The market capitalisation of cryptocurrency assets surpassed US$2 trillion (AU$2.8 trillion) in late 2021. Since the initial release of Bitcoin in 2009, numerous debates have surrounded cryptocurrencies and questions about its future role have been asked. Most people do not understand how they work and the potential impact on our global economy.

The basics of cryptocurrencies

In the past, the value of a currency was weighed against the value of precious materials. Gold was usually the option of choice, with many of the world’s modern currencies starting out as a form of token that signified the value of a previous metal. This has changed over time, with the value of currencies becoming tied more to the fortunes of a country and its economy. Cryptocurrencies aim to change this through decentralised finance or Defi.

Cryptocurrencies are decentralised and are not controlled by governments, countries, or any body, and the value of each cryptocurrency is based on a resource. This resource is usually computing power, generating coins like Bitcoin, Ethereum and many more.

Cryptocurrencies like Bitcoin have seen a huge surge in popularity since their launch, making them valuable to investors.

What Is Bitcoin?

Bitcoin is currently the most popular cryptocurrency, with a single Bitcoin valued at US$38,000 (about AU$53,000) at the time of writing this article. How did Bitcoin reach this point?

The original creator of Bitcoin is unknown, other than by an alias, Satoshi Nakamoto. There have been many attempts through the years to develop a decentralised form of currency, until Satoshi cracked the code to create Bitcoin in 2009. When Bitcoin hit the market, it promised to change the way that money works forever.

Bitcoin is a decentralised digital currency that does not have a central bank or single administrator. The network that Bitcoin (and most cryptocurrencies) operate on is called blockchain, the technology backbone behind cryptocurrencies.

How are cryptocurrencies created?

Cryptocurrencies are created through the concept of mining. The mining extraction of gold and other metals has existed for centuries and cryptocurrency mining is the digital equivalent.

Cryptocurrency mining is required for the creation of new coins. For stable coins such as Bitcoin and Ethereum, the process involves the validation of digital transactions. Miners’ computer systems work to solve numerical puzzles, essentially guessing a string of numbers in order, relating to digital coins’ transactions. Once the puzzle is solved, a new block of coin (Bitcoin or Ethereum) is created and added to the blockchain ledger.

For the miners' efforts in validating transactions and providing security to the networks, they are rewarded digital coins. For example, the Bitcoin miner who solves the computational guesswork to arrive at the approximate number is rewarded 6.25 Bitcoins. This validation of transactions and rewards occurs every 10 minutes, but solving for the puzzle and winning the Bitcoin prize is difficult.

In the past, currencies like Bitcoin were minable with gaming computers, but it soon became much harder. As each block is mined, the next one is a little harder to get through, and this means that the currency’s value can rise as the challenge of mining it increases.

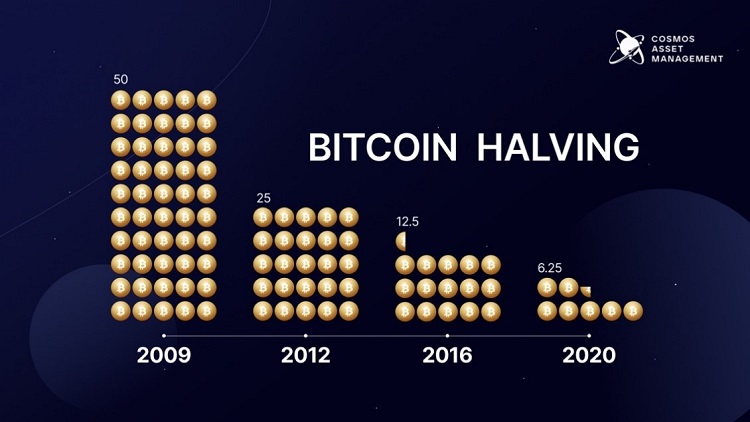

In 2009, a single block reward was worth 50 Bitcoins. The model is engineered so that the reward is halved every four years. The last Bitcoin is anticipated to be mined in the year 2141, approximately 119 years from now.

Over the past several years, entrepreneurs and entities have realised the investment opportunity in mining digital currencies. Most people don’t have access to the hardware required to mine Bitcoin and other digital coins. Globally, we now have companies known as digital miners, like Marathon Digital (NASDAQ:MARA), Galaxy Digital (TSX:GLXY), and Mawson Infrastructure (NASDAQ:MIGI). Their primary business focus on investing in top quality hardware has the sole purpose of mining digital currencies such as Bitcoin and Ethereum. Recently we have also seen top blue-chip companies such as Intel Corp investing resources to get into digital mining. Moves such as this give institutional credibility to the future uses of digital currencies and the investment opportunity.

Understanding the cryptocurrency asset class

Many people have already made their fortunes from their investment in digital coins, but like any emerging asset class, there is significant volatility. Investors must understand the risks versus rewards that cryptocurrency presents within their investment portfolios.

Over the past several years, the prices of digital currency coins such as Bitcoin and Ethereum have experienced low correlation to traditional markets such as gold and broad equity markets, delivering outsized returns. A small allocation to Bitcoin in a traditional 60/40 portfolio can be a fruitful contribution to the returns of some asset allocators. However, as this research paper from Morningstar called 'A little Bitcoin can change your balanced portfolio a lot', the investment comes with high volatility.

The price of Bitcoin has undergone a technical correction in recent months, falling from a high of about AU$90,000 at the start of November 2021 to around AU$54,000 at time of writing. However, as a sign of its potential as well as volatility, the 12-month low in mid 2021 was about AU$38,000. In a change from the past, the price movement in Bitcoin over the past few months has been highly correlated to price changes in the US Russell 2000 index of US stocks.

Importantly, the amount of money in the stock market (estimated at US$125 trillion) dwarfs the dollar value of the entire crypto asset class, and it will only take a small movement out of stocks into crypto to achieve rapid price rises in Bitcoin along with other crypto assets. It is also worth noting that the majority of Bitcoins are owned by long term “HODLers” (Hold On for Dear Life) and liquidity in Bitcoins represents a small portion of mined Bitcoin.

Investing in cryptocurrencies

There is always a limit to the number of coins that can be generated with each cryptocurrency, and while anyone has the chance to mine them, it can take a huge level of resources to produce anything. But mining for cryptocurrencies yourself is not the only way to invest.

Global digital miners are companies listed on global exchanges with a primary focus on providing sustainable and efficient Bitcoin mining services. These listed companies provide exposure to cryptocurrencies such as Bitcoin and Ethereum.

Cryptocurrencies are here to stay and offer an alternative to the fiat money that a lot of people find easier to trust. Investor need to commit to research and learning to understand whether the crypto opportunity is suitable for them.

Dan Annan is the Chief Executive Officer of Cosmos Asset Management. The Cosmos Global Digital Miners Access ETF (DIGA) is traded on the Cboe (formerly Chi-X) market in Australia. This article is general information and does not consider the circumstances of any individual investor. Investing in cryptocurrencies involves high risk and potential investors should ensure they are fully informed in how the market operates.

Investors with interest to learn more can check the latest Bitcoin Mining Council (BMC) report here, including an analysis of energy usage focussed on renewable resources.