In a period when the case for investing in health care companies is perhaps as strong as it’s ever been, it is worth reminding that the advances in the sector are not just confined to the obesity wonder drugs.

In an age of remarkable health care innovation, scientists are manipulating human DNA to find new ways to treat diseases. In this era of “gene hacking”, scientists have moved from the laboratory to the real world with a treatment for the life-shortening disease sickle cell — the first approval based on a revolutionary gene-editing technology known as CRISPR (clustered regularly interspaced short palindromic repeats).

It is significant from an investor’s perspective. Whether it’s biotechnology or medical devices, history has shown that there is always been an important moment that has changed how investors view a new technology or therapy. It could be one major success or a series of successes, and we are seeing pockets of that now across the health care sector.

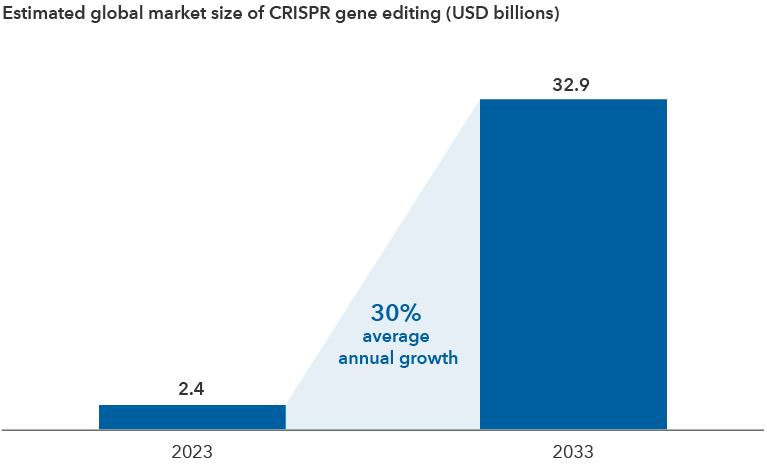

Gene editing is set to expand over the next decade

Source: Statista. As of January 2023. CRISPR stands for "clustered regularly interspaced short palindromic repeats."

Novo Nordisk’s and Eli Lilly’s weight loss drugs, originally developed for the treatment of diabetes, are prime examples. The drugs, sold under the brand names Ozempic, Wegovy and Zepbound, could reshape industries beyond healthcare.

Meanwhile, cell and gene therapy companies are forging their own paths. These therapies can modify, replace, activate and disable genes. And rather than outright change human DNA, some companies are working on ways to moderate or fine-tune how they are expressed.

Arguably, approvals for genetic disorders based on a single gene such as sickle cell are just the beginning for gene-editing therapies. There are likely to be more to come, but it’s not likely to be a linear progression. Authorities and regulators will need to see these technologies work for diseases that affect a wider patient population before their use becomes widespread.

The science and the share price

Biotech investing is notorious for hype not quite meeting reality. More recently, the US Federal Reserve’s monetary tightening policy siphoned capital away from more speculative investments like biotech.

Many companies were also caught flat-footed as demand for pandemic-era innovations such as vaccines, dropped faster than projected. During the Covid-19 period, there was tremendous excitement over anything that was going to treat the pandemic, and valuations spiked in a big way. The bubble has since burst, particularly for companies with their revenue potential tied to the pandemic.

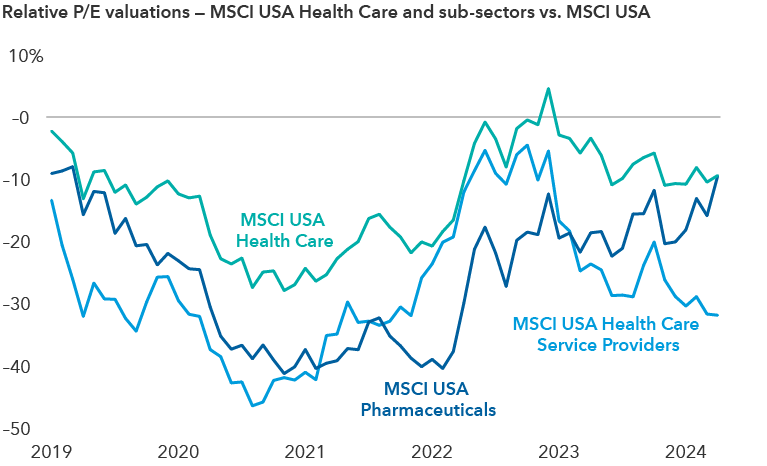

Health care stocks appear undervalued relative to the broad market

Sources: Capital Group, MSCI. Relative valuation is the ratio between the forward 12-month price-to-earnings (P/E) ratio of health care-related sectors and the MSCI USA Index. P/E for a stock is computed by dividing the price of a stock by the company’s annual earnings per share. A value below zero indicates that health care is relatively undervalued. As of 24 April, 2024.

