Despite the often-cited narrative, large caps actually out-perform small caps in Australia over the long term. But at different stages of the equity cycle, small caps come into their own and out-perform the broader indexes. This normally occurs where:

- Large caps have appreciated to the point where valuations are stretched.

- The ‘animal spirits’ (aka market confidence) return such that investors are prepared to take on more risk.

- The economic cycle is constrained, and hence provides limited growth across the broader market (large caps).

- There has been a period of relative under-performance with small caps.

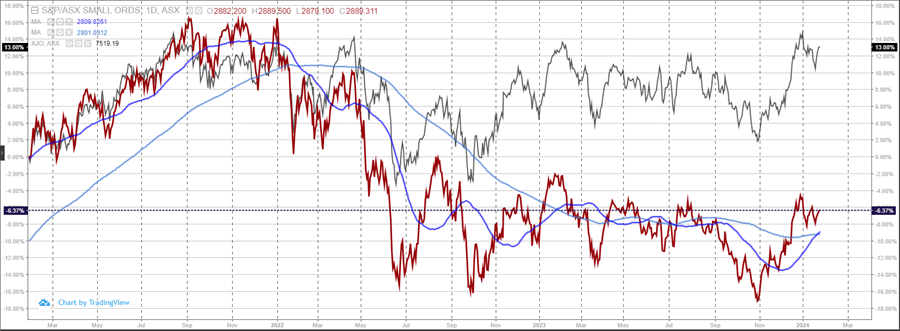

Above: Small Caps have underperformed the ASX200 by ~20% over the past 3 years (IRESS)

Some of these conditions are now in place, and whilst we haven’t seen any concrete ‘evidence’ that a re-rating is afoot, we are starting to see small caps increasingly mentioned in the media and by professional investors. This means that it's time to do the work and ready the list, in the event that this segment begins to move.

Portfolio approach

Small caps are where fortunes are made and lost. But it is the latter that is often overlooked. Investing in smaller companies has a higher risk for a host of reasons:

- The companies often have a shorter operating history.

- There is likely to be less diversification across clients, geographies and operations.

- Research coverage is often sparse, if it exists at all.

- Corporate governance can be on the skinny side.

- Stocks can get lost in the market; for example, there is only one BHP, but there are nearly 2,300 ‘small caps’ all vying for attention.

- And of course, liquidity can be dangerously light.

Accordingly, investors should take a ‘portfolio approach’ when investing in smaller companies. This means spreading the designated capital amongst a portfolio of stocks to spread the risk. Irrespective of an investor’s expertise or experience, losses are inevitable. The focus is to choose a mix of quality emerging companies so that the overall portfolio generates an appropriate return. Small cap investing requires a shotgun, not a rifle.

The Katana portfolios currently hold in excess of 55 stocks. Most of these companies are in the ASX100 or ASX200. However, where we see a particularly lucrative risk-return proposition, we are prepared to back our work and take on smaller companies.

Recently, we have been buying four companies in the smaller end of the market.

Praemium Limited (PPS)

There are just under a dozen platforms on the market of any size, and PPS’s SMA and Powerwrap are collectively the 8th largest. Importantly, PPS is one of the 3 challenger players along with Netwealth and Hub24. And despite its size, PPS regularly ranks 4th for net inflows (in absolute, not relative terms).

The platform industry is a scale game. There is considerable operating leverage and every incremental dollar of funds under administration (FUA) disproportionately impacts profitability. PPS has around 2.5% of the market, yet it has a market capitalisation of <$200 million (or an enterprise value of just ~$160 million if we include the $40 million cash on the balance sheet). Netwealth and Hub 24 have approximately 3x the funds under management,, yet they are trading on valuations that mean their market capitalisations are 25x and 20x that of PPS.

It has taken Netwealth and Hub 24 the better part of a decade to get to where they are. Acquiring PPS would grow FUA by more than a third in one relatively quick and easy transaction. It is not surprising therefore that in November 2021, Netwealth lobbed a $1.50 bid for PPS. For a variety of reasons, a deal was not consummated. However, at the current price of 38 cents, it would be hard to see that both Hub24 and Netwealth would not be running the ruler over PPS.

Pepper Money Limited (PPM)

PPM is one of the best risk-return opportunities across our entire stock universe.

