The S&P500 Index reached 60 years earlier in 2017, and it's my turn this week.

(The S&P500 was called the 'Composite Index' prior to 1957 and included 90 stocks).

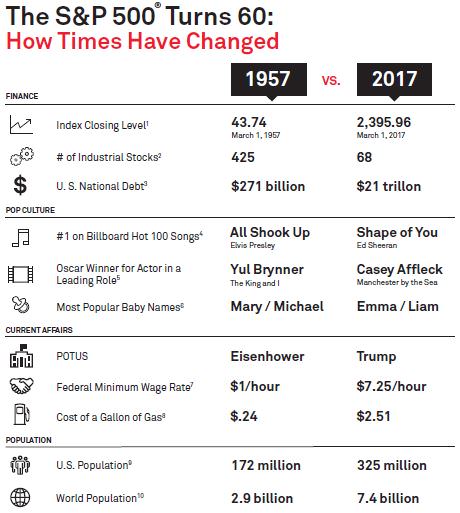

S&P has produced this graphic on how the world has changed in my lifetime. Very kind of them.

I have gone from being one of 2.9 billion people to one of 7.4 billion. The S&P Index has increased from 44 to 2,396, showing the power of long-term investing. The number of industrial stocks in the S&P500 has fallen from 425 to only 68.

Source: S&P Dow Jones Indices. See Indexology, December 2017 edition.

The following chart of the S&P500 (non log scale, not inflation-adjusted) between 1957 and shows the recessions in the grey bars, and on this scale, the tech-wreck around the years 1999 to 2000 and the GFC from 2007 hit the market hard. But what an amazing recovery since the start of 2009.

60 years of the S&P500

Source: Macrotrends

My longevity and investing

While the S&P500 will outlive me, according to this longevity calculator, which asks questions specific to me, my life expectancy is 92 years. So even at my 'mature' years, I should have an investment horizon of at least 32 years, requiring a decent allocation to growth assets. We will also have amazing medical breakthroughs in the next decade or so that will extend life expectancy beyond our wildest estimates.

Please comment on life from 60 and beyond. What lessons have you learned, what can I expect, how should 'older' people view their investment horizon, what is most important?

Graham Hand is Managing Editor and Co-Founder of Cuffelinks.