Nevertheless, health care is a global industry, and it is an industry that long-term investors cannot ignore. Health care spending in the United States reached $4.5 trillion in 2022, according to the Centers for Medicare and Medicaid Services, or 17.3% of US GDP. Valuations have improved for industries within health care. Since the start of 2024, investors have returned to health care stocks. And if interest rates decline, that could support continued capital flows into the industry.

As investors, it’s important to remember that when an industry is on the cutting edge of science, there will always be failures. Significant hurdles remain for widespread adoption of cell and gene therapies, and health care investing is a decades-long endeavour. The framework that a long-term investor works from is considering the potential future earnings and the probability of success.

Biotech charges forward

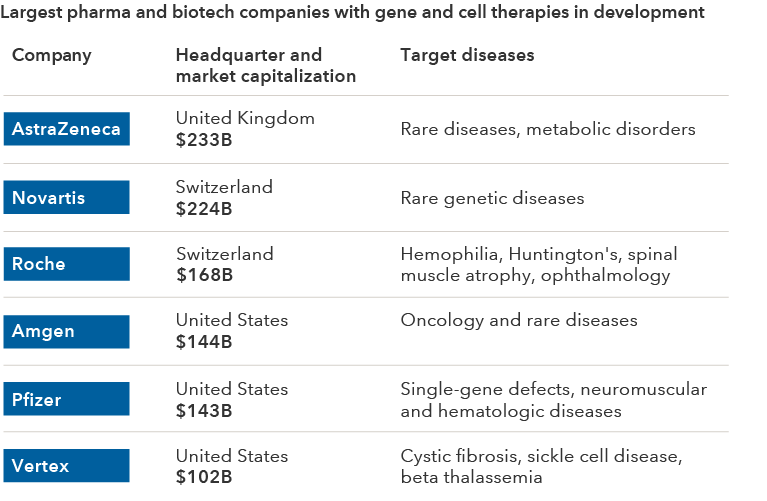

Health care companies are racing to define how diseases are treated. Cell and gene therapy companies — including Vertex Pharmaceuticals, Gilead Sciences and Amgen — are going after the same diseases that weight loss drugs are targeting in the kidney, liver and heart, as well as cancers, autoimmune disorders and others.

Companies are developing cell and gene therapies for many diseases

Sources: Capital Group, MSCI, Drug Discovery & Development. Company examples include constituents of the MSCI All Country World Pharmaceuticals, Biotech and Life Sciences Index that fall within the top 15 largest companies by market capitalisation and have gene editing and cell engineering candidates in current development as of March 10, 2023. Market capitalisations as of 25 April, 2024.

In the case of cell therapy, cells are modified outside the body and then infused into patients. One specific type is commonly known as CAR-T, which has gained approval to treat certain blood cancers. CAR-T stands for chimeric antigen receptor, with the T referring to a type of immune cell modified to find and destroy cancer cells.

Current CAR-T treatments use a patient’s own cells and are limited by the long, complex journey involved for patients, manufacturing challenges and high costs. However, treatments may eventually become more accessible and safer as scientists develop off-the-shelf techniques derived from unrelated donor cells. Additionally, companies may go beyond using T-cells and incorporate other types of cells over the next decade.

Another area of cell engineering is focused on modifying stem cells to replace missing or defective cells. For example, Vertex aims to cure Type-1 diabetes by transplanting insulin-producing cells into the pancreas, a program currently in human clinical trials.

Yet another promising innovation is RNA-interference (RNAi). This technology allows companies to create highly specific therapies that turn off the production of proteins that cause disease. Biotech company Alnylam is currently developing programs in areas such as heart failure, hypertension and Alzheimer’s.

The idea that you’re not irreversibly changing the DNA is compelling, but like most health care innovation, safety is paramount. And every patient population has a different risk profile.

Matt Reynolds is an Investment Director for Capital Group Australia, a sponsor of Firstlinks. This article contains general information only and does not consider the circumstances of any investor. Please seek financial advice before acting on any investment as market circumstances can change.

For more articles and papers from Capital Group, click here.