There aren’t too many must-reads in the investment world, but UBS’ Global Investment Returns Yearbook (formerly Credit Suisse) is among them. In it, a trio of academics – Ellroy Dimson, Paul Marsh, and Mike Staunton - dig deep into historical data and uncover key long-term trends, often at odds with current investment thinking. The latest publication, out earlier this year, hasn’t received the attention it should as it ties in with other, just-released research, that debunks the long-held notion that taking greater risks in markets equates to higher returns. If right, it has ramifications for how investors should allocate assets for their portfolios.

Questioning Markowitz’s Modern Portfolio Theory

In 1952, Harry Markowitz put forward a theory that would revolutionise finance. His Modern Portfolio Theory (MPT) said that taking more risk would reward you with a higher expected return. Markowitz later won a Nobel Prize for MPT, and it’s framed how financial advisers and investment managers put portfolios together to this day.

There’s now enough evidence to show that it’s wrong. There’s been plenty of research questioning the theory, though the UBS Yearbook should prove the exclamation mark that puts MPT to bed.

Specifically, the Yearbook looks at volatility across US stocks since 1963 and UK stocks since 1984. Volatility is the rate at which the price of a stock increases or decreases over a period. If the price of a stock fluctuates wildly in a short period, hitting new highs and lows, it’s said to have high volatility. If the stock price moves higher or lower slowly, or stays relatively stable, it’s said to have low volatility. Higher stock price volatility often means higher risk and helps an investor to estimate the fluctuations that may happen in the future. The UBS Yearbook orders the US and UK stocks by volatility and calculates how shares with low, medium and high volatility performed.

The study reveals that for low and medium volatility shares, returns are clustered. That means volatility is shown to have little effect on returns. For high volatility stocks, the results are more striking. They reveal that these stocks dramatically unperformed the rest. In other words, investors haven’t been rewarded for putting money into stocks with high volatility; they’ve been punished.

Old and boring industries beat the new and shiny

The latest UBS research builds on their earlier, better-known work on whether it’s better to invest in new industries, often characterized by higher volatility and risk, or older, more seasoned sectors. Its 2015 study examined the rise and fall of industries in the US and UK since 1900.

It found that though new industries and companies have transformed the world, they’ve often been disappointing investments. Why? Because, historically, there’s been a tendency for the market to overvalue new industries and technologies. Part of the issue is that new industries are often born on a wave of IPO activity. And numerous studies show that the post-IPO performance of stocks around the world is poor.

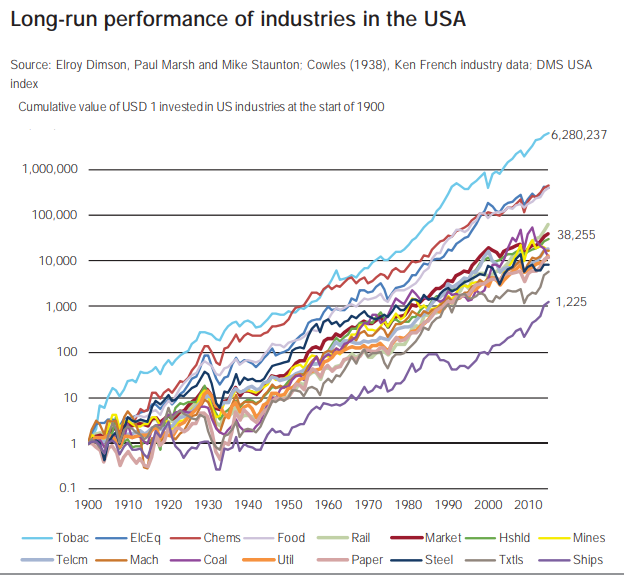

On the flip side, markets have tended to undervalue older industries, and that’s resulted in superior performance over time, as the below chart attests.

It might surprise some that tobacco is the best performing industry in the US since 1900. US$1 invested in the sector back then turned into US$6.28 million in 2015. Not bad for an industry where volumes peaked in the 1960s.

