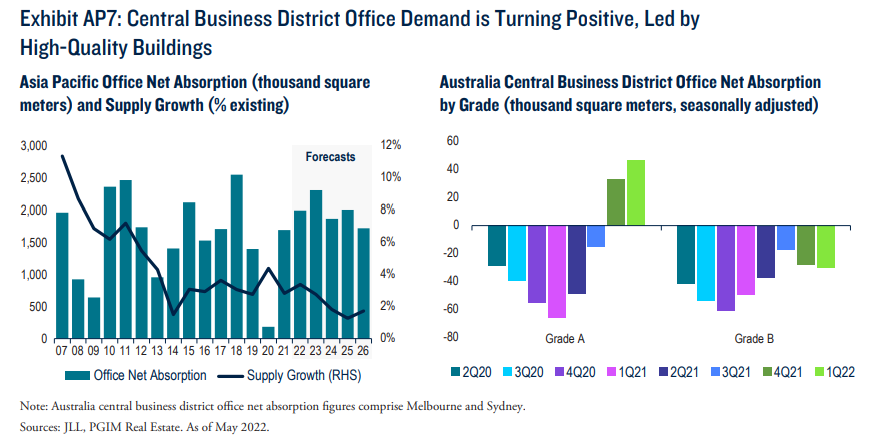

For the office sector, declining vacancy and limited supply in the near term are supportive of a stronger rental-growth outlook. Nevertheless, occupier demand continues to prioritise higher-quality and centrally located offices, with prime buildings that have strong green credentials being the most sought after.

Highlighting Asia Pacific opportunities

Given our assessment of the outlook for the Asia Pacific economy and real estate market, we identify three opportunities as being among the most attractive on a risk-adjusted basis during the next 12 months.

1. Rental housing

Housing affordability has been deteriorating, with house prices outpacing income growth during the past decade. House prices in major Asian cities are now among the least affordable in the world, with the ratio of median house price to household income reaching approximately nine times in Sydney and Melbourne.

As a result of the drop in affordability, home ownership rates have been declining consistently across the region. Housing rental expenditure has been growing fast and is expected to continue rising rapidly with major cities in Mainland China and Australia such as Beijing, Shanghai, Sydney and Melbourne forecast to see their total rental markets double in size during the next decade.

We also expect rental housing markets to grow significantly in other regional gateway cities like Hong Kong, Seoul and Singapore which seems to support the strong secular growth of Asia's rental housing sector in the coming years. Co-living, a segment of the rental-housing sector, is also drawing strong inflows of institutional capital, which is driving investment activities in Hong Kong, Singapore and Mainland China.

2. Logistics

In the logistics sector, the outlook for rental growth is improving, and growth momentum is expected to accelerate in a number of major markets. With the supply pipeline remaining relatively limited outside Tokyo and Seoul, robust demand underpinned by broadening and secular shifts toward e-commerce will drive stronger leasing fundamentals and rental growth in the Australian, Mainland Chinese, Hong Kong and Singaporean markets.

Looking ahead, the leasing fundamentals are set to shift favorably for asset owners in a number of major markets. Indeed, the latest data in the first quarter of 2022 confirms an accelerating rental growth momentum, with annualized uplift of about 13% on average in Melbourne and Sydney, and about 7% in Singapore.

As such, we continue to prefer modern logistics assets that are located within established submarkets offering good transportation links and proximity to urban residential catchments. Among logistics occupiers there is also a growing emphasis on ESG-compliant assets that offer smaller carbon footprints and that have sustainability initiatives in place.

3. Offices

With developed Asia Pacific economies continuing to ease mobility restrictions, employment growth and office leasing demand showed sharp bounces over the past 12 months. Centrally located, well-connected offices in central business districts (CBDs) that offer amenities and proximity to clients and business partners are attracting stronger occupier demand. That trend is reflected by the latest office net absorption data in Hong Kong, Seoul and Singapore.

With supply remaining tight in most markets leasing fundamentals are turning supportive of a stronger rental growth outlook for CBD office across the region. Data on effective rents in the first quarter of 2022 implies an annual growth rate in the range of 10% in 2022 for a number of markets, including Singapore, Hong Kong, Seoul and Sydney. In addition, we strongly believe in green buildings' premium and outperformance. Office space with certified green credentials offering energy efficiency will likely draw stronger occupier demand and achieve higher occupancy rates and stronger rental uplift in the longer term.

Final comments

Undoubtedly, risks around cyclical sectors have increased, making life more challenging for investors in Asia Pacific. The key is to manage threats to the economic outlook by shifting emphasis toward defensiveness and focus on structural growth. Recent events such as rising inflation and interest rates, supply pressures, renewed Covid-19 challenges and geopolitical tensions mean the focus is on assets in sectors and markets like those above that deliver dependable cash flows and in which demand is structurally supported by favourable underlying trends.

Cuong Nguyen is Executive Director at PGIM Real Estate and Head of Asia Pacific Investment Research. This article is general information and does not consider the circumstances of any person.