Identifying and investing in the next big long-term structural growth trend is one way for investors to differentiate themselves in a competitive market.

Doing this is an integral part of our investing process at Munro Partners and we call these major growth trends areas of interests. Innovative health is one of Munro’s key areas of interest and one that is developing and advancing rapidly.

Health offers fertile ground for innovation across areas like diagnostics and patient care, genetic sequencing, virtual reality, and surgical robots.

The COVID pandemic brought specific investment opportunities in vaccines and treatment, but innovative health has been on a structural growth trend for over a decade on the back of several key drivers.

The drivers of healthcare innovation

There is a lot going on in the global healthcare landscape and we believe the resulting investment opportunities from this structural change are shaped by the below three trends.

1. Demographic change

Demographic change is having a real impact on healthcare as populations age across the developed world. Life expectancy has improved dramatically over the past 30 years. A baby born in Australia in 2020 can now expect to live to 81.2 years for a boy and 85.3 years for a girl, whereas in 1990 the equivalent figures were 73.9 and 80.1 years respectively.

The Baby Boomers, with higher expectations around their standard of living, are now between 58 and 76 years old.

A consequence of living longer is that many people end up with chronic conditions that need to be managed. For example, 46% of Australians aged over 65 suffer from two or more chronic conditions, compared with just 11% of those aged 15-44. Nearly half of all Australians aged over 75 have arthritis, and one in five has osteoporosis.

Not only do we have more diseases or medical conditions, but we are also expecting better care when we have them and are often prepared to pay for this superior care.

These demographic changes mean that disease prevention, treatment, and lifestyle management for the older members of society is a massive and growing subsector of the healthcare industry.

2. New technologies

Technology is making headway in healthcare, and companies across the spectrum - from start-up biotech pioneers to global pharmaceutical giants - are inventing new products and processes to assist in diagnosing, treating or curing diseases. More efficient healthcare provision is also a focus.

Predictive analytics in the field of artificial intelligence is also helping hospitals to better manage patient volumes and staff-to-patient ratios. And in surgery, micro robotics are being used in surgical treatments previously considered dangerous and invasive.

Innovations in the fields of genomics and gene therapy techniques are also important. These advances could be the start of a new era of personalised medicine as opposed to old-style generic treatment plans for all patients with the same diagnosis.

All of these innovations are huge and not only do they help in improving the health of everyone on the planet, they also offer a range of potential opportunities for long-term growth investors.

3. The rising cost of healthcare

This brings us to cost. Early-stage innovation technology is rarely cheap, and global spending on health climbed to US$8.5 trillion in 2019, or 9.8% of global gross domestic product (GDP), according to the World Health Organisation.

Unsurprisingly, health spending per capita in high-income countries was more than four times higher than in low-income countries, with the US healthcare system alone accounting for 42% of total global health spending.

There are therefore investment opportunities available in products, processes and systems that can reduce the cost of healthcare.

Lessons from Covid

As the pandemic spread around the world, the race to develop a successful vaccine to inoculate as many as possible began. But rather than pick a winner, in terms of what companies might emerge with the winning vaccine formula, at Munro Partners we decided to focus on the supply chain. We researched a wealth of opportunities and ended up focussing on companies in the biologics ecosystem which were critical in the development of the next generation mRNA (messenger ribonucleic acid) vaccines.

Biologic drugs are unique in that they are developed from cell culture media or living organisms rather than via a chemical synthesising process. Because of this, biologic drugs can specifically target the disease they’re designed to attack. This means they usually have a much higher efficacy and fewer side effects.

We looked to the supply chain for biologic drug companies and found investment opportunities in the companies supplying the consumable equipment needed by the vaccine producers, a strategy we saw as akin to investing in the picks and shovels that enabled the gold rush.

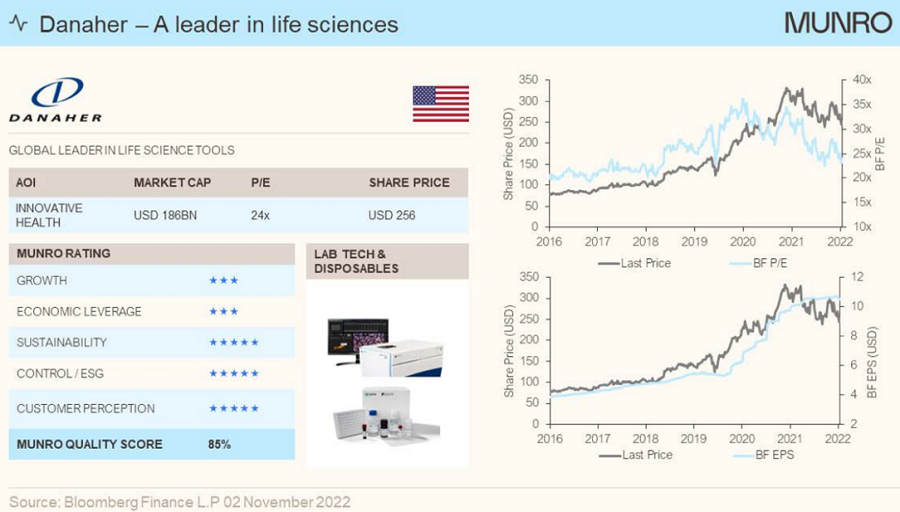

A stock story: Danaher Corporation

One such company is Danaher Corporation in the US. This is currently Munro's biggest position in innovative health and a company we were investing in long before Covid.

Danaher is a specialist in life science products, which make up over 50% of group profits, and is a major provider of the consumable products on which biologic drug developers rely. These products include filtration equipment and cell culture products, which provide a very high recurring revenue stream for the company. Danaher was also quick to develop Covid tests when the pandemic hit.

As biologic drugs take further market share from synthetically produced drugs, Danaher is in a good position to benefit. It has also made a number of strategic acquisitions including GE's bio-pharma business GE Healthcare Life Sciences, which it acquired in 2020 and renamed Cytivia. It is now a standalone operating company within Danaher's life sciences division.

To the future

In terms of innovative health, the long-term outlook will increasingly be about advances in cell and gene therapies, and genomics. Companies that supply those developing the vaccines and other therapies, like Danaher, are uniquely placed to benefit and where we see some of the biggest investment opportunities.

Jeremy Gibson is a partner and portfolio manager at Munro Partners. Munro is a specialist investment manager partner of GSFM Funds Management, a sponsor of Firstlinks. The information included in this article is provided for informational purposes only. Munro Partners do not represent that this information is accurate and complete, and it should not be relied upon as such. Any opinions expressed in this material reflect our judgment at this date, are subject to change and should not be relied upon as the basis of your investment decisions.

For more articles and papers from GSFM and partners, click here.