Other unglamorous sectors such as electrical equipment, food and rail have also handily beaten the market. Rail is also a fascinating case study given it was the new technology of the late 19th century and had a prolonged decline soon after, though the last 30 years has seen a resurgence in the sector.

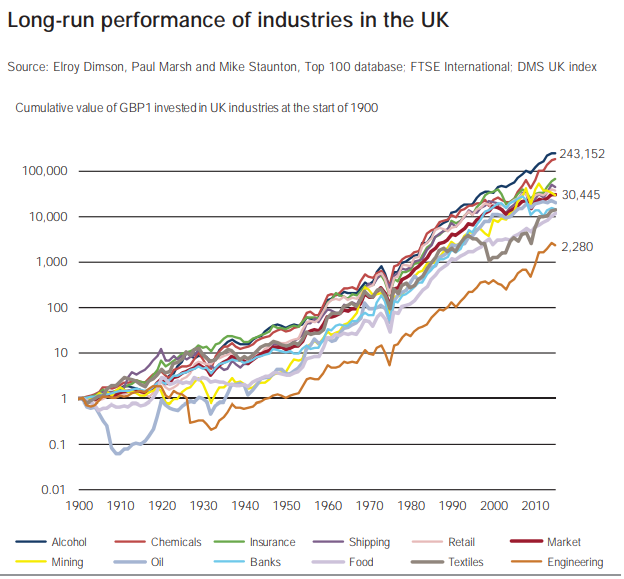

The UK has different sectors at the top of the performance rankings than the US.

Notice how alcohol, part of the ‘sin’ industries including tobacco, is the best performing sector in the UK since 1900. It’s followed by chemicals, insurance, and, surprisingly, shipping.

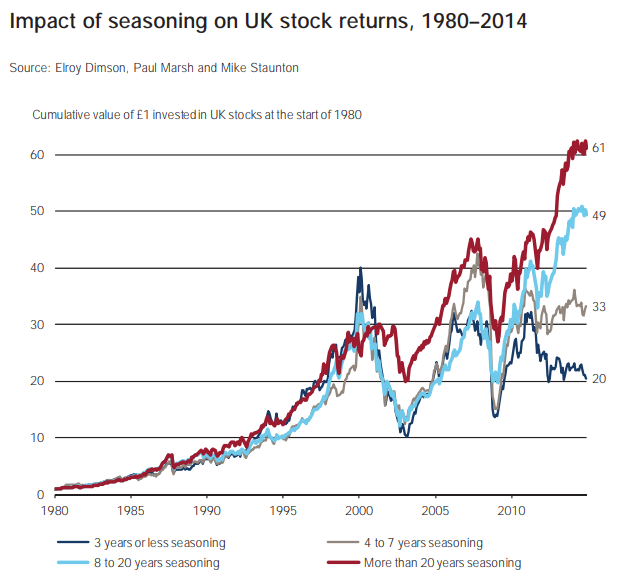

The 2015 study also outlines the performance of stocks based on their degree of so-called ‘seasoning’ – the length of time they’ve been listed since their IPO. It found that over a 35-year period, terminal wealth was almost 3x higher for the most seasoned stocks over the least seasoned. In other words, older stocks on average substantially outperformed newer ones.

Finally, the research tested value and momentum investment strategies that leaned into older industries and stocks against newer ones and found that they would have historically delivered superior returns.

Bessembinder’s best stocks ever

The UBS findings tie into just-released work from renowned finance academic, Hendrik Bessembinder. Bessembinder has become famous, at least in investing circles, for his pioneering work into how very few stocks have historically accounted for the overwhelming majority of market returns.

“Focusing on aggregate shareholder outcomes, we find that the top-performing 2.4% of firms account for all of the $US75.7 trillion in net global stock market wealth creation from 1990 to December 2020. Outside the US, 1.41% of firms account for the $US30.7 trillion in net wealth creation.”

