Many of us don’t think about taxes until it’s too late. This mindset is so pervasive that it’s even crossed over to fictional universes like The Simpsons. During the ninth season of The Simpsons, Homer was on the couch watching the TV news. Channel 6 news anchor, Kent Brockman was reporting a rush of people mailing their tax returns before the deadline.

“Will you look at these morons?” Homer laughed. “I paid my taxes over a year ago.”

After Lisa pointed out Homer’s problem, Homer rushed to complete his return, “Okay, Marge, if anybody asks, you require 24-hour nursing care, Lisa's a clergyman, Maggie is seven people and Bart was wounded in Vietnam.”

The good news about ETFs is that telling porkies to the ATO isn’t required.

Here are two benefits to having ETF investments, plus a bonus perk if you’re in a fund hedged to AUD.

ETF tax benefit 1: streaming

In periods of volatility, many investors flee the funds they are in, waiting for calmer days. We’re sure you’re aware of the perils of such a strategy, but it is worth understanding that in unlisted managed funds, your tax liability goes up as other investors desert the fund. ETFs, being listed on ASX, have a mechanism to mitigate this risk.

In unlisted managed funds, investors who redeem from the fund leave behind their share of the tax liabilities on any capital gains realised. In an unlisted managed fund, these tax liabilities are then attributed to the remaining investors. This does not happen in an ETF. Investors sell their units on the exchange to other investors or the market maker. A market maker ensures there are units available for investors to buy or sell, and they may redeem their units in the ETF. The good news is that when they do, they take the capital gains caused by the redemption with them. ETFs, therefore, protect investors from the impact of redemptions by other investors.

Those who have had a bad tax experience with an unlisted managed fund will understand. An ETF won’t hit you with a large taxable distribution the way an unlisted actively managed fund can do due to client redemptions.

This tax efficiency is often an overlooked benefit of investing in ETFs.

ETF tax benefit 2: passive management

Passive ETFs hold a portfolio of shares or other assets that track an index. As a passive ETF’s portfolio is automatically determined by the rules of the index, its portfolio only changes when the index changes. The contrast to this is ‘actively managed’ funds, where the fund manager picks the shares that they think are going to perform the best. The tax problem with the active management process is that it causes a lot of shares to be sold each year, whereas the index fund process generally does not.

The more shares sold by the active fund manager in a year, the higher the investor’s capital gains tax liability for that year. This brings forward capital gains. In passive ETFs with low turnover, these would otherwise not be payable until the ETF units are sold.

The advantage is in the time value of money. The longer the investor holds the ETF, the more this advantage compounds.

In a nutshell:

- ETFs are generally a tax-efficient investment vehicle because they minimise exposure to capital gains tax when other investors redeem.

- As passive funds, ETFs typically have lower turnover and therefore generate lower levels of capital gains tax compared to actively managed funds.

Bonus benefit for those in funds hedged to the AUD

If you’ve experienced a massive dividend from a global fund that is ‘AUD hedged’, this is for you.

Over the past decade, the government has implemented a series of changes that are intended to benefit investors in these AUD currency-hedged funds. However, the changes are proving not so easy to implement. So much so that the industry has been lobbying to make these rules simpler.

Until there are more changes, only a few fund managers have the skill and processes to implement the newer tax rules.

The tax rules we refer to are called the ‘Taxation of Financial Arrangement’, also known as ‘ToFA’ (pronounced like ‘tofu’ but ending in an ‘a’).

It is important to note any AUD currency-hedged managed fund can adopt these. There are no restrictions, so if your fund manager says they are unable to avail themselves of the ToFA hedging election, the problem is with them, not the legislative framework.

The first hurdle in ToFA hedging is that the tax rules can only be adopted after complex auditing rules found in the accounting standards. Managed funds have no reason to do this apart from ToFA, but to adopt the rules, the fund manager will need to reconstruct their financial reporting process and satisfy their financial auditors that they are complying with all of the rules in the accounting standards.

If the accounting rules can be satisfied, the next hurdle is to install a process to produce, what we will call for simplicity, ‘an adequate document trail’. This is potentially subject to an Australian Tax Office audit. Processes like this require the fund’s tax department and the fund’s portfolio management team to work closely together. These are two teams that usually have little to do with each other, and who think quite differently, so the new process is a challenge. You can imagine that in some big fund managers, these parts of the business will not know one another, and potentially sit on a different floor or in a different office.

The last hurdle is the hardest: the calculations. Among the challenges, in an AUD currency-hedged managed fund, there isn’t always a one-to-one relationship between the hedging instruments and the hedged assets. These also change daily, as do the underlying securities bought and sold. Again, these may not match when currency hedging positions are opened and closed out.

There is no software available to do these calculations, so fund managers have had to develop their own processes and intellectual property.

We think fund managers that properly implement ToFA have a competitive advantage over those that do not.

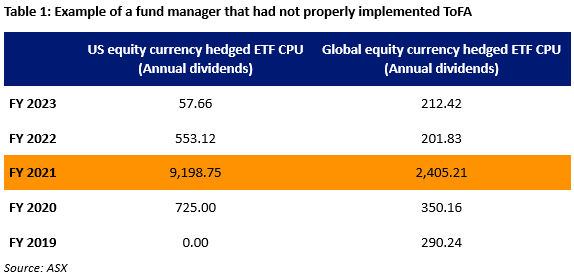

Without the ToFA overlay, currency hedging can lead to tax shocks for investors. This was precisely the experience for a large number of advisers/investors who were invested in two currency AUD hedged global equity products in 2021. See below the historical cents per unit (CPU) declared for these two funds.

For context, the net asset value (NAV) for each of these on 30 June 2021 was $512.44 for the US equity ETF and $155.13 for the global equity ETF. That means the distribution represented 17.95% and 15.50% of the total assets in the funds. The reason for this would be hedging gains in the fund from the rise of the Australian dollar in that financial year.

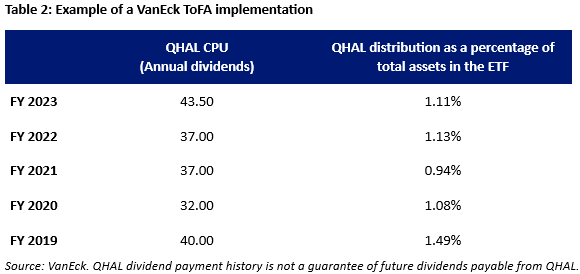

Our currency-hedged international quality equity ETF (QHAL) utilises the currency hedging ToFA rules and it has not been subject to these types of huge surprises.

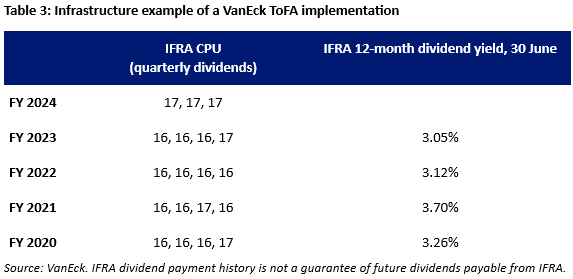

Further, we think this is a particularly important consideration for those investors utilising AUD currency-hedged global strategies for income such as global infrastructure and global property securities.

As an example of the effort we have put into our systems to ensure investors don’t get tax-time shocks in these AUD currency-hedged income ETFs, our global infrastructure ETF (IFRA) has a demonstrable track record of not giving investors nasty high dividends.

Michael Brown is Head of Finance, Legal and Regulatory Affairs at VanEck Australia, a sponsor of Firstlinks. This is general information only and does not take into account any person’s financial objectives, situation or needs. Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

For more articles and papers from VanEck, click here.