As share prices in some of the world’s biggest technology companies challenge their own highs in early 2024, many investors could justifiably be asking themselves if pricing might be getting overly exuberant?

For the long-term investor however, they are perhaps asking themselves, ‘who has the runway for growth?’

As this century has shown, innovation continues to be a driving force for growing businesses and arguably, the culture of innovation especially cultivated by the technology sector in this first quarter of the 21st Century has some companies better equipped and energised to continue to grow.

An innovative company is one that could be described as consistently producing a unique product or service that is not easily replicated by other companies. It also has the ability to drive the product or service towards long-term business growth and profitability.

Unlike inventors, however, innovators are essentially businesses that take existing great ideas and convert them into great products. Apple’s late co-founder Steve Jobs once quoted Picasso with the saying “good artists copy, great artists steal”. Apple revolutionised the music industry with its hit product iPod, but the company didn’t create the first mobile music player. It was Sony’s Walkman that first changed the way we listen to music.

When music piracy and song file-sharing threatened the earnings of record labels, Steve Jobs convinced them to sell music singles through Apple’s iTunes store. This was a strategic, innovative move that became an instant hit with consumers who could download music legally for 99 cents per song, and displaced music retailers in the process.

Were patent rules broken along the way? Possibly in some instances as Apple paid out millions to settle patent lawsuits. But the company also holds numerous patents and generated billions in revenue from the music industry in the years that followed.

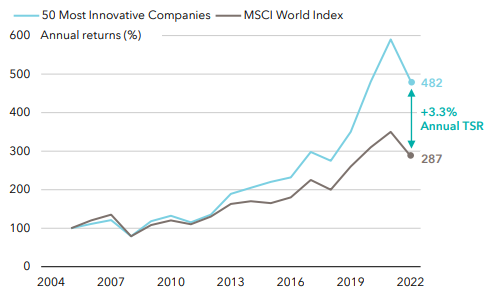

Figure 1: Innovation remains a critical driver for success today

Innovators have outperformed the market through consistent growth and value creation.

Past results are not a guarantee of future results. Source: May 2023, Most Innovative Companies 2023, BCG. Chart compares 50 Most Innovative Companies’ one-year total shareholder returns (TSR) for that year against MSCI World. Top 50 companies are reweighted annually to reflect changes to the list.

Innovation and AI

So, with the advent of artificial intelligence emerging and accelerating more recently, a reasonable question to ask is: will the innovators continue to grow and win?

While artificial intelligence isn’t new, what has changed is the advancement in computing power. Together with the huge database of the internet, today we are witnessing the phenomenal capabilities of smart artificial intelligence coming to bear.

ChatGPT is an example of smart AI. It exploded in popularity, reaching 100 million users in just two months, because of its ability to complete tasks that save time. Students were one of the earliest adopters as it’s a great learning tool.

In business, there is likely to be a dramatic change in the way we do things. The early adopters of AI will be the initial winners, and among them are the hardware providers that provide the picks and shovels. They include data centres and the producers of graphics processing units, both of which could see a ramp up in investments as the demand for AI technology grows. The speed of investment and adoption has the potential for faster returns, leaving the laggards to play catch-up.

Over time, the power of innovation, regardless of AI, will force the breakup of monopolies. In semiconductors, the rise of TSMC opened the doors for other companies to innovate and grow. In drug discovery, CDMOs2 and CROs2 enabled smaller biotech companies to thrive. The same will happen as AI advances and new competitors emerge. Despite all the competition, however, the ultimate beneficiary remains the consumers.

Innovation by geography

Taking the innovation theme concept a little further, it is also clear that the geography of innovation continues to evolve.

Countries like the US and China have established innovation ecosystems that are fuelling innovation catalysts and triggering world-changing innovation.

The ingredients of a successful innovation ecosystem are the 5 Cs: connectivity (online communications), capital (money to invest), courage (risk appetite to invest), concentration of expertise, and channels (exit channels like IPO or M&A).

The internet innovation that came out of the US had those 5Cs, while the innovations that happened in emerging markets were an adaptation of models that were working in the West. China was one of them.

During the early days of the internet, we witnessed the birth of Alibaba and Baidu, which were dubbed the eBay and Google of China. What followed was a material platform shift to mobile. At that time, China had already developed an ecosystem with the 5Cs, which underpinned the creation of world-changing innovation in mobile e-commerce, super apps and short videos.

In the US, many companies have been able to navigate regulatory risks in the past decades through a combination of a strong legal team, political gridlock, and luck.

With successful innovation ecosystems in place, we are likely to continue to see future innovation coming from both the US and China.

When looking for the innovators of the future, it will be important to focus on the companies that retain their DNA and the qualities that made them great, as major cost-cutting measures are likely to eventuate from AI. These companies have the potential for a longer growth runway.

And while a higher interest rate environment has indeed caused much financial pain, it has also made some companies more focused, leaner, and focused on ways to generate returns at a faster pace.

In this tough environment, it becomes clearer which companies are improving faster than the others.

Matt Reynolds is an Investment Director for Capital Group Australia, a sponsor of Firstlinks. This article contains general information only and does not consider the circumstances of any investor. Please seek financial advice before acting on any investment as market circumstances can change.

For more articles and papers from Capital Group, click here.