- Hendrik Bessembinder and colleagues, Financial Analysts Journal, revised March 2023.

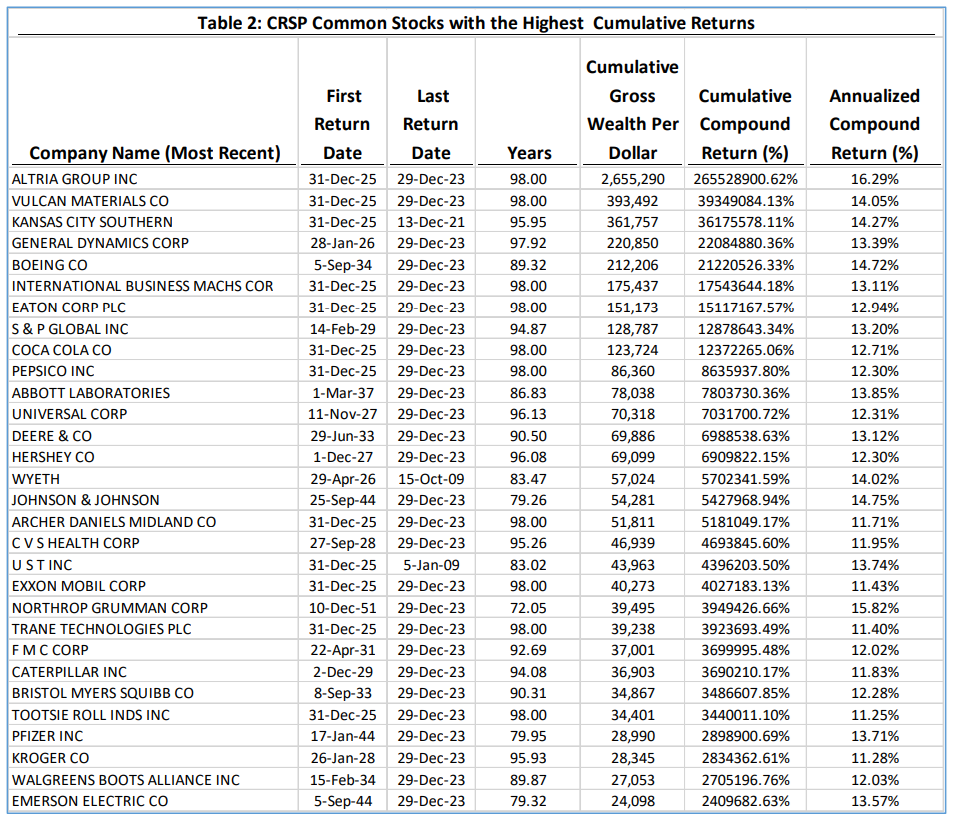

In his latest work, Bessembinder drills down into which specific stocks have performed best in the long-term. Can you take a guess as to which stock has had the highest cumulative returns in the US since 1925? You may have got a clue from the UBS study because the answer is Altria, the tobacco company. US$1 invested in Altria in 1925 turned into US$2.66 million by the end of last year. That’s a compound annual growth rate of 16.29%.

Other stocks with impressive returns include Vulcan Materials (construction materials) Kansas City Southern (rail) General Dynamics (aerospace, defence), and Boeing (aerospace).