Anecdotally, there are some factors that indicate strong management, culture and operational excellence. For example, PPM has won the award for Best Specialist Lender for the past 11 years consecutively. Out of a field of several hundred, they have also been awarded Best Non-Bank Lender in 2017, 2019 and again in 2021 and 2022. In 2023 alone, PPM won a total of 11 awards.

On the distribution side, the PPM brand is well known and respected by mortgage brokers who have more than 22 years of distributing their products. Channel checks confirm that PPM is known for fast turnaround times, consistency, and great customer service. This has led to more than 20,000 brokers distributing their product - and this figure is growing by the month. In addition, Pepper has close to 40 white label partnerships with third parties (also increasing). This captive market now accounts for 45% of originations.

Prior to the 13 rate rises, PPM averaged an AUM growth of 21.3% per annum for 8 years. And considerably more at the bottom line, due to the operating leverage in the business. As the banks continue to retreat from asset financing and impose ever tightening criteria on home loans, non-banks such as PPM are well positioned to continue to grow market share.

Companies with high calibre management, strong growth rates and a consistent, definable strategy, normally trade at high double-digit earnings multiples. But the hysteria around cyclical fluctuations in net interest margin and loan volumes, has seen the stock sold down from its IPO price of $2.89 to the $1.30 level. Consensus PER is now 5.5x, and the net tangible asset backing is approximately $1.50 per share.

West African Resources Limited (WAF)

We are not aware of any 200,000 ounce per annum low-cost gold producers trading on a market capitalisation of less than $1 billion. For the 2023 calendar year, WAF produced 226,000 ounces from its Sanbrado mine at an all-in sustaining cost (AISC) of US$1,126 per ounce. This generated not only a significant paper profit, but more importantly strong operating cashflow. This factor alone justifies a notably higher valuation.

But the real appeal for Katana is the rapidly developing Kiaka gold project south of Sanbrado. This is a mid-scale but world class, low strip, open pit development. Company releases confirm a 19-year mine life averaging 220kozpa. With first production slated for the 2nd half of 2025, this will elevate combined production to >400,000 ounces per annum. On the current market capitalisation, this seems an excellent risk-reward opportunity.

As with every company (and especially smaller ones) it is important to understand why we believe it is ‘mispriced’. In the case of WAF, the market would appear to be concerned with two issues: 1) funding and 2) country risk.

In the case of the first issue, WAF have repeatedly stated that they are fully funded to first production and do not need to raise capital. As a worst case, if they need/choose to raise, it is unlikely to be more than $100 million to $200 million; which is a modest 10-20% of the current market cap. So not material, even in the “worst case scenario”.

With respect to Burkina Faso (country risk), there are superficially some valid concerns around sovereignty. But what investors may not be aware of is that:

- West Africa is now the largest gold producing region globally.

- Burkina Faso is the 2nd largest producer in West Africa.

- Burkina Faso is ranked #1 for gold discoveries over the past decade.

- The country is also ranked #1 globally for permitting times and construction costs.

Integrated Research Limited (IRI)

At a $54 million market capitalisation, this is a micro-cap in every sense. And given its erratic liquidity (turnover), this stock is not for the novice investor, trader, or anyone with a short time horizon.

We have tracked IRI for more than a decade, and as this short extract below illustrates, the price has experienced wild gyrations. Post covid, the stock rallied as high as $4.80, before plunging in early 2022 to the 30 cent mark. But over the past 18 months, the stock price has mapped out a clear accumulation phase. We are now awaiting a break-out to confirm that it is time to meaningfully re-build our position.

IRESS

As with all stocks in the Katana portfolio, we look for the fundamentals and technicals to align. And there are signs that this is finally occurring, with IRI recently releasing a positive trading update for the 1st half of FY24. Statutory revenue, EBITDA and EPS were all up on the previous corresponding period. Importantly, net cash (there is nil debt) also grew to $21.5 million, which represents nearly 40% of their market capitalisation. Research coverage is almost non-existent, but one of Bell Potter’s most respected analysts covers the stock and the broker has historically had a good handle on their operations. Their most recent note places IRI on a PER of 5.3x and they have increased their price target to $0.66 per share.

Romano Sala Tenna is Portfolio Manager at Katana Asset Management. This article is general information and does not consider the circumstances of any individual. Any person considering acting on information in this article should take financial advice.

Past performance is not a guarantee of future performance. Stock market returns are volatile, especially over the short term.