Source: Henrick Bessembinder, ‘Which US stocks generated the highest long-term returns’

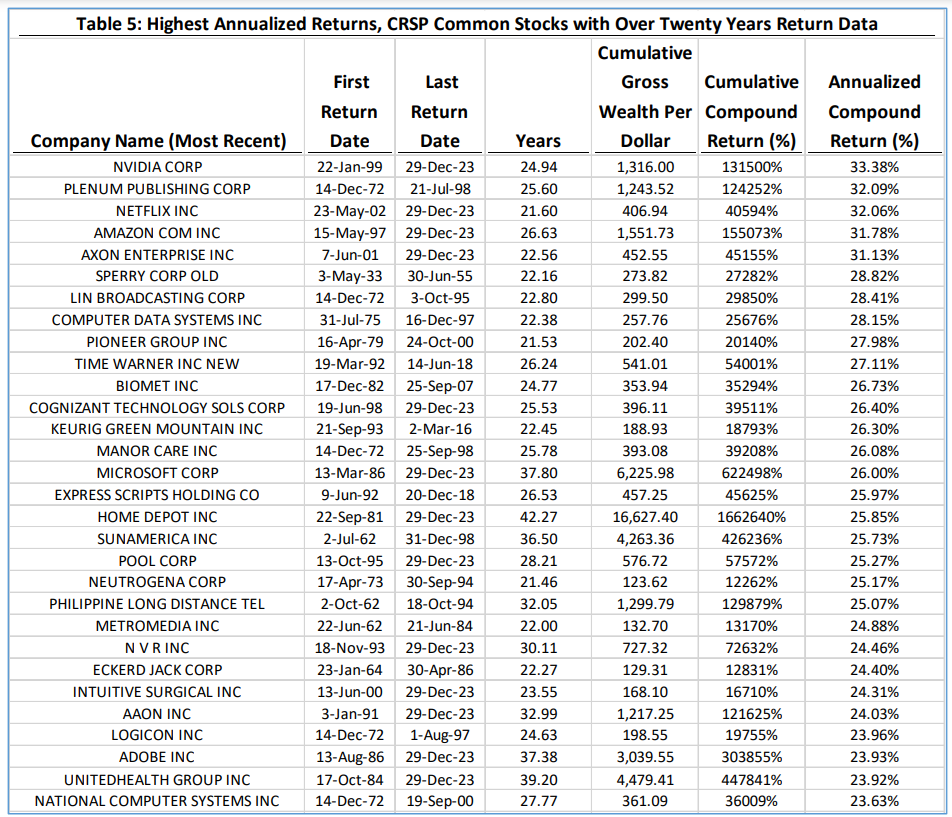

The top five best performing stocks aren’t exactly in sexy industries. Does that mean the mundane beats the new? Bessembinder says yes and no. His study goes on to list the stocks more than 20 years old which have delivered the best annual returns, as opposed to cumulative returns. Topping this list is none other than the hottest company of the moment, Nvidia, closely followed by other technology companies such as Netflix and Amazon.

Source: Henrick Bessembinder, ‘Which US stocks generated the highest long-term returns’

Note how much higher the annual returns of the likes of Nvidia are (33%) compared to Altria in the previous table (16%).

It’s also worth mentioning though how many non-tech companies are in this second list too, including homebuilders (NVR), broadcasters (Lin and Time Warner), pool suppliers (Pool Corp) and healthcare companies (UnitedHealth, Express Scripts).

Key takeaways

Here are some key takeaways from these studies:

- It’s time in the market rather than market timing that counts. As Altria demonstrates, compounding returns at 16% per annum generates mind-boggling wealth in the long-term, and even lower returns can still deliver satisfactory outcomes.

- The UBS study shows that investors tend to overvalue newer industries and stocks and undervalues older ones. It’s not always the case, but that can pave the way for compelling investment opportunities.

- The studies neglect to mention something critical – how important industry structure is to stock returns. I don’t think it’s an accident that tobacco has been such a fruitful sector given the massive consolidation that’s happened in the sector over the past 50 years, and the pricing power that it has given companies in the face of declining volumes. The same goes for the rail industry, where volumes have been flat for a long time, yet many companies have generated incredible returns over the past 30 years thanks to consolidation, pricing power, and streamlined cost structures. Put simply, favourable industry structures can allow some companies to bypass competitive threats and avoid the ‘creative destruction’ that happens to the majority of the market.

James Gruber is Editor at Firstlinks.